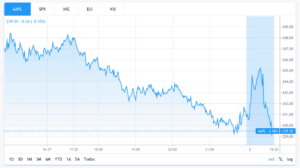

Apple shares started 2020 at a good clip for a mega-stock, gaining around 10% over the first two months of the year, compared to the S&P 500 which only gained 4.8% over the same period.

But now the stock has lost nearly 26% since the trading sell-off triggered by the coronavirus in late February, leaving investors divided about where the company goes next. Bulls favour the long-term fundamentals of Apple, led by chief executive Tim Cook, while bears are fear a worldwide recession and the impact that would have on discretionary products such as smartphones.

What the Bulls Say

Those who rate Apple as a buy make these arguments:

• The Cupertino-based company is about to launch its 5G-capable smartphone generation, which may include a number of new features that can only now be achieved thanks to the higher speed of 5G networks. Apple’s team in charge of developing the company’s latest products and software updates are still working from home to keep the tech giant’s innovation machine up and running.

• Apple services, such as iTunes and App Store, are experiencing a surge in demand due to stay-at-home restrictions across the globe, driving up internet usage internet connectivity for work and entertainment. Even though these units are a relatively small part of the group, around 18% of total revenues, they will partly offset declines experienced elsewhere in the business.

What the Bears Say

Those who rate Apple as a sell make this case:

• Current stock prices underestimate the impact of the virus on the global economy.

• Discretionary spending will be reduced as a result of higher unemployment rates. “Anything that is discretionary I think will be absolutely not spent a penny on for at least a year,” said BK Asset Management managing director Boris Schlossberg told CNBC on Thursday.

Bottom Line

Founded by Steve Jobs back in 1976, Apple employs nearly 140,000 people and sells over 200 million iPhones every year. On Tuesday, the group announced that it acquired Dark

Sky, a weather mobile app, for an undisclosed sum as part of the expansion of its services business, which generated $12.7bn in revenue in the first quarter of this years, while the Mac division generated $7.1bn with the iPad responsible for $5.9bn.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account