Carnival (NYSE:CCL), the world’s largest cruise operator, said it raised $6.25bn by issuing new debt and equity on Wednesday, to keep its business going amid the coronavirus pandemic.

The firm has been forced to dock its cruise ships to comply with lockdown travel restrictions imposed by governments around the world, and offered investors a deeply discounted fundraising.

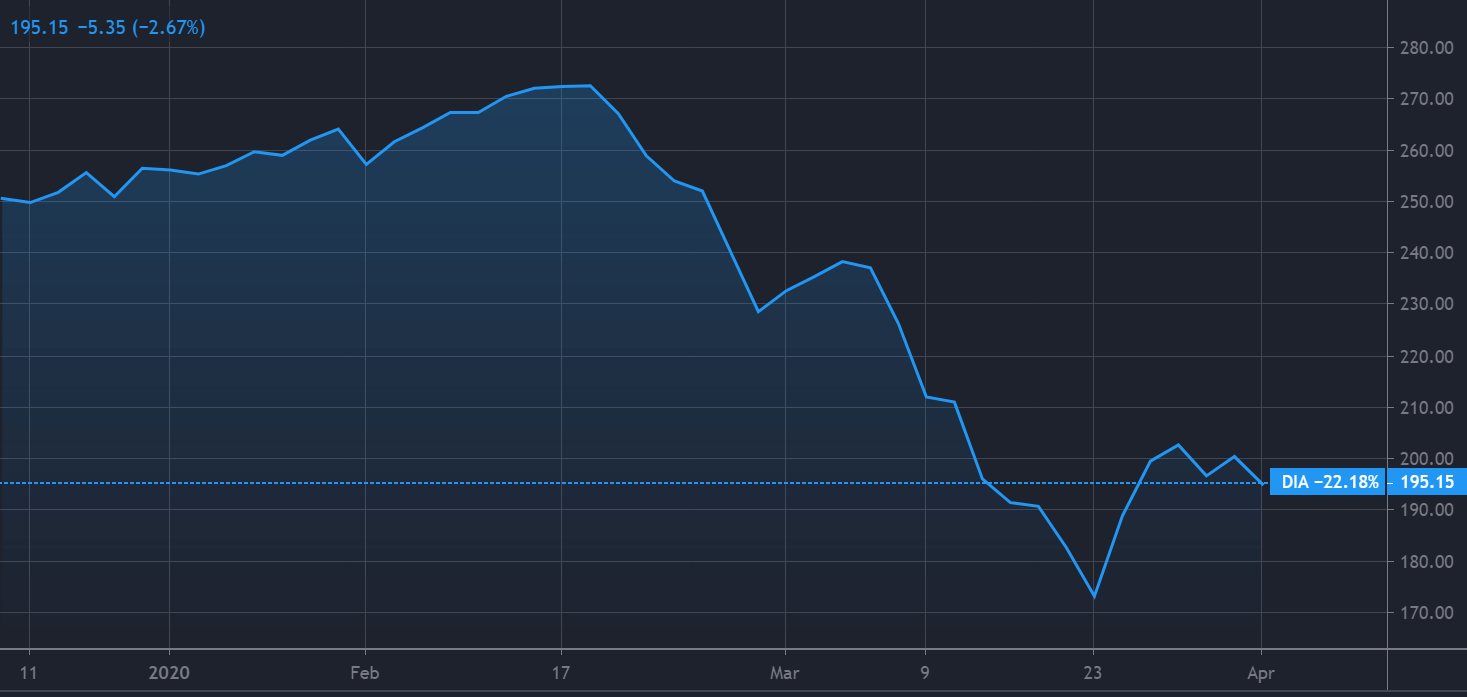

The stock fell by 33.2% to close at $8.80 in trading yesterday, and has slumped by 80% this year, as lockdown restrictions have hit the tourism industry hard. Major rivals such as Norwegian Cruise Lines, and Royal Caribbean have also seen their share prices slashed in 2020.

Carnival priced $4bn in bonds maturing in 2023 – increased from the $3bn originally planned – with a yield at par value of 11.5%, it said in a statement. The group also had to use its ships as collateral to convince bond investors to part with their cash.

By comparison in October, Carnival paid a 1% yield when it borrowed €600m ($657.7m) in the European debt market.

The company also raised $1.75bn in convertible notes with a 5.75% coupon yesterday.

Beyond the bond issues, Carnival also issued new equity, at $8 a share, to raise $500m, less than the $1.25bn it had targetted.

Russ Mould, investment director at broker AJ Bell said: “Under normal circumstances, you wouldn’t expect one of the largest leisure companies in the world to issue debt at such high interest rates, but it goes to show how desperate Carnival now is.”

He added: “Investors brave enough to back the fundraising might think they are getting a bargain, yet Carnival is ploughing through cash at a high rate. The prospectus for the fundraising says it needs $1 billion a month to cover operating costs, cash refunds of customer deposits, servicing debt and some other factors. That implies it needs life to return to normal by autumn otherwise it could be asking investors for even more money.”

The funds are expected to cover Carnival’s current financial obligations over the next 12 months.

Earlier this week, Carnival chief executive Arnold Donald said: “Obviously the travel tourism industry broadly needs the help. This has been devastating for the travel industry. It’s certainly been devastating for cruise, as part of that.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account