Oil giant Chevron is expected to post second-quarter revenues of $19.47bn on Friday, compared to $38.8bn in the same period a year ago, as the health crisis has devasted demand.

The group is expected to post a net loss of $0.93 per share, against an earnings per share of $1.29 in the first quarter of 2020 and $1.77 in the second quarter of 2019.

Tumbling energy prices

Energy prices have tumbled this year as demand has fallen due to the economies of many countries across the world all but closing down to the coronavirus pandemic.

WTI (West Texas Intermediate) is currently trading near $41 per barrel, down from $61 per barrel at the beginning of the year. In April, WTI prices turned negative for the first time in history.

Many energy companies have filed for bankruptcy this year amid lower crude oil and natural gas prices. Last month, BP announced a $17.5bn asset writedown amid the dismal outlook for crude oil prices.

Oil major bids to conserve cash

Chevron has adopted several measures to conserve cash during its first-quarter earnings call. It slashed its 2020 capital expenditure budget by $2bn to $14bn. It also said that it expects operating costs to be $1bn lower in 2020 as compared to 2019 “due to reduced activity levels, lower fuel costs and curtailment of other discretionary expenditures.”

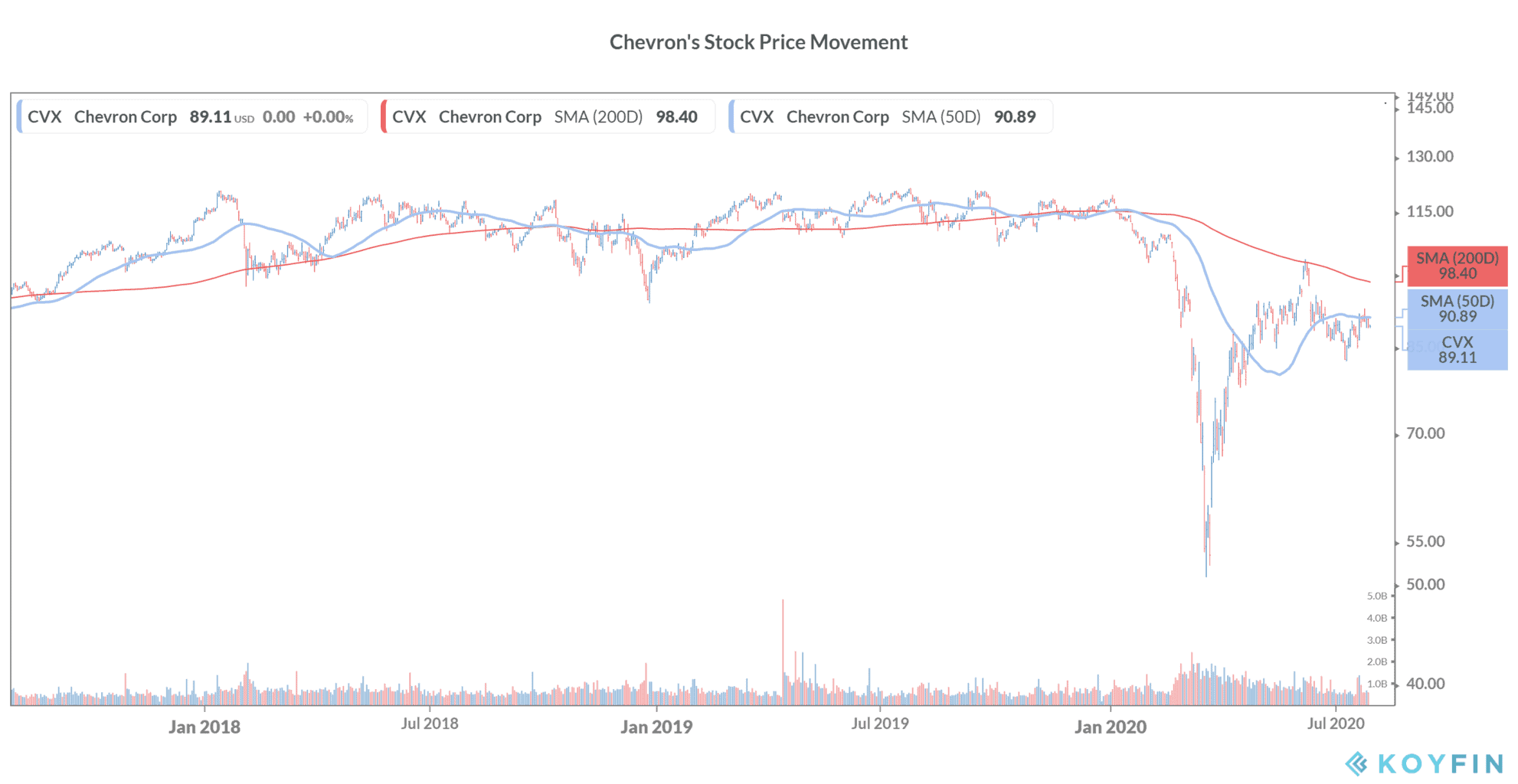

Chevron stock is down almost 26% this year. Energy stocks have tumbled this year amid the sharp drop in crude oil prices. The Energy Select Sector SPDR ETF has fallen 38.5% year to date.

Chevron has a mean consensus price target of $100.71 that represents a 13% upside. 16 analysts polled by Thomson Reuters have a “buy” or higher rating on the stock while seven have given it a “hold” rating. One analyst has a “sell” rating on Chevron stock.

Chevron outlook

This year is turning out to be one of the most challenging years for energy companies like Chevron. Most of Chevron’s earnings come from the upstream oil exploration business where the fortunes are closely tied to energy prices.

While energy prices have recovered, they are still at quite traditionally low levels. Many energy companies, especially shale producers would find it hard to run their operations in a sustainable way with WTI in low $40s per barrel. At the start of the year, most oil majors budgeted new projects at a $60 per barrel oil price.

However, crude oil prices may bounce back in the near term especially as the global economic activity resumes to near pre-pandemic levels say some analysts. Coronavirus vaccine trails look encouraging and a vaccine for the virus could provide a boost to commodities like crude oil. Energy prices, like other commodities, depend on basic supply and demand relationships.

For more information on trading in stocks, please see our selection of some of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account