Standard Chartered chairman Jose Vinals has sounded out candidates to replace chief executive officer Bill Winters (pictured).

Vinals has approached executives from Britain, Southeast Asia, and Europe to take over from Winters, according to Bloomberg, citing unnamed people familiar with the bank’s plans.

Winters, who led Standard Chartered since 2015, suffered a public spat with shareholders last year after some investors had expressed concerns over the compensation policy, which was eventually cut by 6 per cent to £5.93 million following a reduction in pension allowance.

Vinals is understood not to be happy with the way Winter handled the situation.

However, the Asia-focused lender said in a statement that the chairman and the board would like to keep Winters in the role for “as long as possible,” and that he has no plans to leave.

It added: “Succession planning for the senior management team has been ongoing since the chairman joined in late 2016,” according to the statement. It “has included meetings with potential candidates and recruitment firms, along with the development of internal candidates.”

Last week, Winters, 58, added: “I don’t know who the colleagues are saying that I’ve checked out, but they’re certainly not close to me.”

The move comes as a raft of European banks make changes at the top. High street bank Barclays is also understood to be looking to replace its chief executive, Jes Staley. Credit Suisse, UBS, and the Royal Bank of Scotland, have all changed senior management.

Meanwhile, HSBC is also looking for a new chief executive after ousting John Flint and temporarily replacing him with Noel Quinn, while ING plans to appoint a new leader by the autumn.

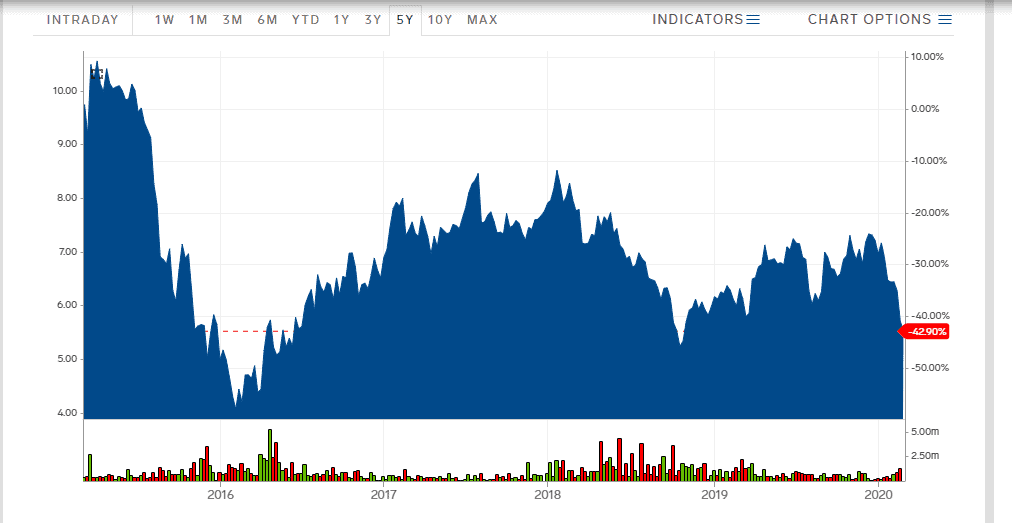

Winters has spent five years leading Standard Chartered, which has been dogged by conduct issues and a 45 per cent decline in the share price since he took the helm.

In April 2019, Britain’s financial watchdog fined the bank $130m for “serious and sustained shortcomings” in its client due diligence and monitoring, including in the United Arab Emirates between 2009 and 2014.

That was part of a $1.1bn settlement with US and UK regulators over its handling of transactions that violated sanctions against Iran, Myanmar, Cuba, Sudan and Syria.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account