Boeing (NYSE: BA) stock stood among the laggards in fiscal 2019. BA share price plummeted sharply after the emergence of 737 MAX issues. The huge increase in debt along with a significant decline in financial numbers due to the impact of 737 MAX grounding increased bearish sentiments. However, the prospects started improving for the largest aerospace and defense company.

Boeing stock price plunged more than $100 from an all-time high of $446 that it had at the beginning of fiscal 2019. Its shares are currently trading at $333, up slightly from a 52-weeks low of $319 a share. BA share price could see improvement in the coming days. This is because of the chatters of the stake from big players and an upgrade from Moody’s.

Prospects are Improving for Boeing Stock

The future fundamentals started improving for Boeing following rumors of the stake from big players. The market reports are suggesting that Warren Buffet is likely to buy Boeing shares following a massive share price drop in the past three quarters. Buffett is popular for buying stocks that are trading below the fair value with strong future fundamentals.

BA shares lost significant value in the past few months and its valuations are trading below the industry average – which makes it an attractive pick for value investors.

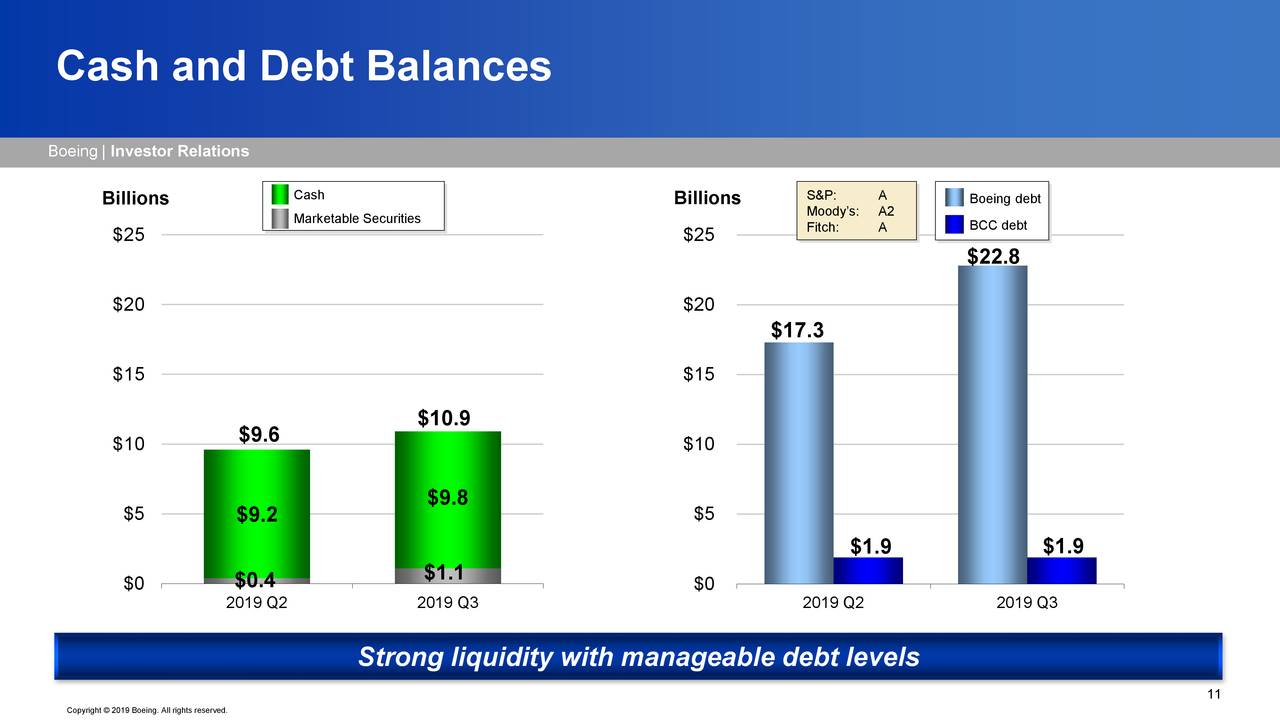

Moreover, the upgrade from Moody’s shows that the company is in a strong cash position to fulfill its liabilities. Moody’s shifted from Negative to a Stable outlook on Boeing.

The rating agency said, “The stable outlook reflects the company’s strong liquidity and financial flexibility which, together with stability in the defense business and ongoing growth in services, mitigates the impact while the MAX remains grounded.”

Cash Position Is Strong Enough to Cover Liabilities

Boeing has been experiencing pressure on its cash position and cash flows amid the huge drop in earnings and payments related to 737 Max grounding. Nevertheless, its cash position is strong enough to cover liabilities. It had almost $10.9 billion in cash at the end of the latest quarter compared to debt of $22 billion. The reports are showing that Boeing can expand available funds to $20 billion through financing from debt markets.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account