Aurora Cannabis (NYSE: ACB) stock price has been extending the bearish trend amid increasing supplies. Its shares are currently trading around $3.5, the lowest level in the past two years.

ACB shares are down close to 60% from 52-weeks high of $10 a share. The selloff is also supported by traders’ concerns over lower than expected revenue in the latest quarter.

In addition, the majority of analysts are expecting cannabis companies to miss their revenue estimates in the upcoming quarters.

Analysts believe Hexo’s lower than expected results for the third quarter and lower guidance for the fourth quarter indicates the downtrend in cannabis markets.

Oversupply Impacts Aurora Cannabis Stock Price

Aurora Cannabis along with other major cannabis compaies have lost billions of dollars of market capitalization in the past couple of months. This is only due to traders’ concerns over the oversupply situation.

The majority of cannabis producers have been investing significantly to enhance their production potential. Moreover, cannabis coming from black markets is adding to oversupply concerns.

For instance, BNN Bloomberg reported that 86% of cannabis in Canada is coming from the black market. Meanwhile, the annualized legal production stood around 750 thousand kilograms in July compared to consumption of 924 thousand kilos per year. This means that legal consumption accounts for only 130 thousand kilos.

On Top, the majority of producers are seeking to increase production up to 100% in the next fiscal year.

Lower Than Expected Financial Growth

Revenue and earnings miss in the latest quarter added to the bearish trend in Aurora Cannabis stock price.

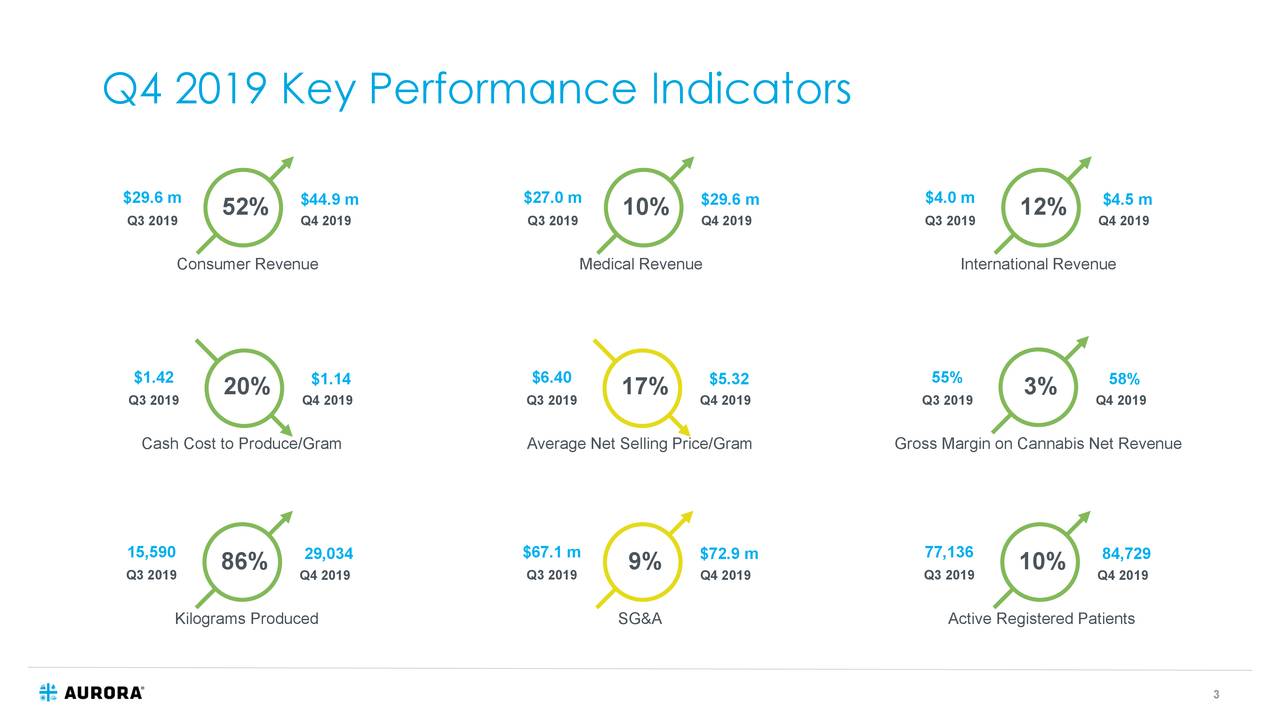

Its fourth-quarter revenue of C$98.94M missed analysts estimate by C$4.57M. Its revenue increased by 52% in the latest quarter, driven by growth in medical and recreational cannabis.

Overall, the sentiments related to cannabis markets are likely to remain dim. The investors are suggested to keep an eye on the upcoming earnings reports of cannabis producers before initiating a position.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account