Abbott Laboratories (NYSE: ABT) stock price rallied 17% this year. The shares are up almost 100% in the past three years. The substantial stock price gains are backed by its innovations in medical devices, diagnostics, and pharmaceutical products.

The sustainable growth in revenue and earnings has also been adding to Abbott Laboratories stock price gains. The company has generated mid-single-digit revenue and double-digit earnings growth in the past three years.

The company’s strategy of offering big cash returns in the form of dividends are helping in optimizing investors sentiments.

Abbot Laboratories currently offers a quarterly dividend of $0.32 per share, yielding around 1.56%.

The company had increased its quarterly dividend by 14% last year. It has increased dividends in the past 47 successive years. Abbott is the member of Dividend Aristocrats Index. It has paid dividends in the past 380 consecutive quarters.

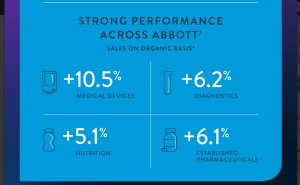

Its organic revenue grew 7.6% year over year in the latest quarter. Its adjusted EPS of $0.82 increased at a double-digit rate from the past year period.

“Our sales growth accelerated and are sustainable,” said Miles D. White, chairman, and chief executive officer, Abbott. “We have great momentum and are raising our guidance above the strong outlook we previously set for the year.”

Abbott has raised its full-year earnings outlook following higher than expected results in the first half.

The company now expects full-year adjusted diluted earnings per share from continuing operations in the range of $3.21 to $3.27. This indicates a double-digit growth from the previous year. It also expects organic revenue growth around 7.0 to 8.0 percent for fiscal 2019.

Abbott Laboratories stock price has also been receiving support from share buybacks. In addition, the share repurchase program enhances earnings per share and dividend per share. Overall, Abbott Laboratories stock is likely to extend momentum in the coming days. It’s a good stock for defensive investors who are seeking steady growth in dividend and share price.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account