After outperforming a broader market trend last month, Amazon (NASDAQ: AMZN) stands among the stocks that are hinting signs of a rebound in the days to come amid demand growth as more people are forced to stay at home. Market analysts have started increasing revenue forecasts for the March quarter and the full year as they believe the group will gain market share after coronavirus.

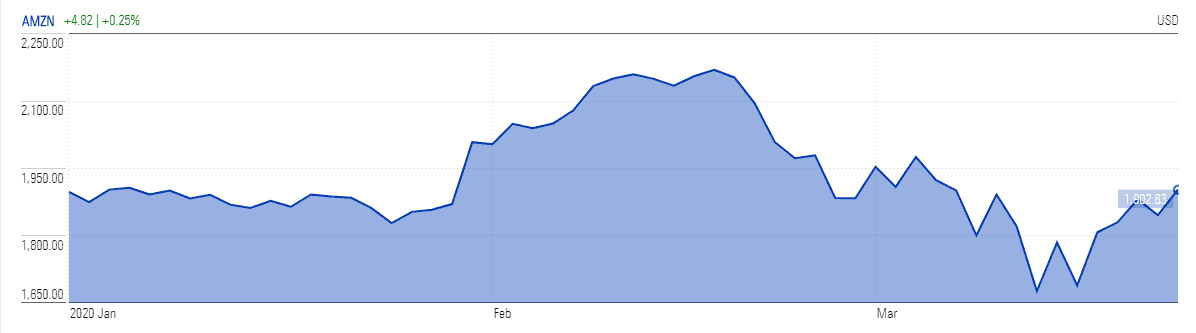

Amazon stock has also been responding to the uptick in demand. Its share price rallied more than 12% in the last five days and the stock is down only 5% in the last month – the NASDAQ index plunged more than 25% during the last four weeks. The Dow Jones Industrial Average and S&P 500 plunged close to 35% in the last month on coronavirus inspired selloff.

Amazon stock price is currently trading at $1900, down from its 52-week high of $2100. The average price target for Amazon stock is around $2300.

“While some items are taking longer to be delivered, and grocery-delivery capacity is strained, we think Amazon is seeing record consumer demand, with share gains likely to remain post-virus,” said Oppenheimer analyst Jason Helfstein. The firm reiterates a $2400 price target for Amazon stock.

JPMorgan claims that Amazon will exceed its high end of the revenue guidance of $73bn for the first quarter by $1bn, citing incremental market share gain of both total retail and online retail in a downturn, as was the case in 2008-2009.

The company had generated fourth-quarter revenue of $87bn. Its core e-commerce business accounted for almost 72% of consolidated sales in the latest quarter. Amazon’s digital advertising-revenue could also experience strong growth in the following quarters due to the substantial increase in the user base. The company’s advertising revenue grew 41% year-on-year in the fourth quarter of 2019.

Last week, Amazon said it will hire 100,000 extra workers to meet the demand. “We are seeing a significant increase in demand, which means our labor needs are unprecedented for this time of year,” the company says.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account