General Electric [NYSE: GE] plans to divert engines from Boeing [NYSE: BA] to European rival Airbus. Its chief executive Larry Culp looks optimistic and stood by its financial and cash generation goals despite concerns regarding the losses from the Boeing 737 MAX production halt.

The Boeing 737 MAX was involved in two crashes that killed almost 350 people between October 2108 and March 2019.

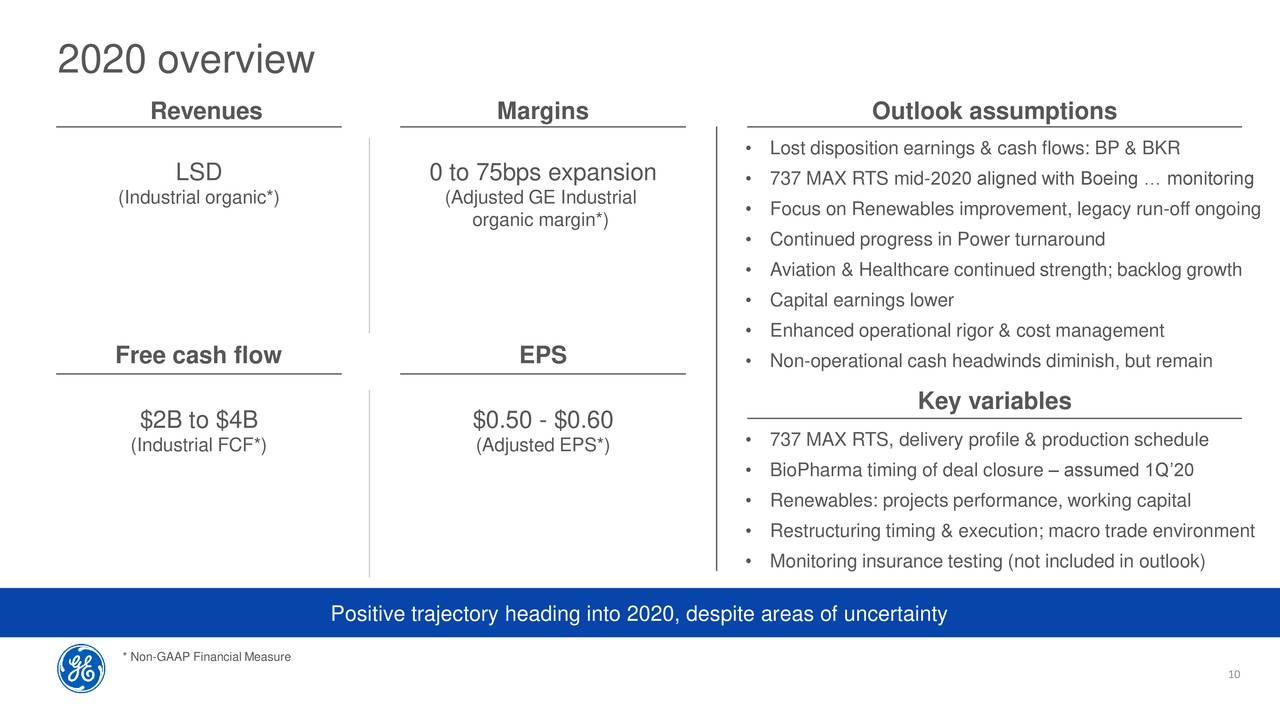

The company expects to generate around $4bn in free cash flows this year. “While the company’s cash burn could worsen to as much as $2bn in the first quarter because of pressure from the Max crisis, we expect a rebound later in the year,” Larry Culp said at a Barclays conference yesterday.

General Electric Plans to Sell Engines to Airbus

General Electric had already diverted engines from grounded MAX 737 to the rival Airbus A320. The company announced that they are seeking to expand their business with Airbus as its other biggest customer Boeing is struggling.

Larry Culp and its management are in talks with Airbus about making a variant of the engine that was previously intended for Boeing’s 787 Dreamliner. General Electric took this step as Boeing announced to cut production to support its cash position.

“The company is always in talks with our engine-makers about new technologies, adding that its current Rolls-Royce engine on the A330neo is a good and solid offering,” An Airbus spokesman said in response to market reports.

Larry Culp is Optimistic About Cash Flows

The chief executive expects to meet its cash generation targets for fiscal 2020. General Electric anticipates flat cash flows from the aviation business this year while the health-care and power units are expected to show improvement. The company is showing concerns over the cash flows from the renewable-energy division.

Larry Culp’s strong outlook for fiscal 2020 has soothed the trader’s sentiments related to the negative impact of 737 MAX grounding and jets production cuts from Boeing. General Electric stock price jumped close to 50 per cent in the past six months; the shares are currently trading around the highest level in the past sixteen months.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account