If you are interested in buying stocks of these or other industrial companies, we have a list of the best stock brokers you can invest with.

The XLI industrial ETF rose 16% in the past month, leading the S&P 500′s 9% gain. With the government lifting lockdown measures, the sector has seen some revival of production and investors are directing their attention to industry veterans like Caterpillar and Raytheon.

Following the coronavirus pandemic, the economically sensitive group of industrial ETFs is one of the first to benefit from the recovery.

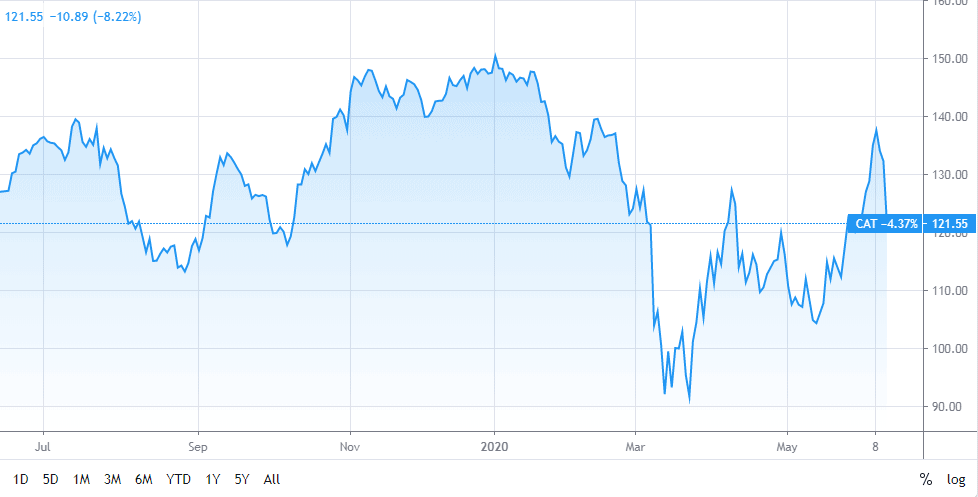

Matt Maley, chief market strategist at Miller Tabak, is using Caterpillar as a barometer for where the entire sector heads next.

The industrial machinery manufacturer ended the first quarter of 2020 with $7.1bn in enterprise cash and had $20.5bn in available liquidity as of April 2020. Not breaking with its tradition of paying a cash dividend every year since the company was formed and a quarterly dividend since 1933, the board of directors of voted to maintain the quarterly cash dividend of one dollar and three cents ($1.03) per share of common stock, payable on 20 August.

Analysts are monitoring Caterpillar’s stock performance closely with Miley seeing its market movements as a tell-tale sign of how quickly the industrial economy will bounce back.

If the stock holds its 200-day moving average to push above highs seen last week, it could indicate growing momentum in the industrials space.

With all the hype surrounding the aerospace sector, Raytheon Technologies is another stock that could mask opportunity.

“That is definitely a stock with some blemishes. I think a lot of investors would prefer to steer clear of this thing right now because of the aerospace exposure, but we feel it’s a bit overblown. I do think that cash flow is going to be weak here in the short term, but it should start to rebound in the second half of the year,” Mark Tepper, president of Strategic Wealth Partners, told CBNC on Wednesday.

Raytheon has rallied 16% this month. It remains 23% lower for the year.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account