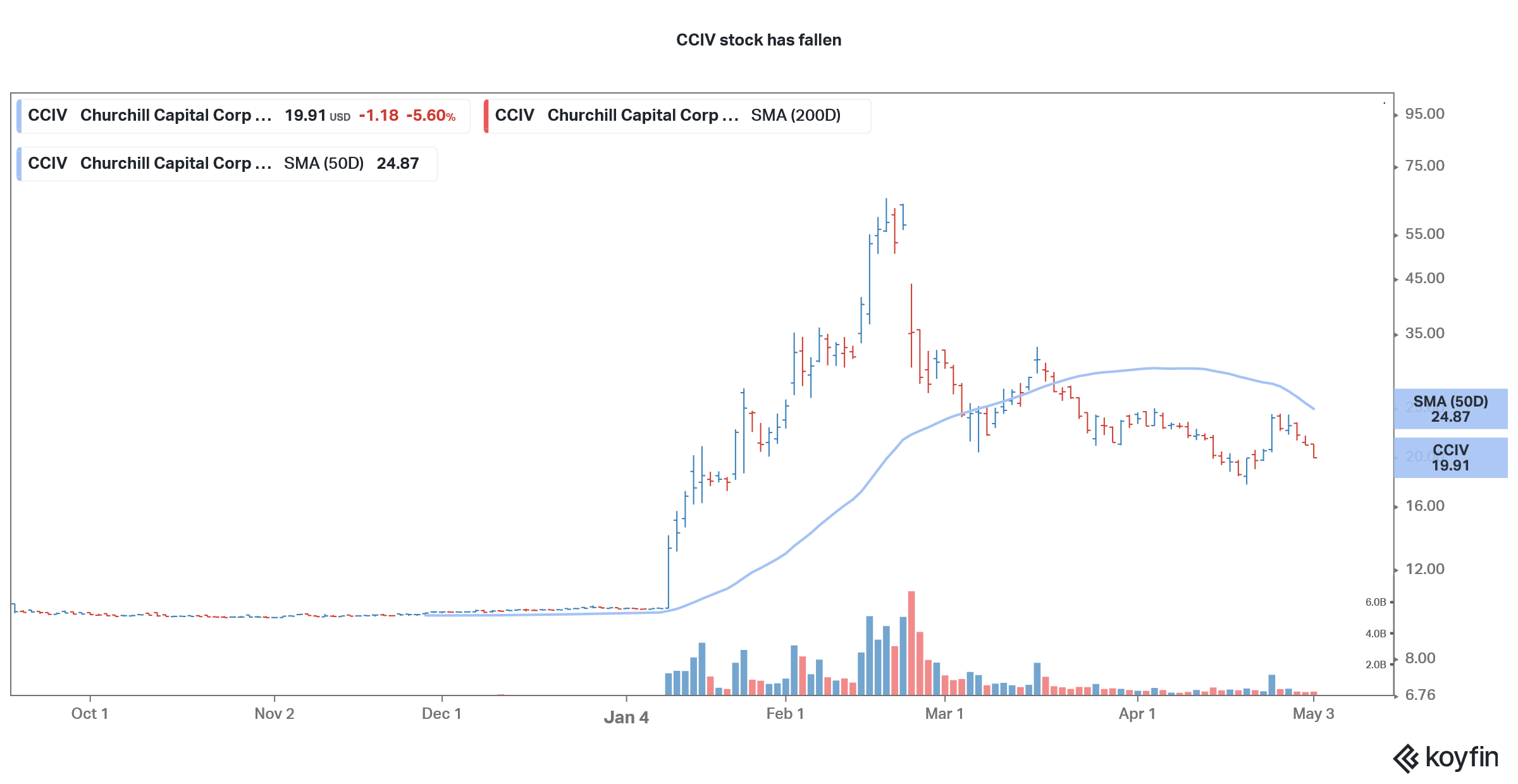

Churchill Capital IV (CCIV) stock has fallen sharply even since it announced a reverse merger with Lucid Motors. The SPAC (special purpose acquisition company) looks shaky ahead of the merger.

CCIV stock was once trading at a premium of almost 550% over the IPO price of $10. None of the other major SPACs traded at such a massive premium even before the merger was officially announced.

CCIV stock has been falling

Meanwhile, it turned out to the typical case of “buy the rumor and sell the news.” CCIV stock has looked weak after it confirmed the merger with Lucid Motors. The deal valued the electric car startup at $24 billion.

The merger transaction involved a $2.5 billion PIPE (private investment in public equity). To be fair to CCIV sponsors, they priced the PIPE at $15 or a 50% premium over CCIV’s IPO price of $10. The usual convention is to price the PIPE at the IPO price which is $10 in almost all cases. Bill Ackman’s Pershing Square Tontine Holdings is an exception as it priced the SPAC IPO at $20.

Lucid Motors

That said, CCIV’s stock price at the time when it announced the merger with Lucid Motors valued the company at almost $65 billion. That’s was a humongous valuation for a company that is yet to deliver its first car. Also, the valuation was higher than Li Auto and XPeng Motors. Both these companies are making and delivering cars.

What contributed to the slide in CCIV stock?

Several factors contributed to the slide in CCIV stock. To begin with, the electric vehicle euphoria that we saw in 2020 has faded and almost all electric vehicle stocks are trading with losses in 2021. On the contrary, legacy automakers have bounced back and Ford, General Motors, and Volkswagen are trading with massive gains in 2021.

Growth to value shift

Also, the shift from growth to value stocks has contributed to the slide in stocks like CCIV. The rising bond yields make companies like Lucid Motors that are not making any current revenues, less attractive. Investors have been apprehensive of speculative growth companies which are expected to generate good revenues and profits in the future but are currently making little to no revenues.

Finally, electric vehicle stocks have started to look overvalued now especially as legacy automakers have unveiled aggressive electrification plans to protect their turf. With an extensive dealer and service network and decades of manufacturing expertise behind them, legacy automakers are looking like formidable competitors to pure-play electric vehicle companies.

What to expect from CCIV stock now?

CCIV stock might not recover much before the merger with Lucid Motors. Also, if we look at SPAC mergers in the electric vehicle ecosystem, almost all the stocks have fallen after the merger. While this is not to suggest that Lucid Motors stock would also fall after it merges with CCIV, markets would question the high valuations and benchmark them against the company’s execution on its aggressive plans.

Lucid Air

Lucid is expected to start delivering its Lucid Air model later this year. The model has good specifications on the battery and driving range. Also, the model looks good and looks set to offer good competition to the incumbent models. Meanwhile, with the competition intensifying, Lucid Air would be up against several models including the revamped Tesla Model S and Mercedes EQS.

The all-electric EQS model is expected to cost above $100,000 and analysts see it as a worthy competitor in the premium electric car market which Lucid Motors wants to target.

CCIV-Lucid Motors merger

“The EQS is designed to exceed the expectations of even our most discerning customers,” said Mercedes-Benz and Daimler CEO Ola Kaellenius. He added, “That’s exactly what a Mercedes has to do to earn the letter ‘S’ in its name. Because we don’t award that letter lightly.”

Jessica Caldwell, executive director of insights at Edmunds.com said that EQS “is going to have to have a hallmark to stand out. I think giving people that very futuristic feel that you’re actually driving something different will be appealing for some buyers.” She added, “But I think the simplistic design for Tesla has made a lot of people very happy.”

Brian Moody, executive editor at Autotrader is also optimistic about Mercedes’ success in the electric car industry and said “I think Mercedes Benz is going to do a great job on EVs (electric vehicles).

NIO versus CCIV

Also, NIO would also start delivering its cars in the US sometime in the future and would give tough competition to Lucid Motors. Both Lucid Motors and NIO are targeting the premium electric vehicle market.

Meanwhile, after the merger with CCIV, Lucid Motors would get $4.4 billion as cash which would help it scale up its manufacturing capacity. NIO has also raised a lot of cash from multiple capital raises over the last year. NIO generated positive free cash flows in the first quarter and ended the quarter with cash and cash equivalents of $7.3 billion.

As for CCIV and Lucid Motors, raising capital should not be a problem even in the future as it is backed by Saudi Arabia’s PIF (public investment fund). It is among the wealthiest sovereign funds globally and also participated in the PIPE investment in the CCIV-Lucid merger.

How to buy CCIV stock

You can invest in CCIV stock through any of the reputed online stockbrokers. An alternative approach to investing in the green energy ecosystem could be to invest in ETFs that invest in electric vehicle producers.

Through a clean energy ETF, you can diversify your risks across many companies instead of just investing in a few companies.

You may also choose from ETFs that invest in IPOs of newly listed companies. The Renaissance IPO ETF outperformed the S&P 500 by a wide margin in 2020 reflecting the strong performance of IPOs. However, it is underperforming in 2021 as newly listed IPOs have not done well.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account