(December 2011) Conventional thinking is that stocks will outperform bonds over any extended period of time. That stock investors will demand more return than bond investors in order to compensate for extra risks involved with holding stocks. By definition stocks are riskier, as bond holders get paid before stockholders in the case of bankruptcy.

(December 2011) Conventional thinking is that stocks will outperform bonds over any extended period of time. That stock investors will demand more return than bond investors in order to compensate for extra risks involved with holding stocks. By definition stocks are riskier, as bond holders get paid before stockholders in the case of bankruptcy.

While bonds have a limited upside, stocks do not.

When a company is growing, stock holders will see big gains, while bondholders will not. There are notable examples of stocks whose values have increased dramatically in relatively short periods of time. Google’s stock price more than quadrupled shortly after its initial public offering. One share of Apple stock was worth $2.75 in December 1980; in August 2011, the same share was worth $396.75.

Bonds simply do not produce these types of returns. So, one would logically think that bonds could not outperform stocks. And they would be right, most of the time.

For the first time since the 1800’s however, bond returns have outperformed stock returns when looking back over the last 30 years (from Dec. 2011). Long-term government bonds, on average, appreciated by 11.5% per year during this period. This was more than the 10.8% average increase per year of the Standard & Poors 500 stock index. So far in 2011 alone, the increase in bond prices has almost tripled that of the S&P 500 index.

Why are bonds beating stocks? – for the moment

The first major factor which has lead conventional wisdom to be flipped on its head, is the starting point. Keeping in mind that bonds rise in value when interest rates fall, the higher interest rates were 30 years ago in comparison to where they are today, the better off the bondholder.

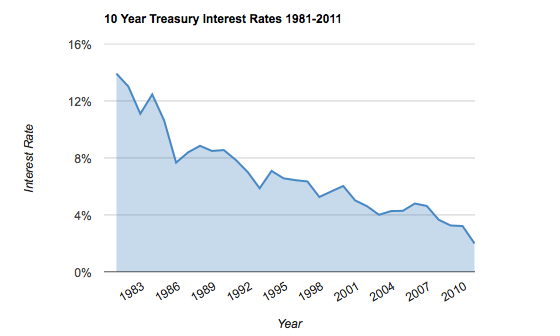

In 1981 (30 years from the date this article was written) the federal reserve had pushed interest rates to extraordinarily high levels by historical standards, in order to combat inflation. In fact rates on the 10 Year Treasury bond, as shown in the chart below, were over 13%.

The second major factor which has lead to bonds outperforming stocks over the last 30 years is where interest rates have gone from 1981 until today. As you can also see from the above chart, interest rates have declined dramatically since that time, and done so in almost a straight line down. The Fed’s intervention into the market in the late 70’s and early 80’s worked, and inflation declined dramatically shortly after. It has remained relatively low since then as well. As bond interest rates and long-term inflation move together, lower inflation has lead to a steady decline in interest rates.

The next reason for this is that when economic times are uncertain, and especially in times of crisis, money moves from higher risk investments like stocks into lower risk investments like bonds. Because there is greater demand for bonds, their interest rates decline (which means their prices go up). With this in mind bonds have performed extraordinarily well since the financial crisis.

Are Bonds Likely to Outperform Stocks in the Next 30 years?

No.

While economic uncertainty still abounds, with the 10 Year treasury currently yielding 2%, the potentially for further declines in interest rates, is very limited. With rates currently so low, the risk is all to the upside (meaning that rates will rise over the next 30 years and ond prices will fall), and stocks are very likely to outperform once again.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account