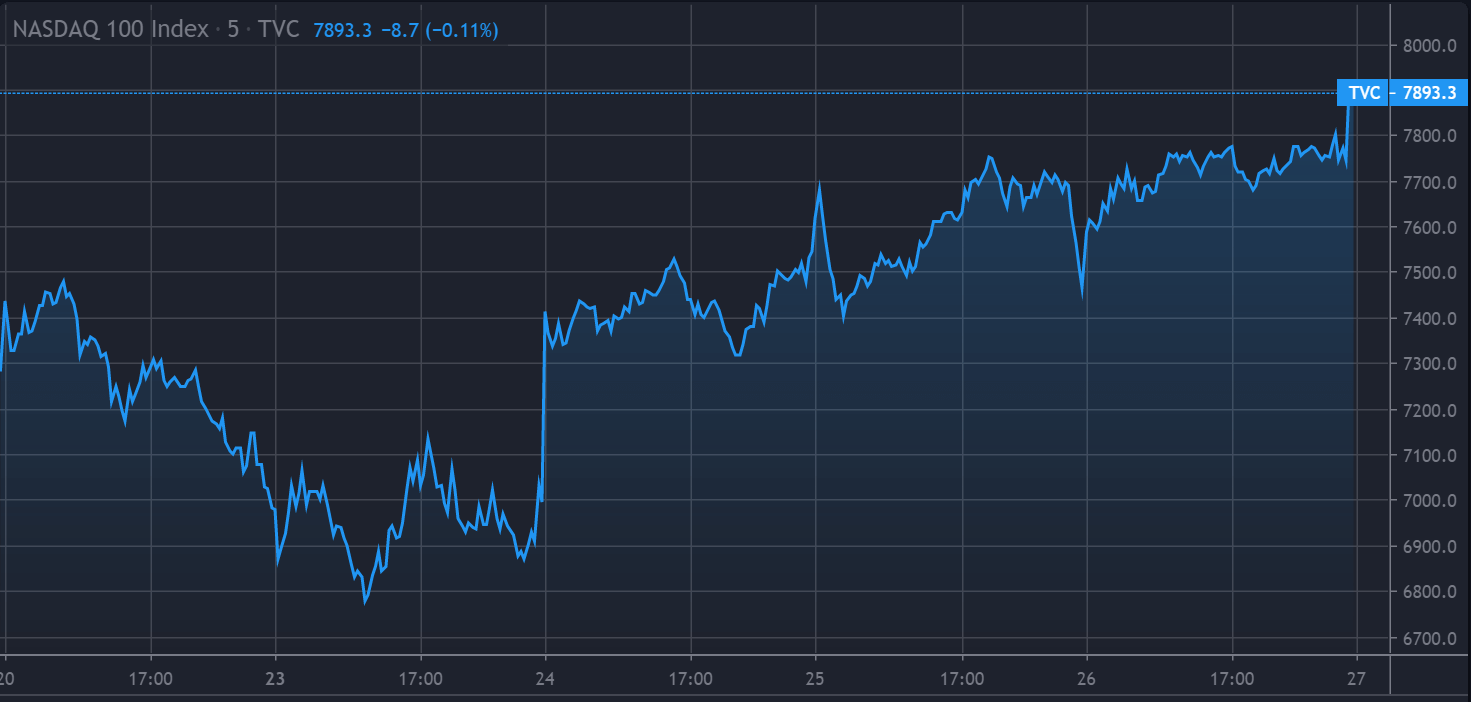

US and global stocks rose on optimism over government bailouts and central bank support for markets yesterday. On Wednesday the US Senate passed a $2trn bill to support consumers and major businesses by a unanimous vote.

The tech-heavy Nasdaq rose by 413.2 points on Thursday at 7,797.5, a gain of more than 5%. While tech has been hit hard by the pandemic, there are a few companies that are in a good position to weather the storm.

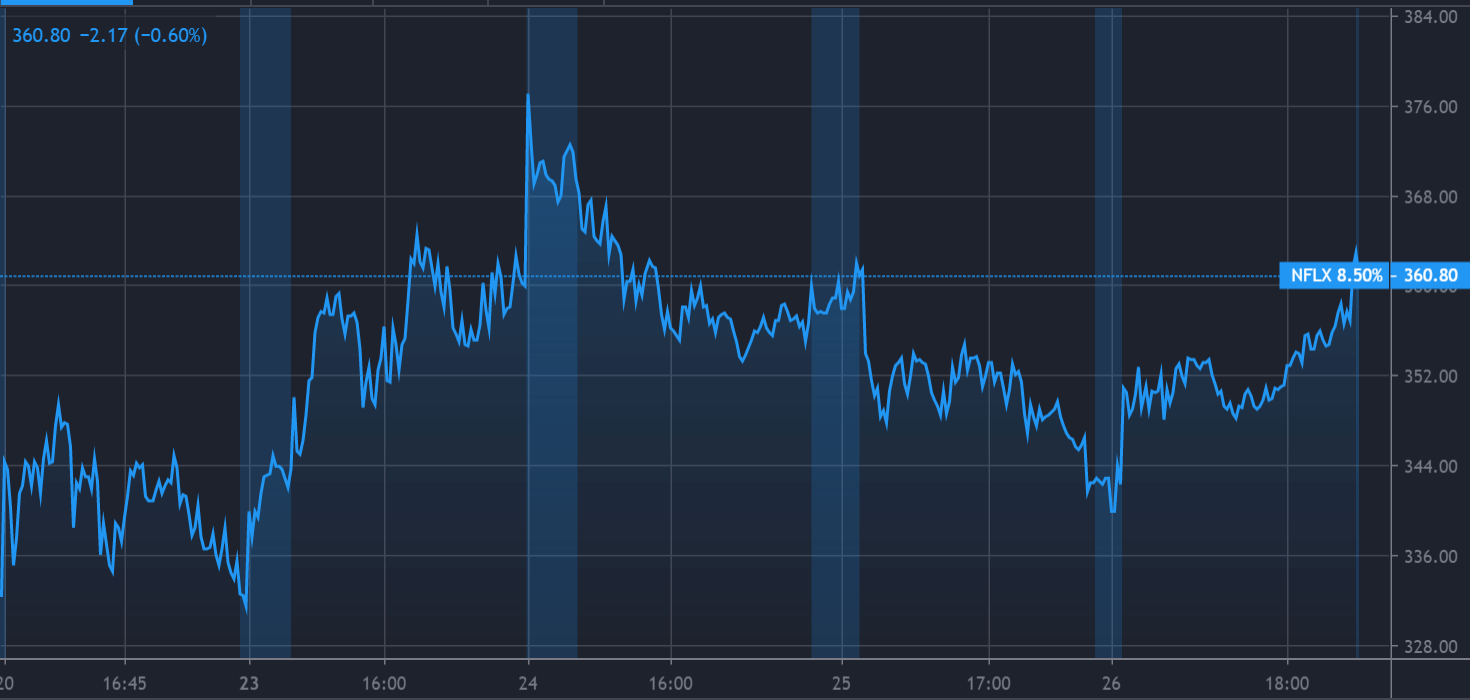

Netflix (NASDAQ:NFLX) was up by more than 6% on Thursday at $363, and has risen by nearly 10% so far this week. The company is well placed to add more subscribers to its streaming platform as the coronavirus confines millions of people to their homes.

While Netflix, which produced Orange is the New Black (pictured), is unlikely to see a bump to its bottom line in the short-term, due to its monthly subscription-based revenue model, it may add subscribers over the next 12 to 18 months as the longer-term effects of outbreak are felt.

A recent response plan from the US government that was obtained by the New York Times states that the virus epidemic may last for 18 months or more, so recent social distancing and quarantine policies might be a part of the new normal for the developed world.

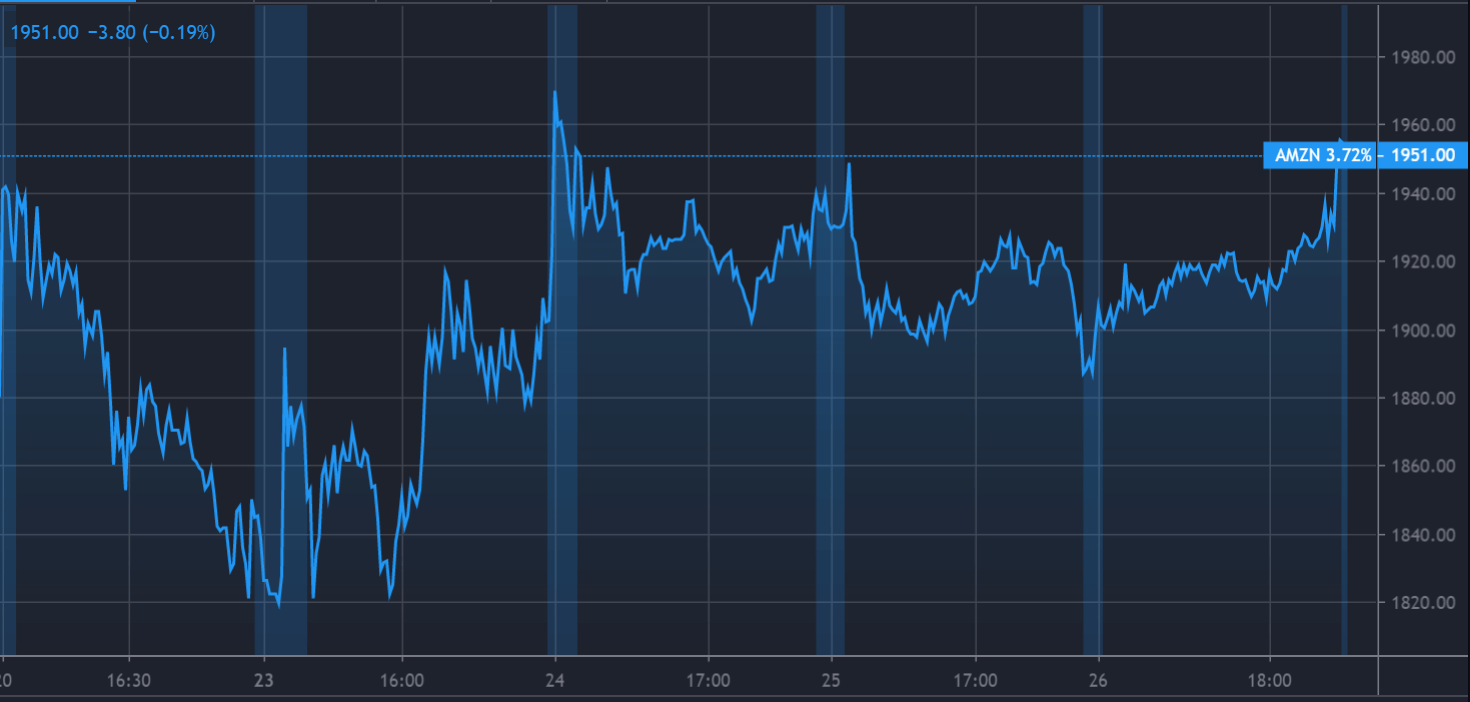

Amazon (NASDAQ: AMZN) is another company that will likely thrive over the next few years. The company is well placed to operate in a period where online purchases spike, and people simply won’t be able to go the shops in the same way they did. Amazon closed up 3.7% at $1,955.5.

While Amazon’s Prime service had to suspend two-day delivery for non-essential items due to massive demand, analysts expect this will soon be resolved.

Netflix has been given a buy rating by both Credit Suisse Group, and JP Morgan Chase & Co. Amazon has numerous buy ratings, including buy ratings from Bank of America, JP Morgan Chase & Co., and Royal Bank of Canada.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account