Alibaba (NYSE: BABA) stock price reversed some losses that it had made during the last couple of weeks due to the threat of coronavirus. Alibaba is the largest Chinese online retailer that has extensive foot-prints in global markets. Some investors believe the outbreak of coronavirus could have a drastic impact on BABA’s financial numbers. This is because the majority of countries have suspended their trade relationship with China following the outbreak of epidemic disease.

Alibaba stock price, however, stabilized after beating fourth-quarter revenue and earnings estimates. BABA share price is trading around $220 at present, down slightly from twelve months high of $230 a share. Some market analysts have also raised BABA share price target despite Coronavirus attack.

Alibaba Beats Fourth-Quarter Estimates

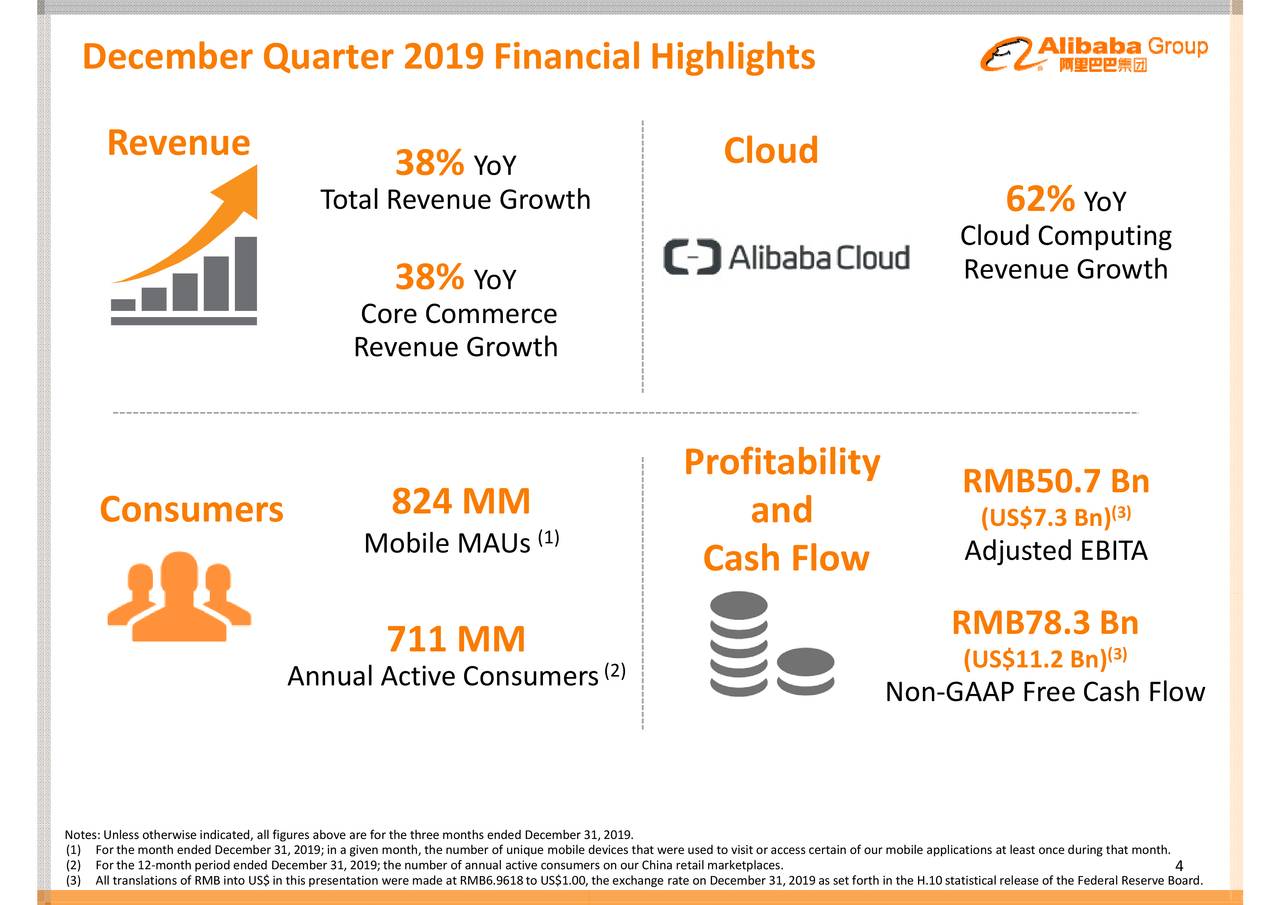

BABA topped fourth-quarter revenue and earnings estimate by RMB161.46B and RMB2.49 per share, respectively. Its fourth-quarter revenue of RMB161.46B increased by 38 per cent from the past year period. The cloud revenue soared 62 per cent to RMB 10.72B from the past year period. The fourth-quarter mobile active users stood around 824ml, up from the consensus estimate for 804.7ml. The company has also been converting revenue growth into profits at a sharp pace. Its fourth-quarter earnings per share rose 49 per cent from the past year period.

“We had a successful listing on the main board of the Hong Kong Stock Exchange in November and delivered strong results for the quarter, with top-line revenue growth of 38% year-over-year and adjusted EBITDA growth of 37% year-over-year,” said Maggie Wu, Chief Financial Officer of Alibaba Group.

Analysts are Optimistic about Alibaba Stock despite Coronavirus

Baird has provided an outperform rating with a price target of $230. “The situation in China is fluid and could lead to further model tweaks, however, reports suggest that people are poised to slowly get back to work,” Baird analyst Colin Sebastian said.

During the earnings call conference, the company anticipated a significant impact of coronavirus on its future financial numbers. The company believes its businesses that rely on physical goods will likely see revenue declines in the current quarter.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account