Last week was pretty productive for many of the altcoins as hopes of an altseason start to materialize. The weekend, however, was totally inactive for most of them as Bitcoin failed to break resistance and its brethren remained flat or in slight decline.

BTC Held at Resistance

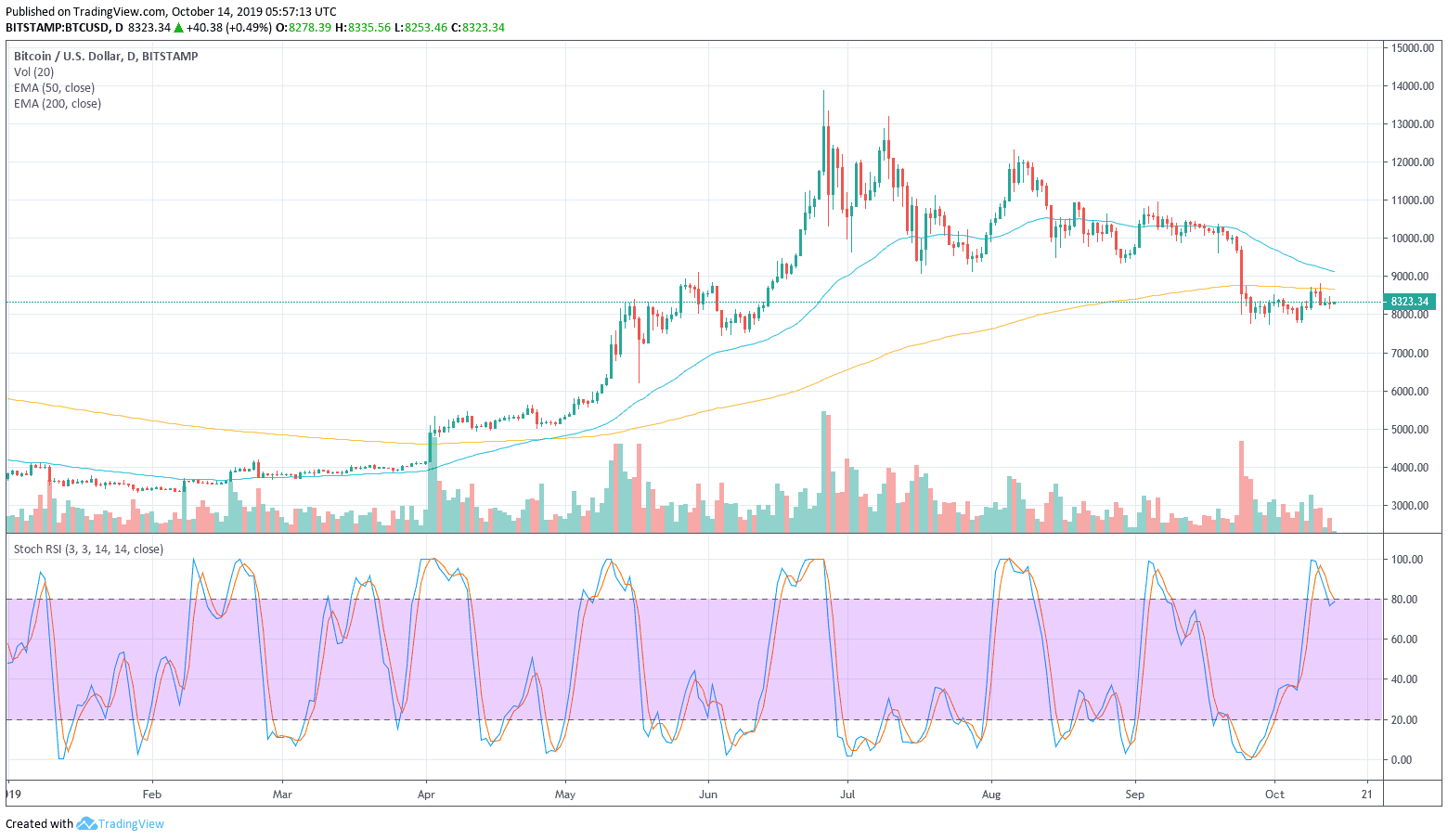

Bitcoin had a brief spell at around $8,600 late last week and even had a little spurt up to $8,800 according to Tradingview.com. As if stung by this move the king of crypto instantly retreated and the following candle was a deep red one dumping it back to support again.

The weekend was spent hovering around this level in the low $8,300 zone. Another push higher was attempted in late Sunday trading which too the asset above $8,400 but it too was followed by a large red hourly candle which dumped BTC back to support.

Clearly the bulls do not have what it takes yet to overcome these strong resistance barriers and at the time of writing Bitcoin remains consolidating at its two day support zone just above $8,300.

Trader and analyst ‘CryptoHamster’ meanwhile observed that the sideways channel is on, or just above, the 50% Fibonacci retracement level which could also be a signal of a bigger breakout approaching this week.

“$BTC will either go above the previous trading zone and 23.6% Fibo, where a lot of shorts stops are concentrated, or BTC will go below the previous trading zone and 61.8% Fibo, where a lot of the longs stops are concentrated.”

Simple:$BTC will either go above the previous trading zone and 23.6% Fibo, where a lot of shorts stops are concentrated, or

BTC will go below the previous trading zone and 61.8% Fibo, where a lot of the longs stops are concentrated.

Let’s follow the trend.$BTCUSD #bitcoin pic.twitter.com/GB7f9kxHPv— CryptoHamster (@CryptoHamsterIO) October 13, 2019

Using those Fib levels, resistance currently lies at $8,600 while there is support at $8,200 and even stronger levels below it at $8,000. When asked about next price levels, analyst Josh Rager offered;

“Under $8k, of course that could happen, break below $8200 and it likely goes to $7700 to $7800 IMO”

On the daily chart a death cross of the 50 day moving average below the 200 day MA is approaching which is a long term down trend indicator. The last time this happened was in March 2018 and a year-long bear market followed. The coming week will be crucial for Bitcoin prices but it must break resistance if trend is to be reversed.

Altcoins Keeping Up

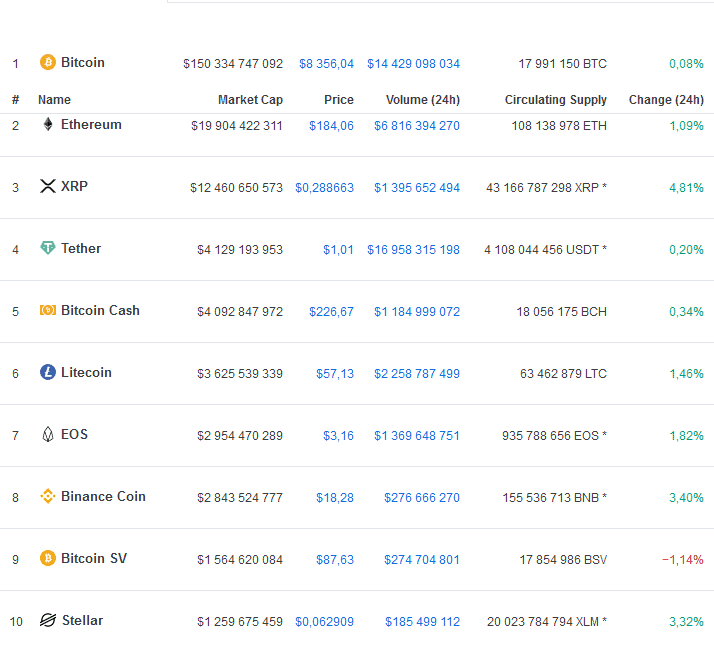

As BTC dominance has failed to regain 70% the altcoins are starting to look healthier. The weekend has been very quiet for most of them but green is starting to filter into markets on Monday morning.

Ethereum has pulled back from its Friday high of $195 to trade at just over $180 and is still very weak at anything below $200. ETH has yet failed to decouple from its big brother and may not until major network updates in Istanbul and first Serenity phases are rolled out early next year.

Click here to know more about Bitcoin Trading.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account