China was expected to lead the global economic growth this year after it the relaxed COVID-19 restrictions last year. However, after the initial rebound, China’s economy is losing steam leaving brokerages scrambling to lower the country’s growth forecast.

Goldman Sachs has become the latest brokerage to lower China’s 2023 GDP growth forecast from 6% to 5.4%.

Brokerages slash China’s growth outlook as recovery stalls

Among other brokerages, Bank of America has made the steepest cut to China’s GDP projections and lowered its forecast from 6.3% to 5.7%. Standard Chartered lowered its forecast from 5.8% to 5.4% while UBS lowered its from 5.7% to 5.2%.

JPMorgan also lowered China’s 2023 growth forecast from 5.9% to 5.5% while Nomura – which is among the most bearish on the Chinese economy lowered its forecast from 5.5% to 5.1%.

Goldman Sachs lowers China’s GDP forecast

In their note, Goldman Sachs economists led by Chief China Economist Hui Shan said, “With continued challenges from the property market, pervasive pessimism among consumers and private entrepreneurs, and only moderate policy easing to partially offset the strong growth headwinds, we mark down our 2023 real GDP forecast.”

The brokerage sees multiple headwinds for China’s economy this year and added “With the reopening boost quickly fading, medium-term challenges such as demographics, the multi-year property downturn, local government implicit debt problems, and geopolitical tensions may start to become more important in China’s growth outlook.”

China is targeting “around 5%” growth in 2023.

Officially, China is targeting GDP growth of “around 5%” in 2023. The world’s second-largest economy expanded at only 3% last year amid its controversial zero-COVID policy.

Amid rising protests against the restrictions, China gave up its zero-COVID policy late last year.

Analysts expected the country’s growth to rebound – just as we saw in the developed world after the lockdowns were eased.

The Chinese economy grew at 4.5% in Q1

The Chinese economy grew at an annualized pace of 4.5% in the first quarter which was ahead of estimates. While the country’s economic data showed uneven recovery most economic indicators pointed to continued recovery.

However, a flurry of economic data has now pointed to the rebound losing steam. For instance, in May China’s exports plunged 7.5% while imports fell 4.5%.

According to Julian Evans-Pritchard, head of China Economics, at Capital Economics, after accounting for the seasonality and inflation, China’s outbound shipments last month were even below what they were at the beginning of the year.

China’s exports plunged in May

Being the “factory of the world” China’s exports reflect the health of the global economy. Similarly, the fall in imports points to softening of demand at home.

To support its economy, China has been relaxing interest rates. The country’s monetary policy is at odds with other major economies where central banks are either still raising rates or have taken a temporary pause in rate hikes.

Goldman Sachs expects the yuan to depreciate

Meanwhile, given the divergence in US and Chinese monetary policies, Goldman Sachs expects the yuan to weaken this year.

While it sees China coming up with some stimulus to boost the economy, it said that it might not be enough. Also, given the spiraling debt, China has limited legroom to offer stimulus.

Goldman Sachs also listed geopolitical tensions as a challenge to China’s growth outlook.

US-China tensions have risen

While the US Secretary of State has visited China and said that he had a “candid” and “constructive” talk with his Chinese counterpart, US-China tensions stay at elevated levels.

Former President Donald Trump imposed tariffs on most Chinese imports and also blamed China for the spread of the coronavirus.

US-China tensions have not come down in Biden’s tenure and if anything, they might have only increased. Biden administration imposed restrictions on high-end chip exports to China, adding another layer of contention between the world’s two largest economies.

UBS is also circumspect about China’s growth outlook

UBS is also circumspect on China’s growth outlook and its Chief China economist Wang Tao said, “Q2 [second quarter] sequential growth may slow to only 1-2% quarter-on-quarter saar [seasonally adjusted annual rate], weaker than our earlier expectation of 4.5%.

According to Wang, China’s real estate sector remains another potent risk to its forecast and added “Risks to our forecast is slightly biased towards the downside, mainly from uncertainties in property market and path of property policy support ahead, as well as weaker external demand.”

Chinese stocks have looked weak

Notably, Chinese stocks have also looked weak this year even as US stocks have rebounded. In February, Goldman Sachs issued a bullish note on Chinese stocks. Several other brokerages were also bullish on the outlook for Chinese stocks but so far the price action has disappointed and the Shanghai Composite Stock Market Index is up by around 6% this year.

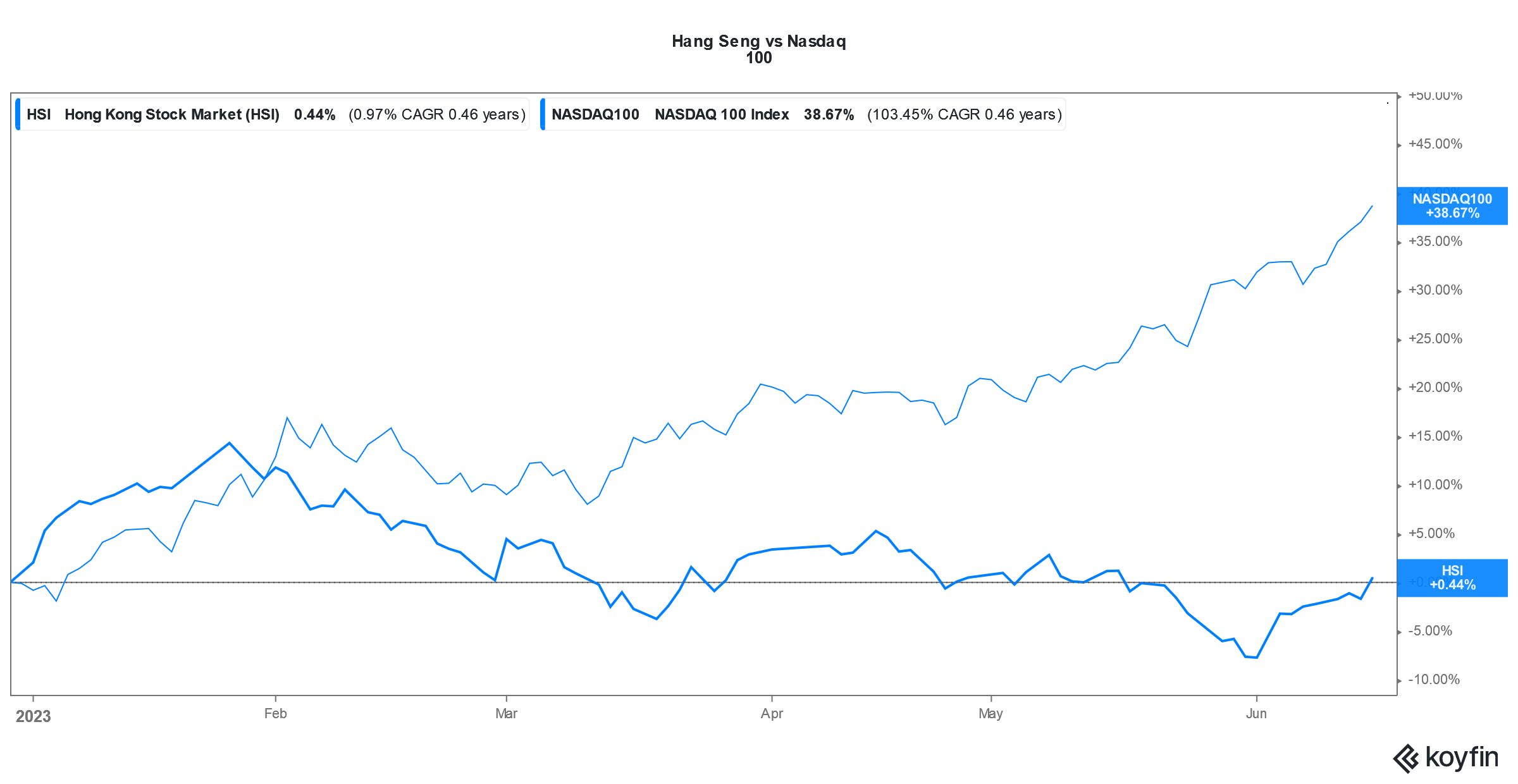

The tech-heavy Hang Seng Index is almost flat for the year while the Nasdaq 100 has gained almost 39% so far – thanks to the euphoria towards AI and US tech stocks.

Chinese stocks are looking weak in today’s price action also as the market continues to monitor the economic recovery which by most accounts is now much slower than what markets previously expected.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account