Apple (NASDAQ: AAPL) stock price retreated despite beating iPhone revenue expectations for the second quarter as the coronavirus spread has dampened consumer demand, raising concerns that iPhone sales performance will suffer later this year.

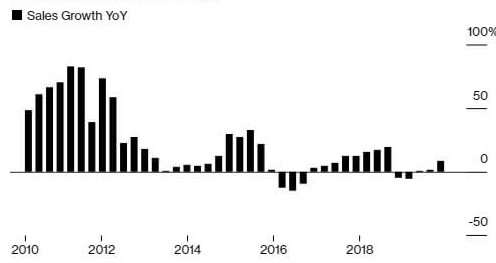

While Apple iPhone sales of $29bn in the second quarter slightly exceeded the consensus guidance of $28bn, investors reacted to a year over year sales drop of 7% along with a bleak outlook for the June quarter. Its iPhone sales stood around $31.1bn in the same period last year.

However, record quarterly revenue of $6.3bn from wearable and $13.3bn from services helped the world’s largest technology giant in lowering the impact of iPhone sales. Its second-quarter consolidated sales came in at $58.3bn, up 1% from the past year period.

The company has raised the quarterly dividend by 6.5% to $0.82 per share, marking the eighth consecutive years of a dividend increase. The company also committed to repurchase $50bn of outstanding stock in the following quarters. The firm’s cash pile stands at $192.8bn.

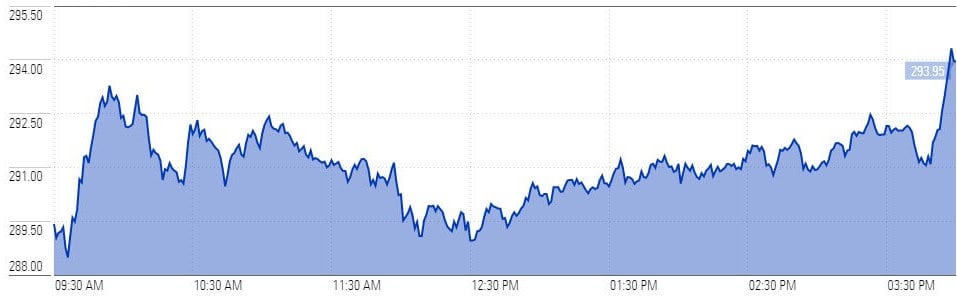

Its production also backs up to typical levels in China, but chief executive Tim Cook (pictured) didn’t comment whether its 5G iPhone fall launch would be on time. Apple plunged more than 2% in extended hours stock trading after announcing second-quarter results.

“This may not have been the quarter it could have been absent the pandemic, but I don’t think I can recall a quarter where I’ve been prouder of what we do or how we do it,” Cook said on a conference call on Thursday.

He added: “As compared to February, we saw a nice improvement in March and a further improvement in April. China is headed in the right direction.”

The company didn’t provide the forecast for the first time in more than a decade, but Cook said that Apple could see a massive revenue drop from wearable tech and iPhones in the June quarter while services, iPads and Macs could perform better than the past periods. The stock was 1% lower at $290.22 in Friday lunchtime trading.

If you are interested in buying Apple stock, you can check out our featured stock brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account