Chevron Corporation (NYSE: CVX) is scheduled to announce first-quarter earnings results on Friday, 1 May, before market open that will demonstrate the toll three months of price wars and lockdowns have taken on the business.

The San Ramon-based group is expected to post earnings down 14% to $30bn from a year ago following the oil price war between Russia and Suadi Arabia amid the slowdown in world economic activity during the coronavirus crisis. Its earnings per share in the first quarter is $0.67 is expected to tumble by 52% from earnings per share of $1.39 in the same period a year ago, according to Yahoo finance data.

The company, led by chief executive Mike Wirth, has beaten earnings estimates three times in the last four quarters.

The current earnings estimate for the first quarter is $0.67 per share, down substantially from earnings per share estimate of $1.67 per share 90 days ago, and $1.04 per share 30 days ago. Nineteen analysts who cover Chevron have dropped their earnings per share estimate seven times in the last thirty days, according to Yahoo finance data.

The company has edged earnings per share estimates 75% of the time over the past two years and has beaten revenue estimates half of the time.

Chevron had generated earnings per share of $1.49 in the previous quarter, topping the consensus estimate by $0.03 per share. The earnings per share in the same period last year stood around $1.39.

The average revenue consensus estimate from six analysts stands at $30bn for the first quarter with a low estimate of $20bn and a high of $39bn. The average revenue estimate indicates a 14% drop from the previous quarter a year ago.

With US oil trading around $14 a barrel and Brent in the $20 range, analysts have dropped the full-year earnings forecast from $6.78 per share to a loss of $0.37 per share.

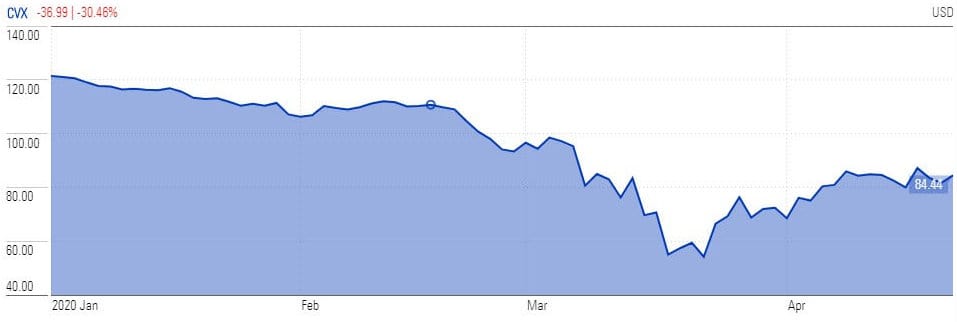

Chevron stock price fallen almost 36% this year due to oil price collapse and sluggish demand trends on coronavirus spread. However, Chevron has upheld its history of paying dividends even in the most difficult times. The company plans to save cash by lowering its capital investments and suspending buybacks. The strategy of generating additional cash through asset sales has also been included in its business strategy.

If you plan to trade commodities, you can check out our featured brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account