Amazon (NASDAQ: AMZN) stock price has been under pressure since the beginning of the second half this year. AMZN shares slid below $1800 level after reporting lower than expected results for the third quarter. The company missed earnings estimates for the second quarter in a row.

In addition, its revenue growth has been softening quarter over quarter. Traders believe increasing market competition is negatively impacting Amazon’s growth potential. Fortunately, market analysts are seeing the dip in Amazon stock price as an attractive entry point for long-term investors.

The Dip in Amazon Stock Price is a Buying Opportunity

The majority of market analysts are showing bullish sentiments for Amazon. RBC’s Mark Mahaney has set a price target of $2500 with an Outperform rating. Morgan Stanley believes the efficiency in one-day delivery is a good sign despite lower than anticipated guidance for the final quarter.

Morgan Stanley says, “About 25% of U.S. units went through one-day shipping in the quarter. The cost and complexity to compete with Amazon are rising.” The firm has set the price target of $2,100.

JPMorgan, on the other hand, suggests investors buy on the dip. The Bank says, “We’ll take the trade-off of lighter profits for higher revenue – Amazon’s earned it.”

Jefferies and Goldman are of the opinion that short-term headwinds are presenting an attractive entry point for new investors.

Light Guidance Could Keep AMZN Shares Under Pressure

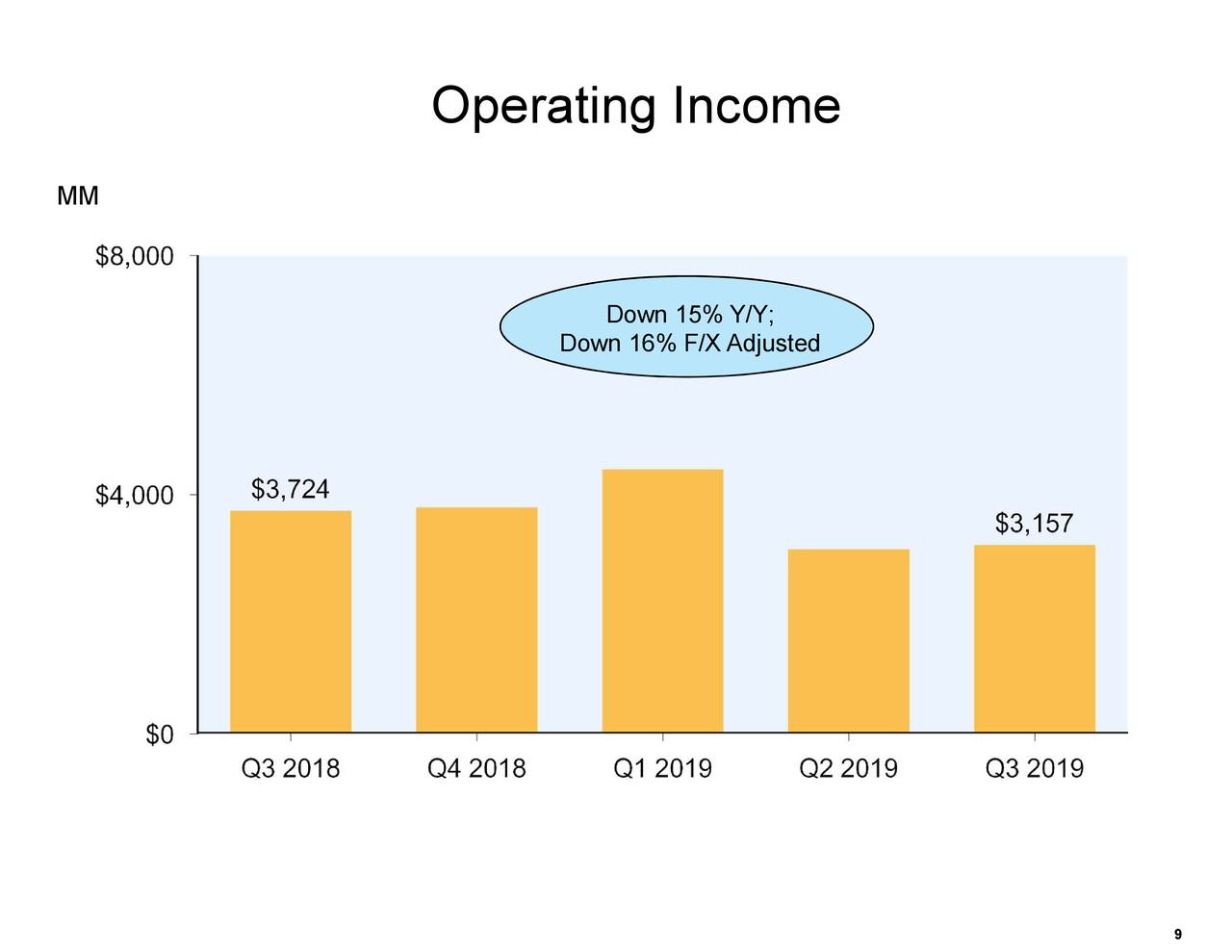

Although its Q3 net sales grew 24% from the previous year period, the company missed consensus profit estimates. Its Q3 operating income declined to $3.2B compared to $3.7B in the year-ago period. The net income stood around $2.1B, down from $2.9B in Q3 of 2018.

The company has reduced its guidance for the final quarter this year. It now expects full-year sales to grow in the range of 11-20% Y/Y. The company’s operating income is likely to stand around $1.2B-$2.9B, down significantly from past year income of $3.8B. Overall, Amazon stock price is likely to remain under pressure in the short-term.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account