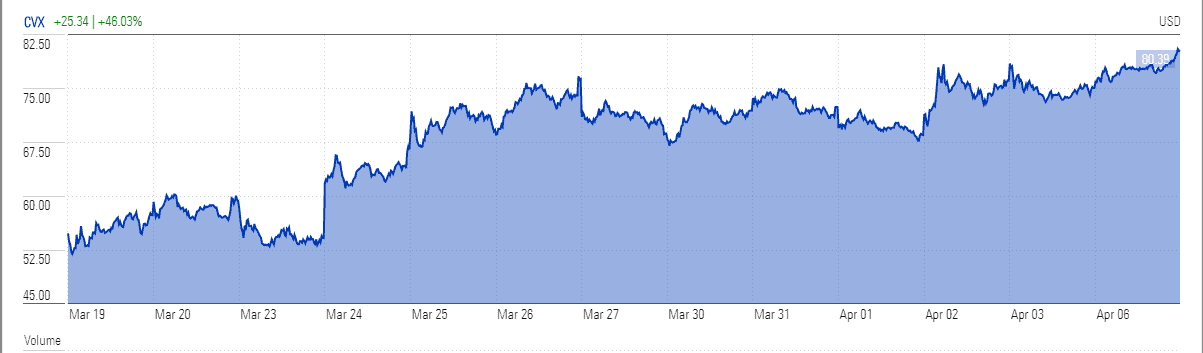

Chevron (NYSE: CVX) stock is leading the recovery rally among major producers after oil prices gained 22% last week, with investors betting on a deal between the largest producers. G20 countries are planning to permit their oil minister to take part in an emergency meeting on Friday, in a bid to cut production. The stock has jumped 46% since the final week in March.

Iraqi oil minister has recently hinted that Opec wants non-Opec producers like the US, Canada, and Norway to participate in production cuts. The world’s main oil producers including Saudi Arabia and Russia may well agree production cuts later this week, although there is talk that meetings could be delayed.

Last week, the president Trump tweeted that Russia and Saudi Arabia would cut 10 to 15 million barrels per day production; he also hinted to take all the necessary steps to save the U.S. oil industry.

“Global storage tanks will continue to get filled and once storage capacity is reached, oil prices could enter free fall,” said Edward Moya, senior market analyst at OANDA in New York. “Opec+ might have a couple of months before global storage capacity is reached, so production cuts will have to happen no matter what.”

While Opec and other players are looking to cut global supplies by 10 to 15 million barrels per day, market analysts believe the cut would not be enough to match supply with demand. Global oil demand plunged 30% after coronavirus outbreak and the supply overhang is likely to stand around 23 million barrels per day in April 2020.

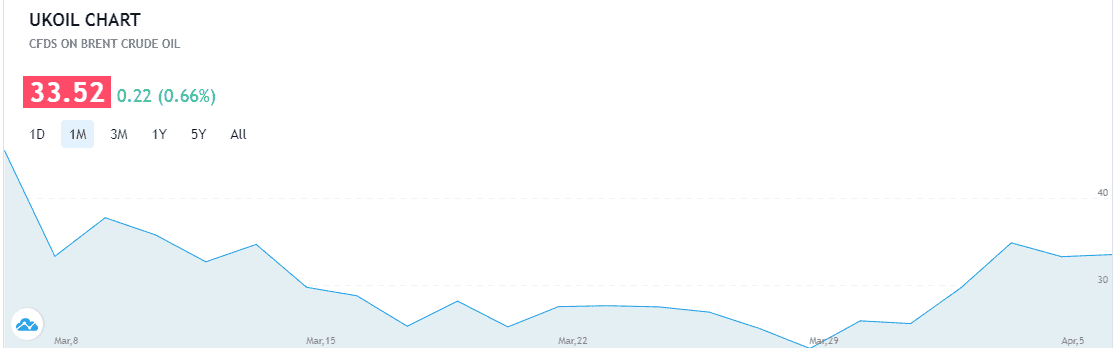

Chevron stock price bounced back to $80 level after hitting lows of $55 last month. The company’s strategy of keeping its dividends despite the massive slump in oil prices has supported its stock rising. However, Chevron announced to cut its capital spending by $4bn to save cash due to the uncertainty in oil markets. US West Texas Intermediary (WTI) oil is currently trading in a $20 range while Brent is standing around $33 a barrel.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account