Find more information about how to buy and trade stocks in our stock trading guide here.

Delta Air Lines (NYSE: DAL) is most affected travel stock by the coronavirus outbreak, following US President Donald Trump’s travel ban.

Trump’s suspension of European flights into the US for 30 days is likely to create more chaos in the industry. The majority of US airlines have already slashed their scheduled flights, as the outbreak poses the biggest threat to travel demand since the Sept. 11, 2001, terrorist attacks.

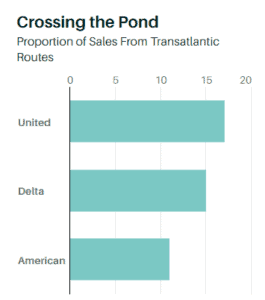

United Airlines (NASDAQ: UAL) has the largest trans-Atlantic business while Delta Air Lines is the second-largest US airline in terms of sales among the top three. American Airlines Group (NASDAQ: AAL) stands at the third spot. These three players account for the majority of sales from the trans-Atlantic business.

American Airlines has previously predicted that they could lose up to 70% of revenue in May and April in a worst-case scenario.

Airlines for America, the lobby group for US carriers, said, “Trump’s action will “hit U.S. airlines, their employees, travellers, and the shipping public extremely hard,” but that they “respect the need to take this unprecedented action.”

Delta said it is reducing its international flights by as much as 25% and domestic capacity between 10% and 15%, among some of the deepest cuts announced in the U.S. so far.

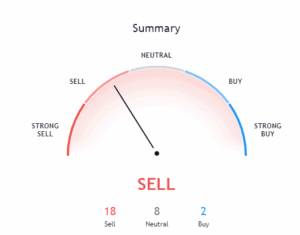

Delta Air Lines stock has already lost almost 30% of value in the last thirty days due to problems related to Asia Pacific operations. Tradingview technical analysis suggests headwinds in the short-term for Delta Air Lines stock. The stock price is likely to react negatively to the European travel ban as this could significantly impact its financial numbers and fiscal 2020 outlook.

Some big market investors like Warren Buffett claim the dip is a buying opportunity and travel companies will rebound once coronavirus impact fades. Buffett has added almost 1 million shares to his Delta Air Lines stake in February. The billionaire investor is the largest stockholder in Delta Air Lines.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account