The price of Bitcoin is crashing this morning, only a day after rallying to all-time highs, as the latest seemingly endless bull run takes a breather.

Bitcoin is trading 7.7% lower so far today at $17,297 per coin in early cryptocurrency trading activity, as traders appear to be taking some profits off the table after a two-month rally that pushed the price of BTC from the low 10,000s in early September to almost $20,000 per coin yesterday.

The price of the cryptocurrency traded above its $19,377 all-time highs two days ago, the first time this happens since December 2017, but failed to settle at those levels as it closed the session at $19,160 per coin.

Meanwhile, yesterday’s session saw Bitcoin (BTC) price rise to as much as $19,490 during intraday activity but significant selling activity ended up pushing the price to $18,470 to then settle at $18,732 per coin.

A pullback has been widely expected by experienced Bitcoin traders at this point, given the furious rally that the cryptocurrency has seen in the past couple of months while today’s session, although overly bearish, has seen significant buying activity as the price has recovered from an intraday low of $16,317 to the current level of $17,300 per coin.

Apart from a potentially overheated rally, other factors seem to be driving today’s BTC meltdown, including remarks from Coinbase CEO, Brian Armstrong, who warned crypto-supporters about a potentially “rushed” regulation pushed by President Donald Trump’s administration to control self-hosted crypto wallets.

The news came only a few weeks after Paypal – the American digital payments giant – announced a new feature that allows individuals to buy and sell cryptocurrencies by using the company’s platform.

This regulation, according to Armstrong, could require some sort of identity verification made by financial institutions before funds can be withdrawn from the wallets. This, according to experts from the crypto-sphere, would harm the case for crypto assets, as one of the appeals of these financial instruments is the lack of government involvement in controlling their functioning.

What’s next for Bitcoin?

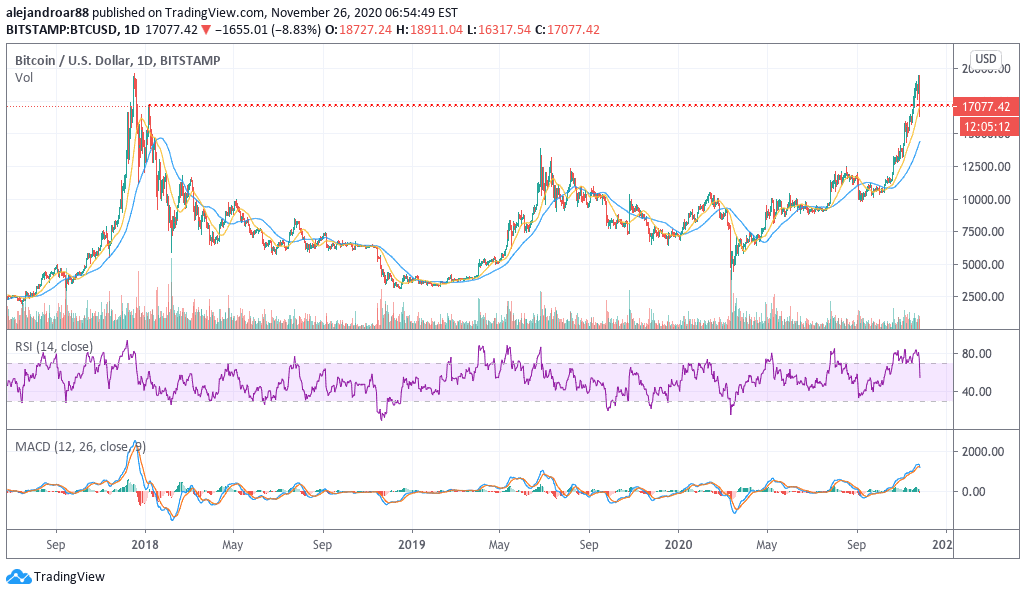

From a technical standpoint, today’s pullback was long overdue, as indicators were flashing overbought for probably a month now.

Meanwhile, the MACD oscillator was also extended to a level not seen since December 2017 – and we all know how that ended.

At this point, the pullback remains a healthy one as late buyers will see today’s drop as an opportunity to jump in at a much more conservative price point.

However, the next few sessions will tell if these government intervention rumors could fully derail Bitcoin’s rally or if this is just a temporary breather before the bull run resumes.

Interestingly enough, the price of Bitcoin is finding support right now at the $17,200 level, which was the peak of a bull trap that took place in the weeks that followed the December all-time high, with the price of the cryptocurrency then collapsing to the low 6,000s only a month after.

Although Bitcoin supporters continue to make a case for the cryptocurrency being a strong hedge against the recent fiat debasement carried on by central banks around the world, this kind of volatility continues to be one of the factors driving institutional investors away from incorporating BTC into their portfolios, while also luring regulators who fear that small investors may not fully understand the risks of exposing their capital to these instruments.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account