The price of Bitcoin has bounced back from its late February lows after reports that one of the coin’s largest mining hubs in the world could be facing a government crackdown amid concerns related to high energy consumption levels.

Local authorities of Inner Mongolia – an autonomous region that is part of the People’s Republic of China – have effectively banned cryptocurrency mining activities in the region, putting in harms way around 8% of Bitcoin’s supply as the amount of electricity required to perform this activity has become a concern for Chinese regulators.

An exclusive report from Bloomberg indicated that the decision came after the region failed to meet a milestone set by China’s economic planning authority in regards to energy consumption levels – which are part of the country’s goal to dramatically reduce carbon emissions by 2030.

The cryptocurrency market seems to be reacting positively to the news, as a constrained supply of BTC could lead to a short-term imbalance.

As a result, the price of BTC has gone up 13.2% since the report broke, posting a 10% gain on the day that the news broke, while also jumping 6% today at $51,225 during early cryptocurrency trading action.

A project from the University of Cambridge highlighted that Bitcoin mining activities consume around 128.84 terawatts per hour every year, an amount that is similar to the annual energy consumption of Argentina.

China accounts for roughly 65% of the world’s bitcoin mining industry with Inner Mongolia alone taking up 8% of the market share as its energy prices are quite low compared to other regions.

This latest anti-mining move has brought back fears about a potential countrywide crackdown coming for the Bitcoin (BTC) mining industry, as the PRC has already banned other activities related to cryptocurrencies including initial coin offerings and trading.

What’s next for Bitcoin (BTC)

The Inner Mongolia news seems to have helped in reversing Bitcoin’s latest downtrend, with the price bouncing from its 28 February lows while reentering the $50,000 mark.

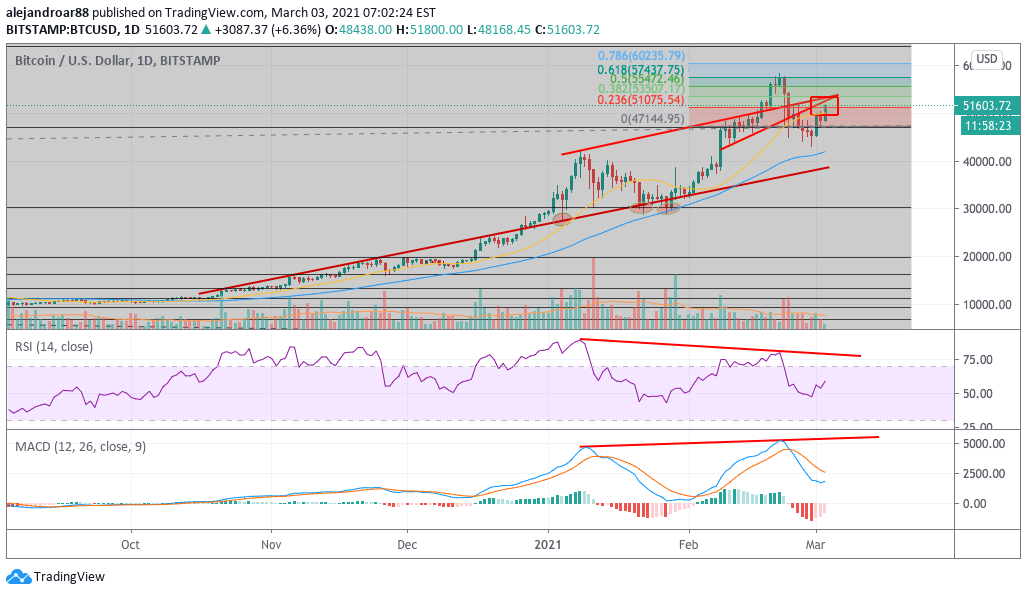

Today’s uptick seems to be stopping at the 0.236 Fibonacci extension shown in the chart above, while the price is breaking above the 2.618 extension derived from the 2017’s retracement again.

These Fibonacci levels have been relevant for Bitcoin ever since the cryptocurrency reached its all-time highs of $58,354 in late February and they serve as potential targets for the price action.

For now, the lower trend line shown in the chart is the next resistance to overcome for BTC. Meanwhile, the RSI remains on a downtrend until proven otherwise, while the MACD has not yet sent a buy signal despite the coin’s latest upticks.

If the price were to move above the $53.5K threshold, chances are that the bull run might accelerate as a result of the breaking of multiple important resistance levels.

However, it is important to note that trading volumes are not remarkably high at this point, which means that a big portion of the market is not yet embracing this bull run as a buying opportunity.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account