Amazon (NASDAQ: AMZN) stock price soared above $2000 mark after analysts raised their price targets. The fourth-quarter results are playing a key role in strengthening analyst’s and investor’s sentiments. The world’s largest online retailer exceeded estimates by a large margin. Some analysts are anticipating an almost 50% increase for AMZN share price.

The company’s strategy of expanding its grocery business along with the potential launch of a large-format grocery chain this year is among the biggest catalysts for AMZN share price. Amazon stock price performance remained soft in fiscal 2019. AMZN share price grew in a single-digit during the last year compared to the S&P 500 rally of close to 30%.

Fourth Quarter Beat and Strong Outlook Is Supporting Amazon Stock Price

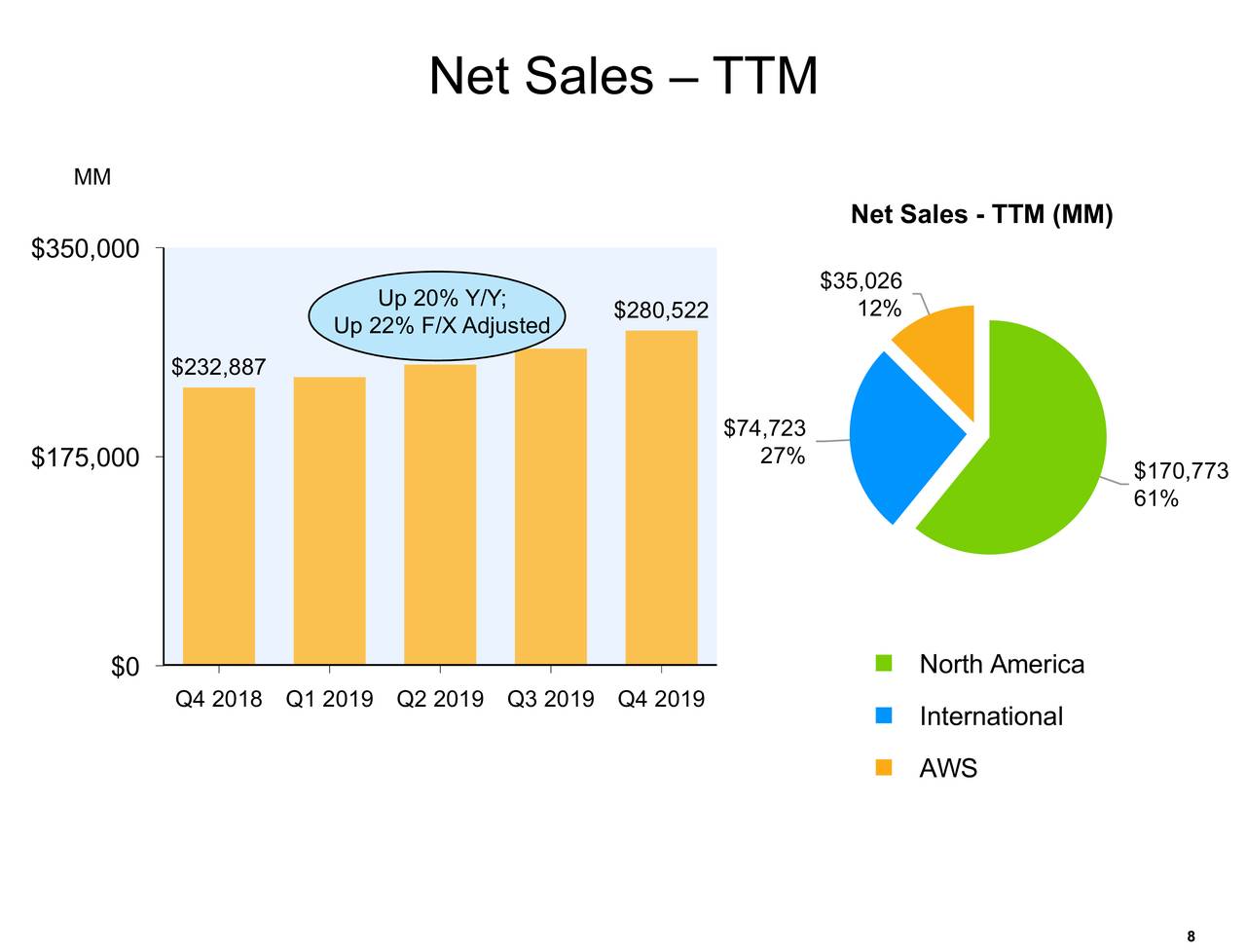

The largest online retailer topped revenue estimates by $1.35bn and earnings per share exceeded expectations by $2.51. Its fourth-quarter revenue of $87.44bn increased by 20% from the year-ago period. Its fourth-quarter earnings of $6.47 grew sharply from earnings of $6.04 per diluted share in the prior-year period.

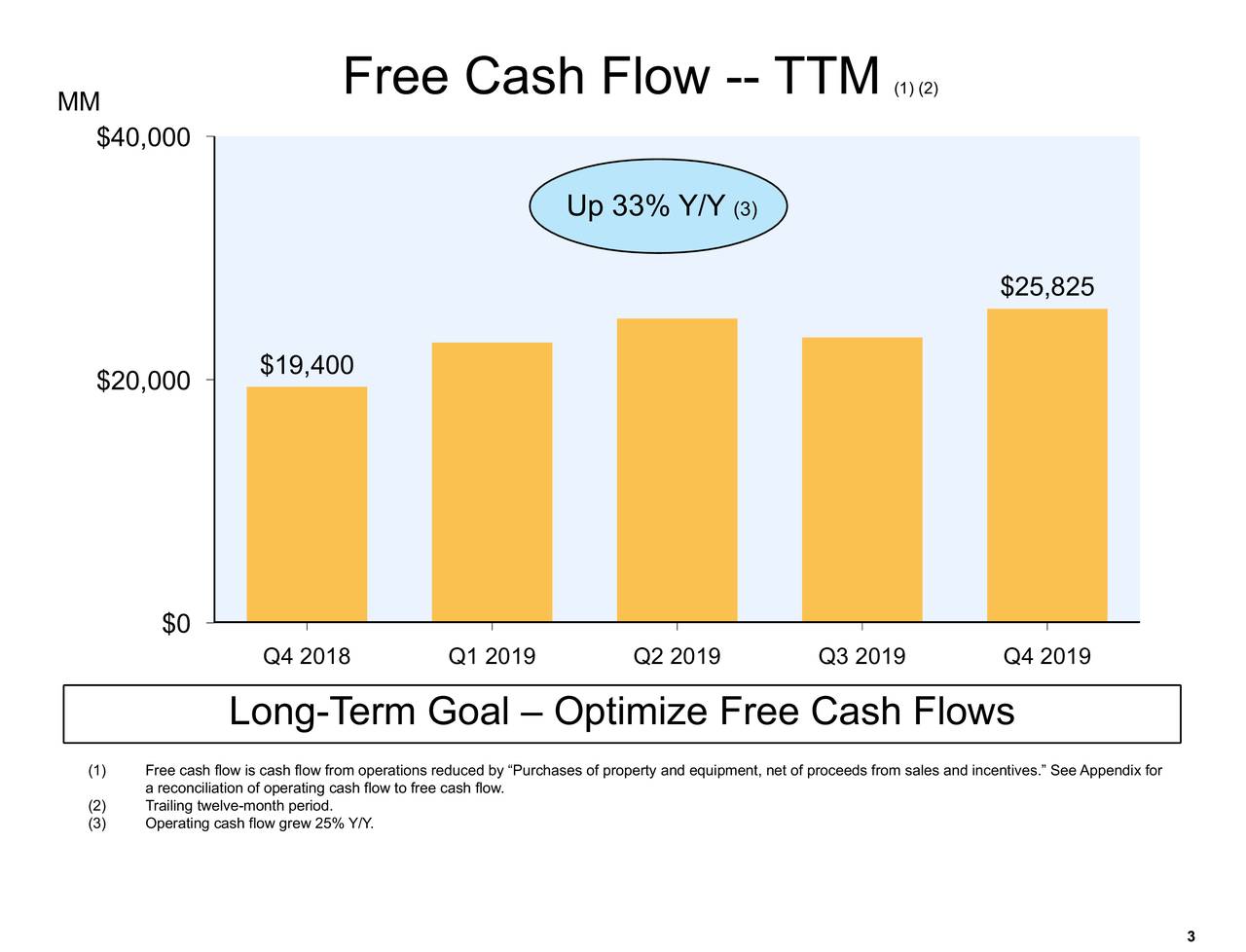

The cash flow generation also increased substantially amid revenue and earnings growth. The company reported operating cash flow of $35bn in the past twelve months. This represents an increase of 25% from the past year. Strong cash generation would help in expanding its grocery store chain network. Its free cash flows enlarged 33% in the trailing twelve months.

Analysts Lifted AMZN Share Price Target

The prominent market pundits are seeing significant upside for Amazon stock price. For instance, RBC Capital’s analyst Mark Mahaney raised the Amazon target to $3,200. “Amazon has been one of the most dislocated of the high-quality, large-cap stocks, and expects this to quickly change after the earnings report,” the analyst said.

Barclays increased the price target to $2400. The firm expects further room for growth despite shares are trading near the highest level. KeyBanc is showing confidence in grocery deliveries along with its potential to capitalize on a huge share in grocery markets. The firm provided a $2400 price target for AMZN share price.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account