Chevron (NYSE: CVX) stock price is likely to form bullish trend in the coming days following Yemen’s Iranian-aligned Houthi rebels drone attack on the heart of the Saudi oil industry.

The drone attack has erased almost half of Saudi oil production. This accounts for close to 5% of global production. The substantial decline in Saudi oil production is likely to offer a huge boost to oil prices.

Brent oil price soars sharply by 19% after attacks, making it the biggest intra-day jump since 1991. U.S. West Texas Intermediate (WTI) futures also increased as much as 15.5% to $63.34 a barrel on Monday, the biggest intra-day percentage gain since 1998.

The attack on the world’s largest processing facilities has erased oil output by 5.7 million barrels per day. Armco, on the other, has not provided a deadline for the resumption of oil output.

Companies like Chevron are likely to benefit from the steep increase in oil prices. It is well set to generate steady growth in production. The growth in oil prices would significantly add to Chevron’s third-quarter revenues, earnings and cash flows.

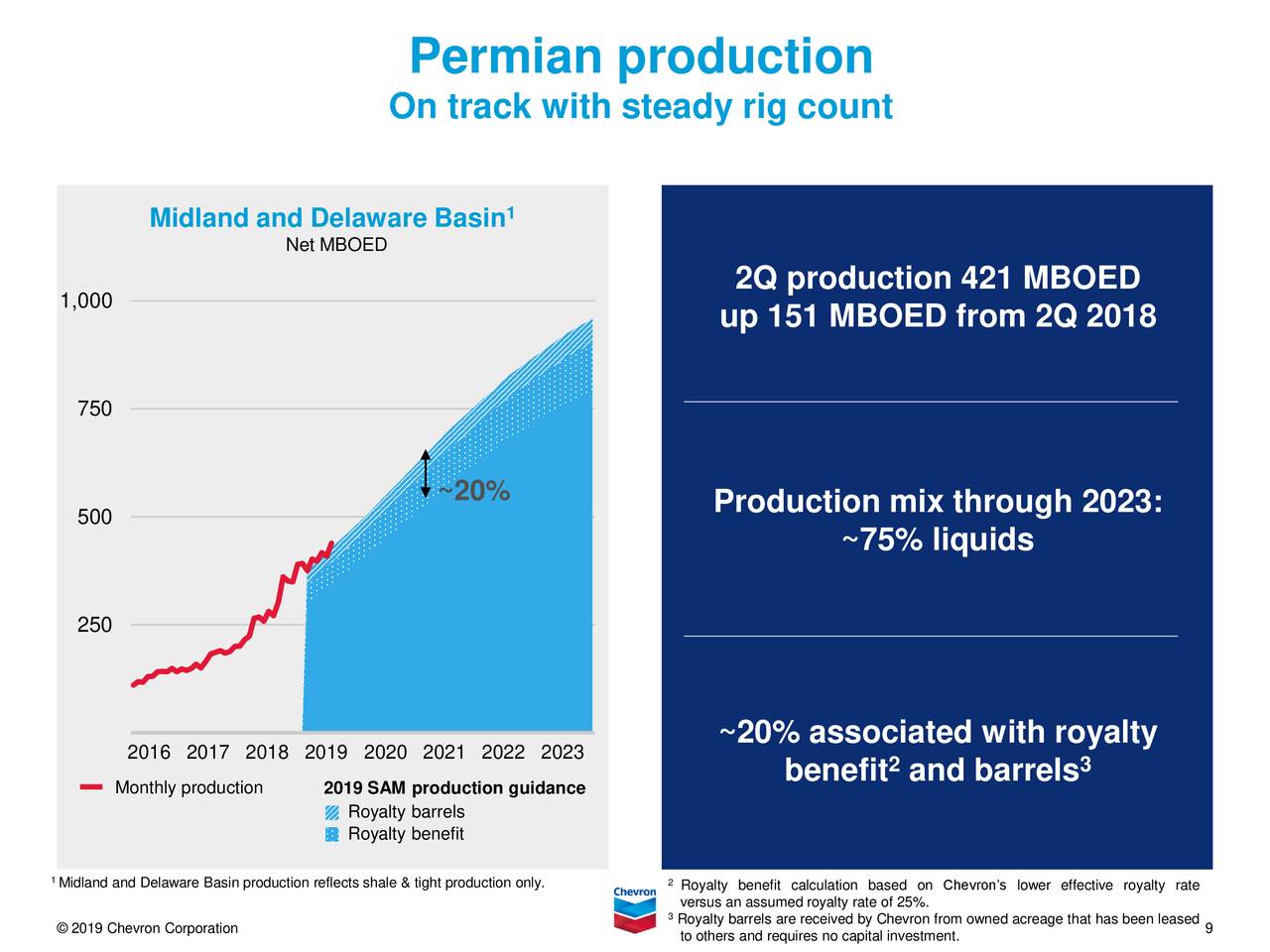

Its focus on high growth areas like Permian basin is likely to enhance its overall production potential at a high single-digit rate in the coming quarters.

In the latest quarter, its worldwide net oil-equivalent production stood around 3.08 million barrels per day. This represents an increase of 9% from a year-ago period.

Michael Wirth, Chevron’s chairman of the board and the chief executive officer said. “Net oil-equivalent production was the highest in the company’s history, driven by continued growth in the Permian Basin and at Wheatstone in Australia.”

The production growth is driven by shale and tight properties in the Permian Basin in Texas and New Mexico. Its unconventional production from the Permian Basin rose 50% year over year to 421,000 barrels per day in the second quarter.

Overall, the reduction in oil supplies from Saudi Arabia is expected to offer a huge boost to oil prices. Consequently, the higher prices would help Chevron stock price and financial numbers in the coming days.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account