How to Buy Activision Stock in 2021

Activision Blizzard (NASDAQ:ATVI) is a leading global entertainment company, developer, and publisher of video games. It is best known for its Call of Duty, World of Warcraft, and Overwatch franchises. It is also the owner of the widely popular Candy Crush mobile game.

Activision’s ability to innovate and its track record of profitable growth has made it a darling of many investors worldwide. Over the last 5 years, Activision Blizzard stock has significantly outperformed both the S&P 500 and the Nasdaq Composite.

Thinking of buying Activision stock today? In this guide, we’ll walk you through the stock purchase process and detail some reasons why you might consider investing in Activision stocks.

-

-

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.3 Simple Steps to Buy Activision Stock

In a hurry? If you don’t have time to read our guide, simply follow these 3 simple steps to buy Activision stock now!

[three-steps id=”199555″]Where To Buy Activision Stock

1. eToro: Best all-around broker for buying stocks directly and via CFDs

eToro is one of the most popular online brokers in Europe, boasting over 5 million customers and thousands of instruments from Stocks to Forex, Commodities, and Cryptocurrencies. It offers its instruments directly or via CFDs.

Buying a stock without leverage is executed directly, but leveraged and short orders are done via CFDs. All trades are commission-free, and CFD trades feature very competitive spreads and overnight rollover fees. Overall, eToro prides itself on low & transparent fees.

eToro offers very intuitive web and mobile platforms that will satisfy beginners & seasoned traders. The platforms include a newsfeed, useful risk management & comparison tools, and plenty of charting functions to make stock trading seamless

A unique feature of eToro is the social trading dimension via its CopyTrader system. You can browse other traders, see what they hold and what their historical performance has been, and decide to automatically copy their trades. This way, you can learn by observing the best, but also delegate some of your trading decisions to other experienced traders!

Our Rating

- Stocks can be bought directly (unleveraged long trades) or via CFDs

- No commissions, tight spreads & low fees

- User-friendly and well-designed web & mobile platform

- Stock trading is not available to US customers

- No MetaTrader integration

Disclaimer: 75% of investors lose money when trading CFDs with this provider.2. Stash Invest: Seamless mobile stock trading experience for beginners

Stash is a mobile app for US investors that makes stock investing fun & accessible. It is most suited to beginners and investors only willing to invest small amounts, and allows users to choose between hundreds of popular stocks and a wide range of ETFs.

The app is beautifully designed and very easy to use. A key feature of Stash Invest is the ability to buy fractional shares starting at $5. For example, instead of investing in a $67 Activision share, you may simply invest $20 and own just under a third of a share!

Trading on Stash is commission-free. However, users must choose between 3 separate plans ($1, $3 and $9 per month) that allow investing in full or fractional shares & offer different options depending on their needs.

Last, Stash allows hands-off investors to auto-invest (Auto-Stash) according to their needs, and offers automatic dividend reinvestment for long-term investors!

OUR RATING

- Stocks & ETFs investing made simple for beginners

- No commissions, offers fractional shares

- Automatic investment and dividend reinvestment options

- Only available in the US

- Limited range of ETFs

- Monthly account fees

3. Plus500: Leader in CFD trading offering a wide range of instruments (including options)

Plus500 is one of the leading online brokers, based in Cyprus with its parent company publicly listed on the UK FTSE 250 Index. It offers hundreds of instruments from Stocks to Commodities & Forex (all via CFDs) and is one of the few leading brokers to offer options.

All trades on Plus500 are commission-free with low spreads and overnight rollover fees. Beginners and experienced traders will find its mobile and web trading platforms very intuitive and well-designed.

You can open an account on Plus500 quickly & seamlessly, with access to leverage up to 5:1 for Stocks and 30:1 for Forex.

Last, Plus500 offers high-quality charting & analysis tools and lets you set up a variety of notifications when prices or sentiment change for your favorite securities.

OUR RATING

- Hundreds of instruments offered via CFDs

- No commissions, low spreads & competitive fees

- User-friendly web platform & mobile app

- Not available to US customers

- Limited customization options vs. peers

- No MetaTrader integration

Disclaimer: 76% of retail investor accounts lose money when trading CFDs with this provider.How To Buy Activision Stock Using eToro

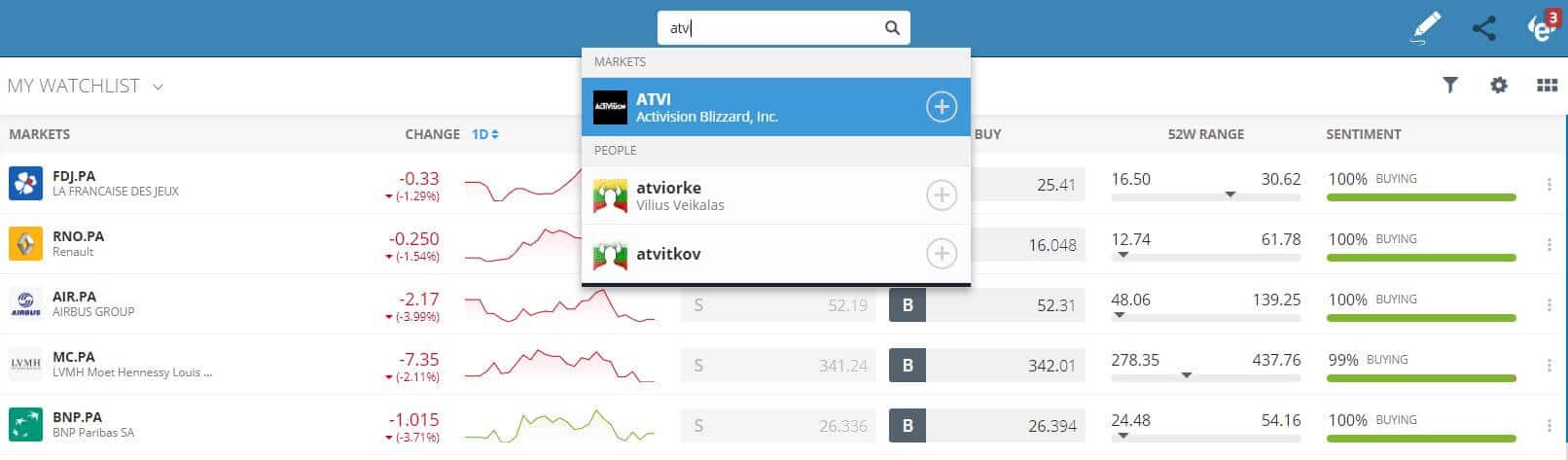

Step 1: Search for Activision (ATVI) stock

Use eToro’s handy search function to find Activision Blizzard stock. In addition to stocks & tradable instruments, the investment app allows users to copy trades of pro investors. This is similar to using trading signals, but with the benefit of being able to pick from a range of individuals or funds with clearly demonstrated returns on investment.

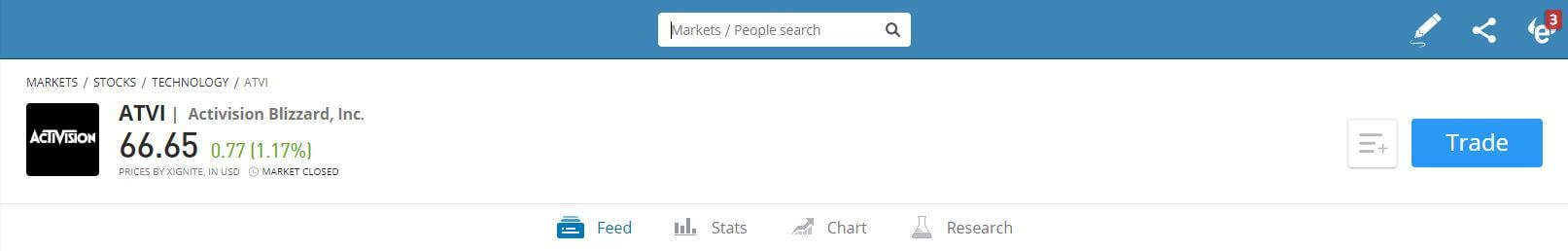

Step 2: Click on “Trade”

When you are ready to buy or sell Activision stock, initiate the transaction by clicking on “trade”, using your “Real” portfolio. If you just want to try your hand at trading, you can also choose the free “Virtual” demo portfolio!

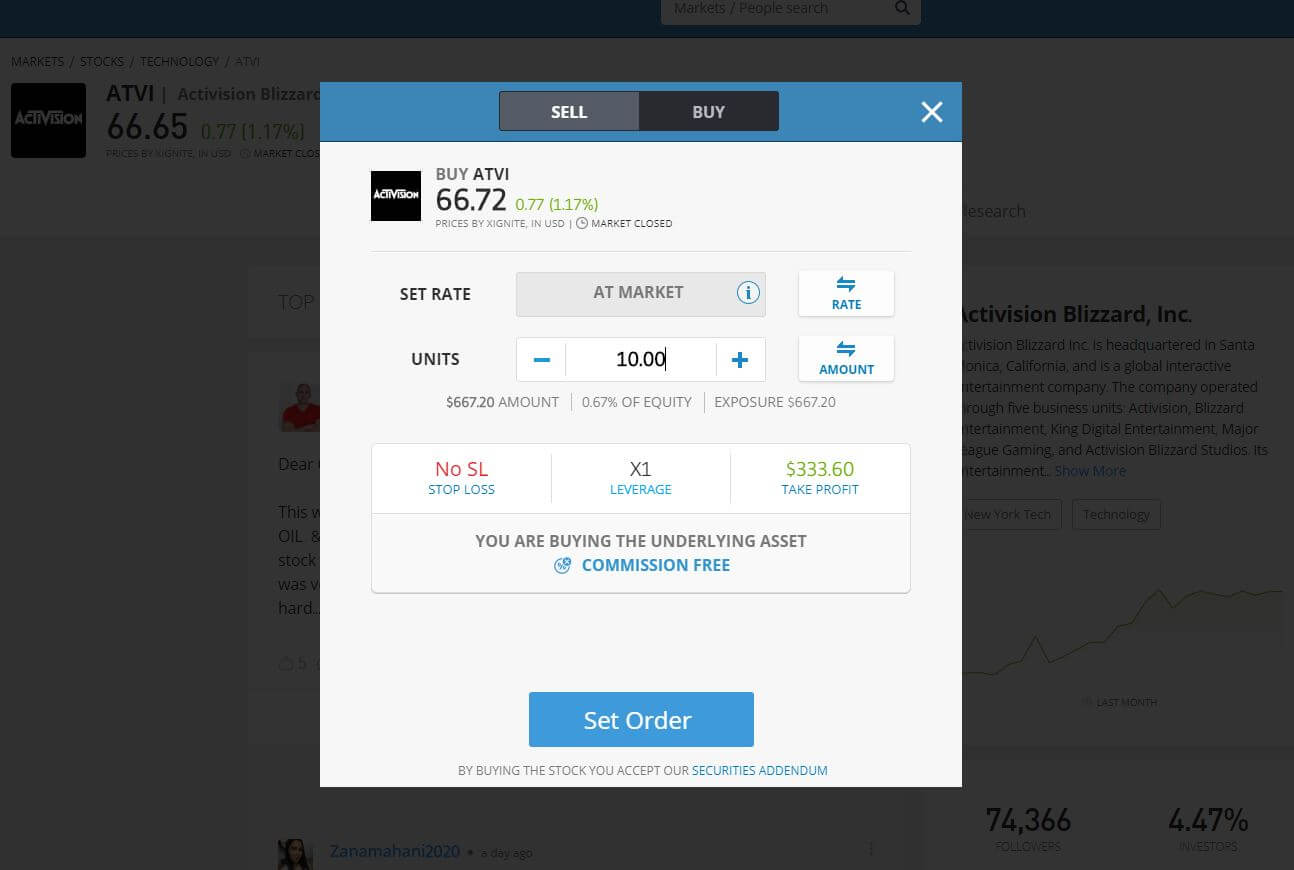

Step 3: Select your order type, the amount and the options you want

In the “Trade” menu, you will first be able to choose to buy (direct order if you don’t use leverage) or sell (trade via CFD) Activision stock. You can select to trade a specific number of stocks (like the example) or a dollar amount of your choice.

By default, your order is a market order, but you can make it a limit order by clicking “Rate”. When you specified your order type & quantity, you will see how much money and what percentage of your equity the trade represents.

If you wish, you can use additional options such as leverage or special order types (take-profit, stop-loss). Finally, if you trade via CFDs, you will see the daily fees displayed at the bottom.

Before deciding to trade, it is crucial that you conduct your own careful research (particularly if you’re using leverage) on any given stock!

When you are ready, click “Open Trade”.

Company Background

Activision Blizzard is a leading global developer & publisher of video games and entertainment. The company is a product of a combination between Activision, Vivendi Games, and Blizzard Entertainment in 2006. It is headquartered in California and listed on the NASDAQ.

Some of Activision’s most famous franchises include the Call of Duty series, World of Warcraft, Overwatch, and Diablo. In 2016, Activision purchased King Digital Entertainment, the maker of global sensation Candy Crush.

Activision Blizzard derives its revenues from 4 major sources:

- Full games sales (purchased physically or downloaded)

- Downloadable content (e.g. game extensions)

- Microtransactions (mostly in-game purchases)

- Subscriptions (particularly for World of Warcraft, a monthly subscription game)

As of December 31st, 2019, Activision Blizzard had approximately 410 million monthly active users and $6.5 billion in revenues.

Its 3 divisions (Activision, Blizzard, and King) contribute almost equally to the company’s revenues, although the Activision division is the most profitable.

Activision’s revenues are quite concentrated, however: in 2019, the largest 3 franchises (Call of Duty, World of Warcraft and Candy Crush) represented 67% of revenues, with no other franchise making more than 10% of revenues.

At the time of writing, the company had a market capitalization of $51.3 billion.

Activision Stock Performance

Activision Blizzard has had a strong start for 2021, up almost 14% at the time of writing.

While the company experienced operational disruptions from the coronavirus crisis, stay-at-home orders worldwide have been a blessing for video game sales. While Activision’s 2021 Q1 results are yet to come, many expect that game makers across the board will set new sales records thanks to the lockdowns.

Activision stock still trades well below its $83 peak in late 2018 but has been on the rise for over a year.

At the time of writing, the analyst consensus was mainly split between “Strong Buy” and “Buy”, with a median price target around $70.

Why Invest in Activision?

Activision Blizzard is one of the world’s largest video game makers, competing with other game titans like Microsoft, Sony, Electronic Arts, and Nintendo.

With approximately 410 million monthly active users across its online games (and many more offline) and the exclusive IP for Call of Duty, World of Warcraft and Candy Crush (67% of 2019 revenues), Activision’s position in the interactive entertainment market is very strong.

Deciding to invest in a stock is a personal decision that must be based on personal research. To help you in the process, below are 4 aspects that make Activision an attractive stock to buy:

1. Strong & profitable track record

In 2019, Activision made $6.5 billion in revenues, $2.3 billion in EBITDA (35% margin) and $1.5 billion in profits (23% margin). Over the period, it also generated $1.8 billion in operating cash flows (28% margin).

Its 2019 return on assets (ROA) stood at 7.6%, its return on equity (ROE) at 11.7%, and its return on invested capital (ROIC) at 16.4% – well in excess of its cost of capital.

While these figures were lower than the previous 2 years, primarily because of divestitures & lower-than-expected product sales, Activision’s margins and returns remain very healthy.

With the ongoing popularity of its existing franchises and Activision’s large cash pile ($5.9 billion) for potential acquisitions, the company’s future looks bright.

2. Growth opportunities

Activision has repeatedly demonstrated an ability to innovate and grow, organically or through strategic acquisitions.

The successful purchase of Candy Crush maker King Entertainments in 2016 underlined Activision’s desire to expand on mobile. Its success following the launch of Call of Duty: Mobile (150 million users in a few months) shows that the firm is capable to build a strong presence on the mobile segment.

In addition to its enormous cash pile for potential acquisitions, Activision has shown that its franchises can innovate and bring new games & extensions to the market to meet growing demand.

Last, the coronavirus crisis and the potential for a more socially distanced future offer Activision opportunities to reach an ever-wider user base.

3. Modest dividend & possible buybacks to complement upside

While most of Activision’s attractiveness for investors lies in its upside potential, it complements its returns with a modest but fast-growing dividend.

At the time of writing, the dividend yield was 0.6% ($0.37 per share), growing at 9% year-on-year and at 10% per year on average over the last 5 years. At <19%, this payout ratio is very sustainable, particularly in light of Activision’s strong cash flows and large net cash position.

In addition, Activision’s Board of Directors authorized a $1.5 billion buyback program over 3 years, although the company may choose not to proceed with the program.

4. Strong net cash position and cash-rich business model

Last, Activision at year-end 2019 had $2.7 billion in debt for $5.9 billion in cash, leaving it with a significant $3.2 billion net cash balance.

The company’s cash position is currently so large that it earns more interest on cash than it pays on its debt, making it highly unlikely to default.

In addition to this comfortable cash cushion, Activision’s subscription-based business model for many games (e.g. World of Warcraft) and the in-app purchases allows it to generate a lot of cash, amply covering any capital expenditures and changes in working capital.

Consequently, Moody’s rates Activision as investment-grade with a Baa1 rating, suggesting a low credit risk level. While this does not mean that Activision’s stock is not risky, it is certainly comforting that the company is unlikely to experience near-term financial distress.

Should I Buy Activision Stock?

As we discussed, Activision is a leader in the interactive entertainment industry, with several highly-established franchises rallying hundreds of millions of users. Consequently, investors may find Activision stock quite attractive.

Nonetheless, we cannot give you investment advice, and the decision to invest rest solely on your shoulders. Before making any investment decision, carefully review a company’s financial statements, press coverage, and understand the risks to make sure you are making the right call.

Investing is not easy and very time consuming, but it can be incredibly rewarding. For more resources, make sure to consult our stock investing and stock trading guides!

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

Where is Activision listed and incorporated?

Activision is an American company headquartered in California and listed on the NASDAQ under the ATVI ticker.

What businesses is Activision primarily involved in?

Activision makes and sells interactive entertainment through its Activision (Call of Duty etc.), Blizzard (World of Warcraft, Overwatch, Diablo) etc.) and King Entertainments (Candy Crush) divisions.

What’s the difference between Activision and Activision Blizzard?

Activision Blizzard, often referred to as just Activision, is the parent company (listed on the NASDAQ). It is a product of the merger between Activision, vivendi Games and Blizzard in 2008. Activision, Blizzard Entertainments and King Entertainments are all divisions of Activision Blizzard.

What should I do before buying Activision stock?

This guide is designed to help you get started, but you cannot only depend on it for your decision. We recommend reading Activision’s SEC filings (at least forms 10-K and 10-Q), revieweing its press coverage and reading what equity analysts have to say about it.

Can I buy Activision stock if I am not a US citizen?

You can, you simply need a broker that offers US stocks listed on the NASDAQ. All the brokers covered in this guide do!

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up