Caterpillar (NYSE: CAT) shares bounced sharply in the past few months amid expectations for the trade agreement between the two largest economies. Unfortunately, slowing economic growth and higher inventories have been negatively impacting its financial numbers.

The lack of financial growth is likely to create pressure on its share price in the short-term. Slow economic growth combined with higher inventories has forced the machinery maker to reduce its production plans.

The company says customers are waiting to see the outcome of trade talks and the economic environment before buying new products. Caterpillar shares are currently trading around $140, down slightly from the 52-weeks high of $148 a share.

Lower Financial Numbers are Likely to Limit Caterpillar Shares Upside

The company has been experiencing a steady decline in sales over the past few months. For instance, its three-month rolling sales growth in the region slowed to 4% in October. This represents the slowest growth since mid-2017.

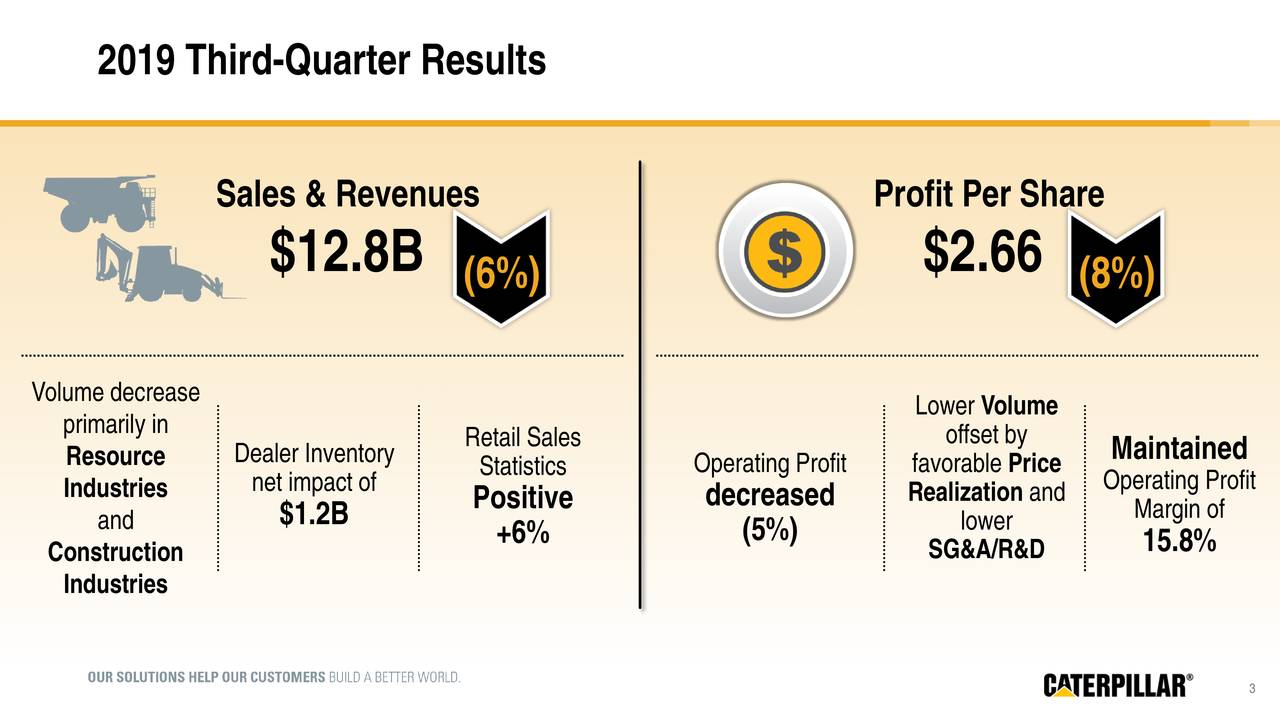

The company had also missed third-quarter revenue and earnings estimates. In addition, it has lowered the outlook for the full year. Its third-quarter sales declined 6% from the same period last year. The earnings per share dropped 8% from the year-ago period.

“Our volumes declined as dealers reduced their inventories, and end-user demand, while positive, was lower than our expectations,” said Caterpillar Chairman and CEO Jim Umpleby.

Poor Financial Numbers Could Also Impact Cash Returns

Caterpillar is famous for offering strong cash returns to investors. It is among the dividend aristocrats as it has raised the dividends in the past 26 years in a row. However, poor financial numbers could also create a negative impact on dividend growth and share buybacks.

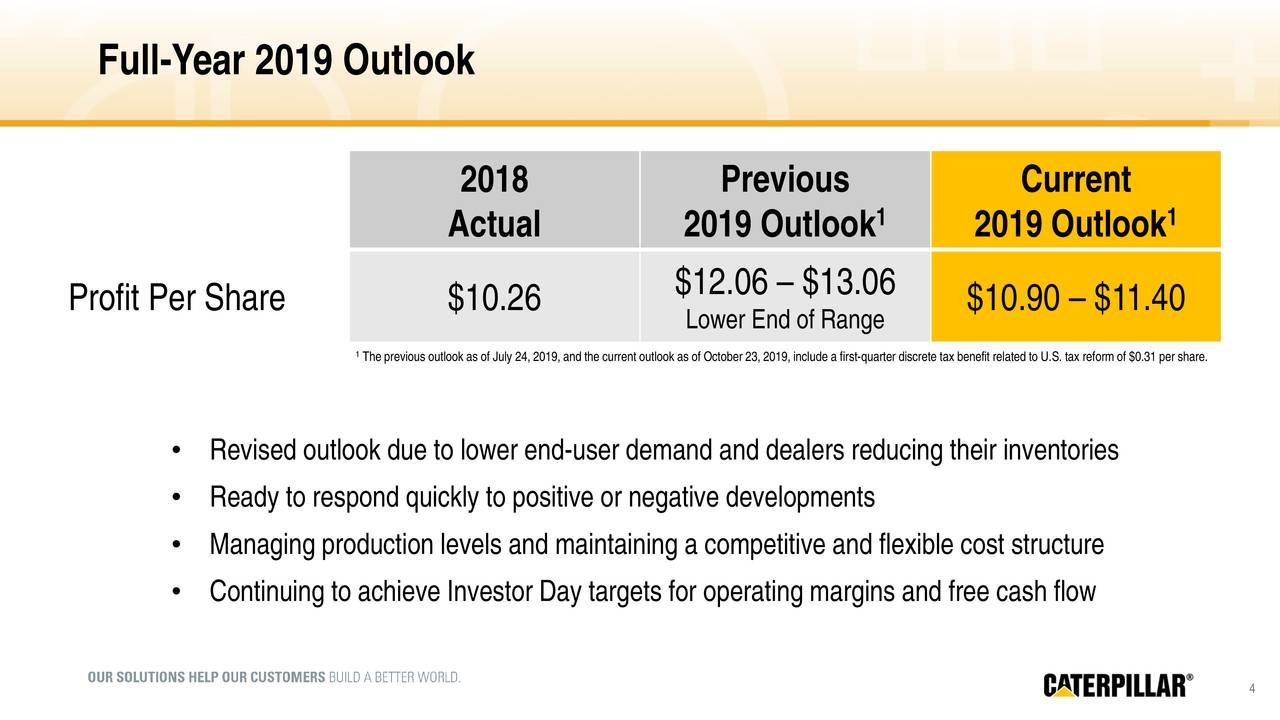

The company expects to generate earnings per share in the range of $10.90 to $11.40, compared to previous guidance of $12.06 to $13.06 range. The huge decline in earnings creates pressure on its payout ratio, which is currently standing around 40%. Overall, Caterpillar shares need support from financial numbers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account