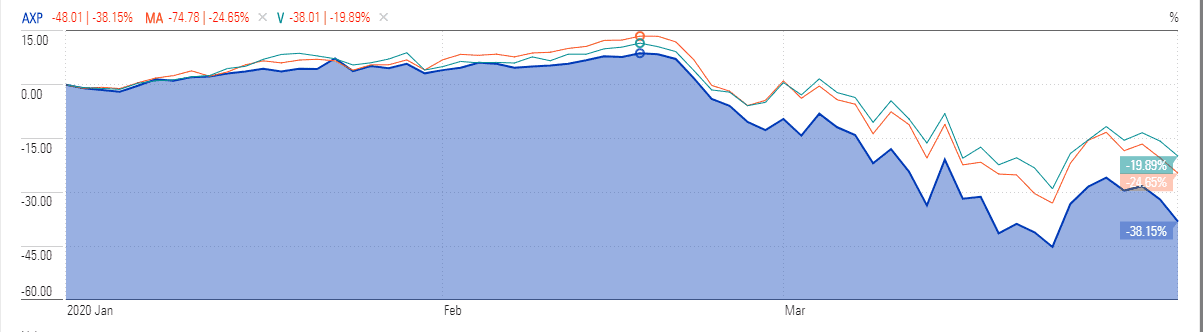

American Express (NYSE: AXP) stock price has been making bigger price swings than its rivals such as MasterCard (NYSE: MA) and Visa (NYSE: V), as its business model is significantly exposed to recession fears compared to others.

Also, the company’s strategy of avoiding layoffs in 2020 despite slowing demand and declining revenues has raised investors’ concerns over profitability. Its shares fell back to $80 level in market trading after briefly hitting $100 mark last week; the stock price is down more than 40% from its 52-week high of $138.

Unlike MasterCard and Visa that purely operates as payment processors, American Express is not only payment processors, but act as a lender. This is known as a closed loop’ payment network. When you swipe your American Express credit card, Amex not only moves money from your account to the merchant’s, but it actually loans you the money itself.

This creates an entirely different level of exposure to recession fears. Not only could payment volume slow down, but consumers could have trouble paying their bills in a prolonged downturn.

The payment volume has already slowed sharply in the last two months amid lockdowns on health crisis; fears of a recession may make it difficult for consumers to pay their bills weighs on American Express stock price future fundamentals.

The business recently dropped its revenue and earnings outlook for the first quarter due to the negative impact of the virus outspread. It expects revenue to grow 2-3% in the first quarter while earnings are likely to stand around $1.90 to $2.10 compared to the consensus estimate of $2.14 per share.

“American Express has a long runway to deliver strong, long-term performance, driven by our differentiated business model and our focus on our strategic imperatives,” said chairman and chief executive officer Stephen Squeri. “We will continue our strategy of investing in share, scale, and relevance, and we are focused on running the company for the long term.”

On Monday, American Express said that its 60,000 employees are working from home; Stephen Squeri says he not intending to reduce the workforce even in a difficult environment and slumping demand.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account