MGM Resorts (NYSE: MGM) stand among the worst performers as the spread of coronavirus has created unprecedented damages in the tourism industry – including massive layoffs, expansion plans and the threat of bankruptcies. Executives from the tourism industry recently met US President Donald Trump to get a bailout package for the struggling industry.

MGM, which trades on the New York Stock Exchange, has announced a huge layoff plan along with the closure of all nightclubs, buffets and day clubs, fitness centers, spas, and salons in the wake of coronavirus. The company closed 150 food and beverage outlets and suspended its buyback plan.

However, shares in the group lifted 18% in Friday trading, following Securities and Exchange Commission filings earlier in the week that showed that 16 top MGM executives, including outgoing chairman Jim Murren, all upped their stakes in the company. Other investors also seem to be betting that it now a good time to get back into the casino business.

“As the nation grapples with the effort to contain the coronavirus, the travel industry has been challenged, and our company is no different,” acting chief executive officer Bill Hornbuckle wrote. “Business demand has decreased significantly. In response, we will temporarily close MGM Northfield Park tonight and have suspended operations of all nightclubs and day clubs. Our spas and salons will suspend operations as of Monday.”

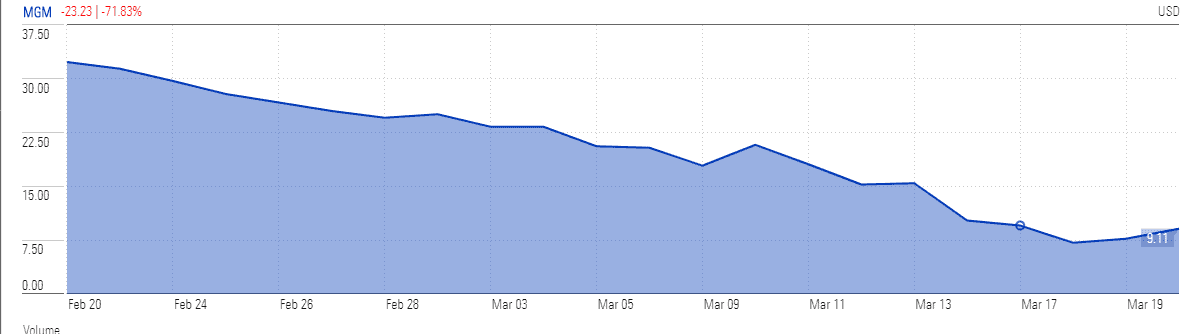

MGM stock price tumbled close to 70% over the last month to the lowest level since 2012, as investors believe coronavirus could have a long-term impact on plans for expansion in the casino and hotel business.

However, the management still believes they are in a good position to face a tough time. The company had $2.3bn of cash at the end of the latest quarter, which its senior management claims is enough cash to weather the current uncertainties. Analysts add its asset sale strategy is likely to generate $8.2bn of cash in the coming days. MGM missed its earnings targets in the latest quarter, while the closure of business operations must point to further losses in the coming quarter.

Some investors believe government aid is among the catalysts that could drive its share price higher in the coming days. The American Gaming Association recently indicated that the US economy will get a hit of $21.3bn in consumer spending for an eight-week closing period.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account