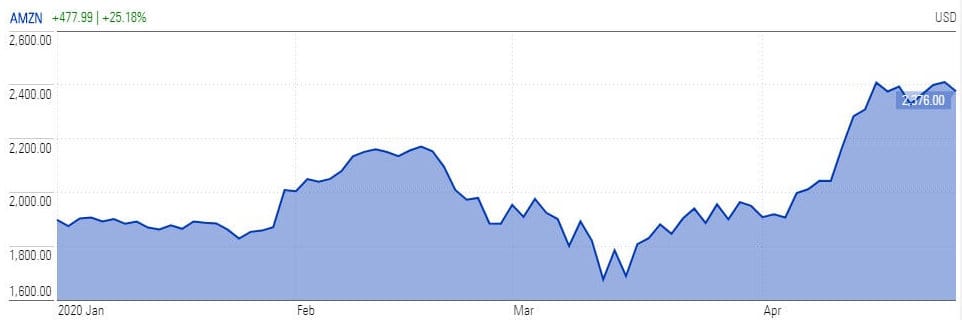

Amazon (NASDAQ: AMZN) stock price gained more than 30% of the value from March lows as investors are expecting the Big Tech giant to post strong top-line numbers on Thursday for the first quarter due to stay-at-home demand due to the coronavirus pandemic.

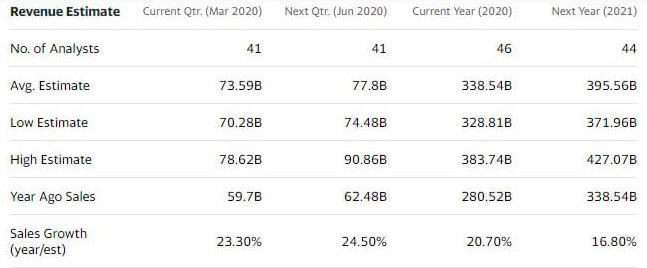

The consensus revenue estimate is $73.5bn for the first quarter, indicating close to 23% growth from the same past a year ago.

Amazon has surprised investors in the past four consecutive quarters. Analysts believe peoples rush for household essentials, groceries, and cloud computing over the last two months will help it again beat estimates.

The hiring of almost 175000 workers last month also hints revenue growth for the first and the second quarter, with reports revealing that each new hire would increase quarterly net online sales by $75,000. However, the rush in hiring new workers for stockpicking and delivery could create pressure on its operating margins, say analysts.

The Seattle-based firm has topped earnings per share estimates 75% of the time over the last two years, it and has also beaten revenue estimates 75% of the time it that period.

Investment bank Stifel has raised Amazon’s revenue estimate by 1.5% to $73.9bn for the first quarter. “We are raising our revenue estimates given the e-commerce opportunity stemming from the pandemic and the potential that prolonged dislocation in traditional retail accelerates e-commerce penetration,” the firm said.

The rating agencies are also bullish about Amazon stock price. Despite the gains in stock trading throughout April, Oppenheimer expects Amazon stock to hit $2,700 level on strong first-quarter results. The online retailer is currently at around $2,333 on Tuesday lunchtime.

Meanwhile, Jefferies analyst Brent Thill provided the Street-high price target of $2,800, citing the “upside to forward profit estimates and attractive growth- adjusted valuation.” Thill also predicts that Amazon stock is well set to hit $4,000 level in the next three years due to its leadership in cloud computing and online retailing.

You can use our featured stock brokers if you plan to trade Amazon stock on first-quarter earnings.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account