The Cheesecake Factory (CAKE) has sidelined most of its workers, without pay, and told landlords it will not pay rent on its properties next month, as the impact of the coronavirus swept through the restaurant chain.

The California-based business, led by chief executive David Overton, said it has as furloughed about 41,000 of its 44,900 staff. Stay-at-home restrictions, caused by the health emergency, have hit the leisure and travel sectors hard. The group said it did not say how long the furlough will last, but it said the affected workers will keep their insurance and benefits eligibility until June 1.

The chain also told landlords that it will not pay rent for any of its restaurants for the month of April. “We are in various stages of discussions with our landlords regarding ongoing rent obligations, including the potential deferral, abatement and/or restructuring of rent otherwise payable during the period of the COVID-19 related closure,” the group said in a Securities and Exchange Commission filing on Friday.

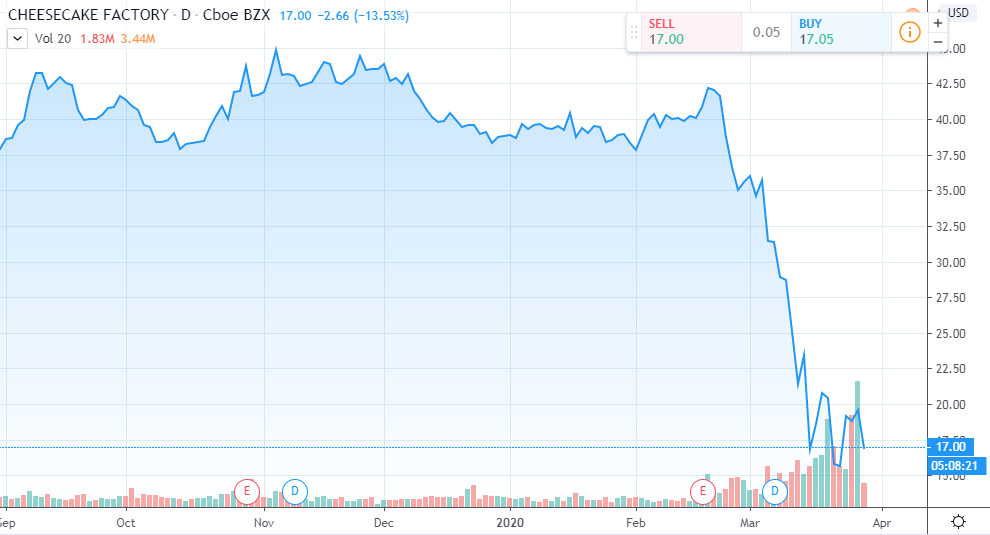

Cheesecake Factory shares tumbled 14% to just over $17 per share in early afternoon trading on Friday. The stock has plunged by more than half over the last three months,

Cheesecake Factory announced its latest dividend payment February 19th, with it going ex-dividend March 6th and paying out March 20th. The company has 45 million shares of stock outstanding with a 36 cent per share quarterly dividend paid regularly. If paid, this will amount to a roughly $16m of quarterly outlay.

The chain has standard 10 or 20-year initial leases with options to extend beyond that. In the company’s most recent 10-K in March, it said its remaining average lease spanned 16.6 years.

Despite Cheesecake Factory’s stock shedding more than half its value since the coronavirus pandemic, only 27 of its 294 US restaurants have been forced to temporarily close completely. The rest of the chain’s restaurants have continued providing delivery and takeout in “off-premises” service. Later this month, the company also withdrew its 2020 first-quarter and fiscal-year guidance.

Even after its recent sharp decline, the Cheesecake Factory has a market cap of around $760m. It paid $179m in rent in 2019, putting monthly rent expenses in the region of $15m. Analysts reacted to the Cheesecake Factory defaulting on obligations equal to about 2% of its market cap by recommending a bearish put option on its stock.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account