BlackBerry (NYSE: BB) stock price had lost substantial value in the past two years. Nevertheless, BB share price is likely to bounce back this year. This is because of its strategy of moving towards the software application business. Its strategy is working considering the prominent improvement in financial numbers. The company is expecting to generate high double-digit revenue growth this year.

The BB share price upside movement in the past few weeks is an indication of investors’ confidence in future fundamentals. The company had topped revenue and earnings estimates in Q3. In addition, its revenue grew 23% year over year in the third quarter. BlackBerry stock rose close to 17% in the last month alone.

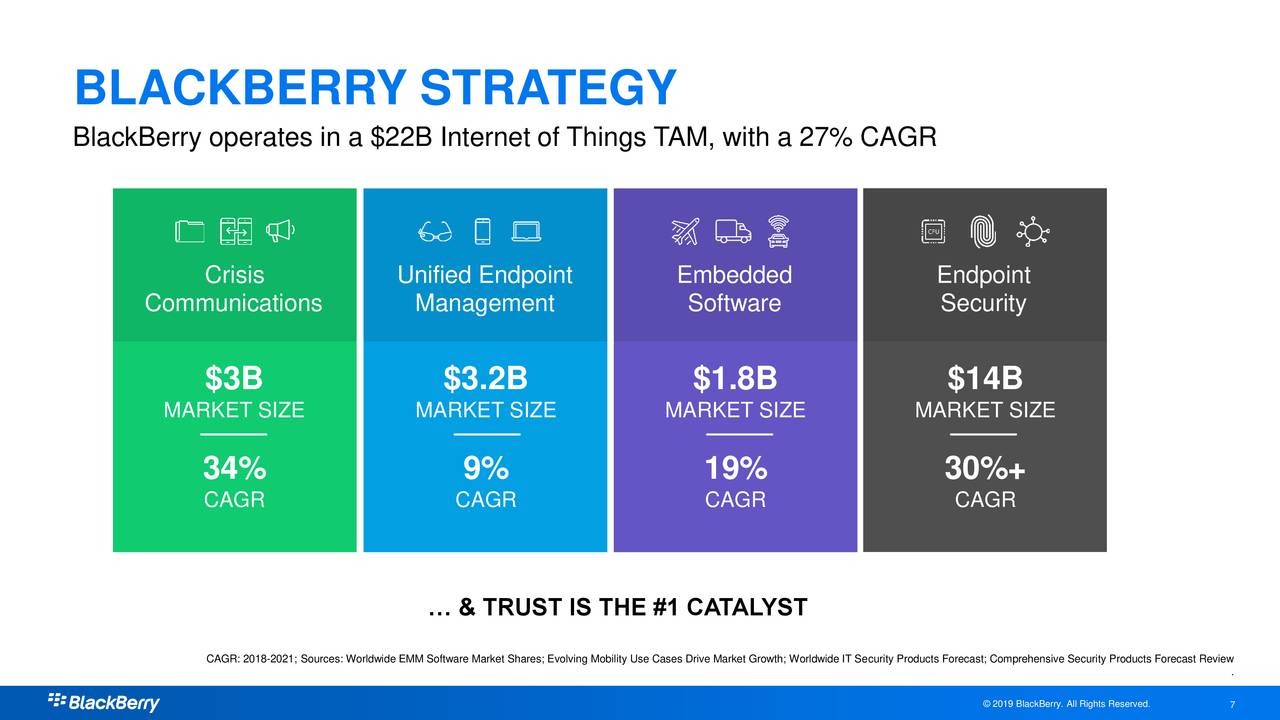

New Business Strategy is Supporting BlackBerry Stock Price

BlackBerry’s strategy of moving its focus towards the software application business is working. This is evident from robust growth in financial numbers. The company had generated Software and Services revenue of $275 million in the third quarter, up 26% from the year-ago period. Its software and services revenue accounted for 90% of consolidated revenue in the previous quarter.

John Chen, Executive Chairman and CEO said, “BlackBerry achieved sequential growth in revenue across all of our software businesses while generating healthy non-GAAP profitability and free cash flow as we continue to invest in our future. Our pipeline is growing as we deliver against our product roadmap and execute on our go-to-market expansion.”

The company has also been steadily moving towards positive earnings and cash flows. Its free cash flows stood around $37 million in the latest quarter.

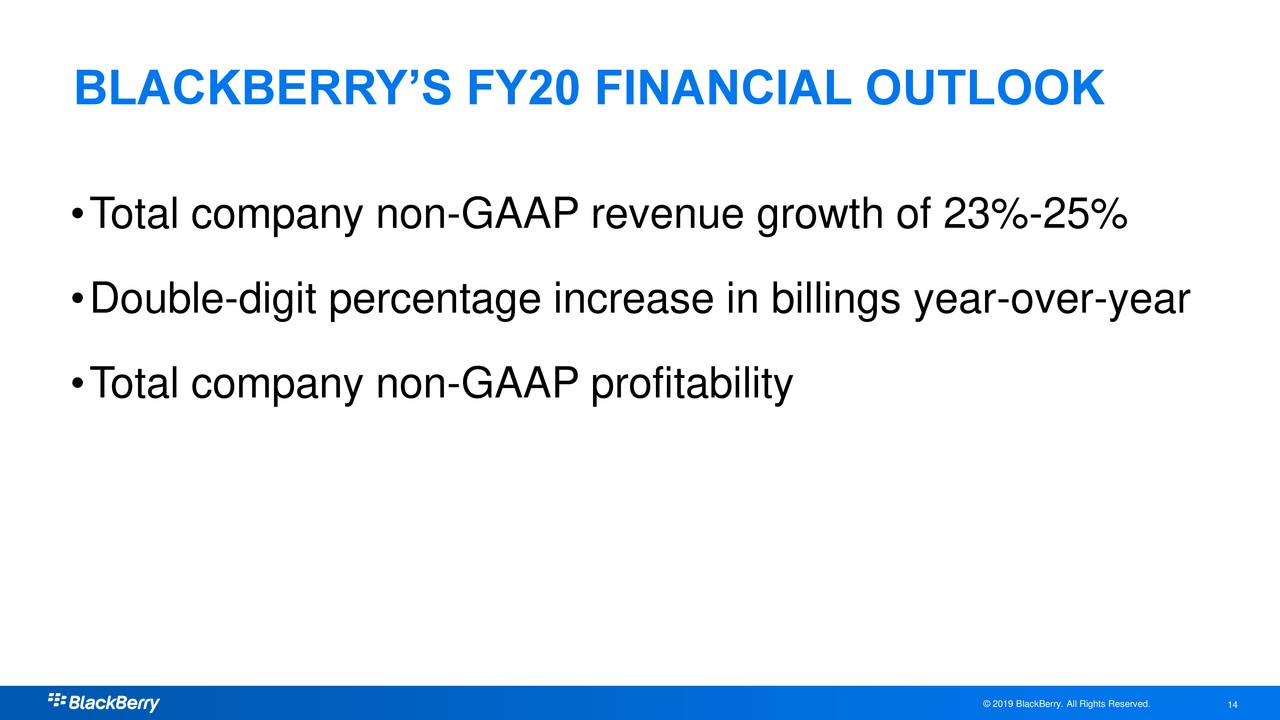

Outlook Indicates Strong Growth

The company expects to generate $1 billion in fiscal 2020 revenue. This represents growth of 25% from the past year. It also anticipates posting positive earnings and cash flows for the full year. Moreover, the improving demand for software application products would help BlackBerry in extending the revenue growth trend into the following years. Overall, BlackBerry stock is well set to generate gains for investors in the coming days.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account