General Electric (NYSE: GE) stock price slumped sharply after topping $13 two weeks ago, its highest level in over a year. The shares dropped in the past eight straight sessions due to investors’ concerns over reduced orders from Boeing (NYSE: BA). The bearish comments from JPMorgan analyst Stephen Tusa have added to the share price selloff in the past couple of days.

General Electric’s potential to reach its cash generation target looks gloomy amid Boeing’s pullback; General Electric is among the biggest engine supplier for Boeing and Airbus. General Electric is looking for new business with Airbus after Boeing announced it would reduce aircraft production in 2020.

General Electric has already moved engines built for 737 MAX aircraft to the rival Airbus A320.

Stephen Tusa’s Bearish Comments Added to General Electric Stock Selloff

JPMorgan analyst Stephen Tusa claims that General Electric’s 2019 annual report revealed some worth watching factors.

“2019 results indicate that the $1.4bn headwind from the issues with Boeing’s 737 MAX was not the whole story for the company’s aviation business after all and that the entire free cash flow beat for 2019 was a result of restructuring and should be viewed as “unsustainable progress payment benefits,” Tusa said.

The analysts also pointed out the activity between General Electric and GE Capital Services, the group’s financial services arm, which provides billions of cash positive transactions for GE Industrial.

Restructuring Actions Supported Recent Rally

Besides the latest selloff, General Electric stock price rallied significantly in the past couple of quarters on the back of restructuring actions. The company generated earnings per share of $0.21 in the latest quarter, up almost 50 per cent from the past year period.

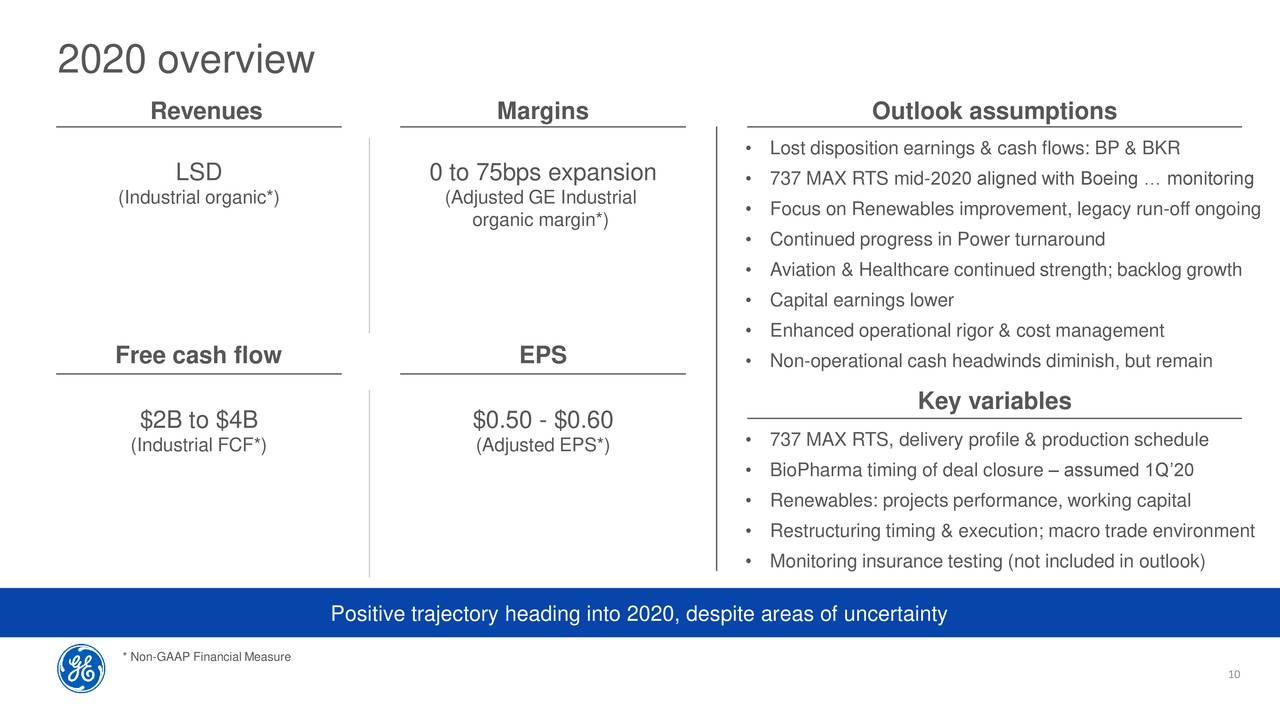

It expects 2020 adjusted earnings in the range of $0.60 per share with GE Industrial free cash flow around $2bn to $4bn.

“Our priorities looking forward are clear. We are solidifying our financial position, continuing to strengthen our businesses as improvement efforts build momentum, and driving long-term profitable growth. We remain committed to creating value as we continue our multi-year transformation,” said GE chairman and chief executive officer Lawrence Culp (pictured).

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account