Amazon’s (AMZN) market cap has fallen below $1 trillion yet again amid the sell-off in tech shares. The company is battling a severe slowdown and has also seen an escalation in costs.

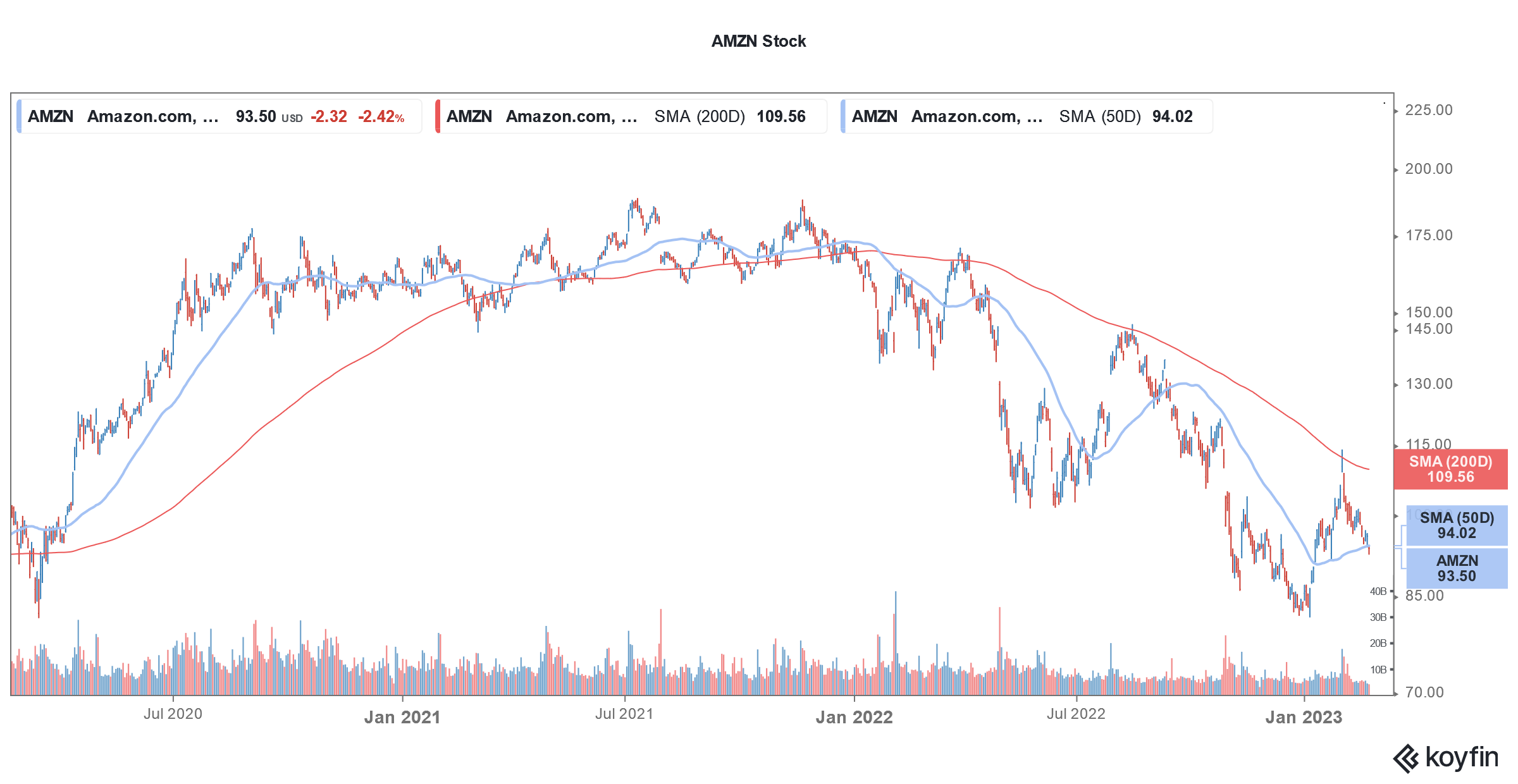

In 2021, Amazon looked set to become a $2 trillion company. However, the stock underperformed markets by a wide margin that year. It shed almost 50% in 2022 as well and also lost its status as a $1 trillion company. It has the dubious distinction of becoming the first company to lose $1 trillion in market cap. Earlier this year, Apple too joined the list as the iPhone makers’ market cap briefly fell below $2 trillion.

As for Amazon, its market cap surpassed $1 trillion in January as US stocks rallied. However, the tech sell-off resumed in February and AMZN’s dismal earnings did not help matters.

AMZN provided tepid Q1 2023 guidance

Amazon reported revenues of $149.2 billion in Q4 2022 which was 9% higher than the corresponding quarter last year. The revenues surpassed analysts’ estimate of $145.4 billion and were also higher than the company’s guidance of between 2-8% revenue growth.

Looking at the breakup of Amazon’s Q4 2022 revenues, AWS reported revenues of $21.4 billion which fell short of the $21.87 billion that analysts were expecting. The segment’s sales rose 20% which is a new low for the cloud business.

Amazon’s advertising business has performed well

Amazon’s advertising business meanwhile performed better than expected and generated revenues of $11.56 billion in the quarter which was ahead of the $11.38 billion which analysts expected.

All said, in the full year Amazon’s sales growth was only 9% which is the slowest pace of annual rise since it went public.

Amazon posted a net income of only $0.3 billion in Q4 which transforms into an EPS of 3 cents. The company’s profits fell short of what markets were expecting. It posted an operating income of $2.7 billion in the quarter which was above the midpoint of its guidance.

That said, only AWS posted an operating profit of $5.2 billion in the quarter. While the North American segment lost $240 million, the international business reported an operating loss of $2.2 billion.

It guided for a sales growth between 4%-8% for the first quarter.

Amazon’s growth and profits have nosedived

Amazon’s growth has nosedived while its profits have plummeted. Amazon’s CEO Andy Jassy said, “In the short term, we face an uncertain economy, but we remain quite optimistic about the long-term opportunities for Amazon.”

Notably, Amazon has eliminated 18,000 positions as part of the cost-cut exercise. The company was previously looking to lower the workforce by around 10,000 but scaled up the layoffs.

It has also mandated employees to work from the office for a minimum of three days a week. Many employees are against the decision and we might see some attrition at AMZN as the May 1 deadline approaches. Through cost cuts, AMZN is looking to boost its sagging profitability.

During the Q4 2022 earnings call, Jassy said, “We’re working really hard to streamline our costs and trying to do so at the same time that we don’t give up on the long-term strategic investments that we believe can meaningfully change broad customer experiences and change Amazon over the long term.”

Analysts still see AMZN as a long-term buy

Meanwhile, despite Amazon’s dismal guidance and the multiple headwinds, Wall Street analysts see it as a good long-term buy.

After Amazon’s Q4 earnings release, Goldman Sachs said, “While the next few quarters will likely remain volatile as an output of macroeconomic volatility, the long-term narratives from Amazon and a compelling multi-year risk/reward should appeal to investors.”

Evercore ISI’s Mark Mahaney said that Amazon is the “strongest, most successfully diversified company” in its coverage universe.

He added, “AMZN has a clear track record of operating through economic cycles and has been belt tightening since Q1:22, so investors can have some comfort that AMZN will defend the bottom line.”

Morgan Stanley also reiterated AMZN as overweight and sees further improvement in the company’s e-commerce business. Loop too reiterated similar views and sees a “retail bull” case for Amazon.

Amazon’s growth has sagged amid multiple headwinds

The macroeconomic slowdown is hurting Amazon. US retail sales have slowed down and sales of discretionary products have especially been tepid. Also, as more people have started shopping in stores, online sales growth has come down.

Meanwhile, Wall Street analysts were quite bullish on AMZN in 2021 and 2022 but the stock underperformed badly in both years. Would 2023 be any better for the e-commerce giant? We’ll have to wait and see.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account