ConocoPhillips (NYSE: COP) stock price lost more than 10 per cent of value since the beginning of this year due to lower oil demand from China. The coronavirus outbreak has significantly slashed oil demand from the second-largest economy; the country accounts for almost 20 per cent of global oil imports. Oil prices declined sharply in the past couple of weeks amid lower oil demand.

The oil demand is likely to drop by 435,000 barrels per day (bpd) year-on-year in the first quarter according to the International Energy Agency (IEA). ConocoPhillips is the world’s largest exploration and production company. Its business and financial performance is directly correlated to oil prices.

Ryan Lance Expects More Pressure on Financial Numbers

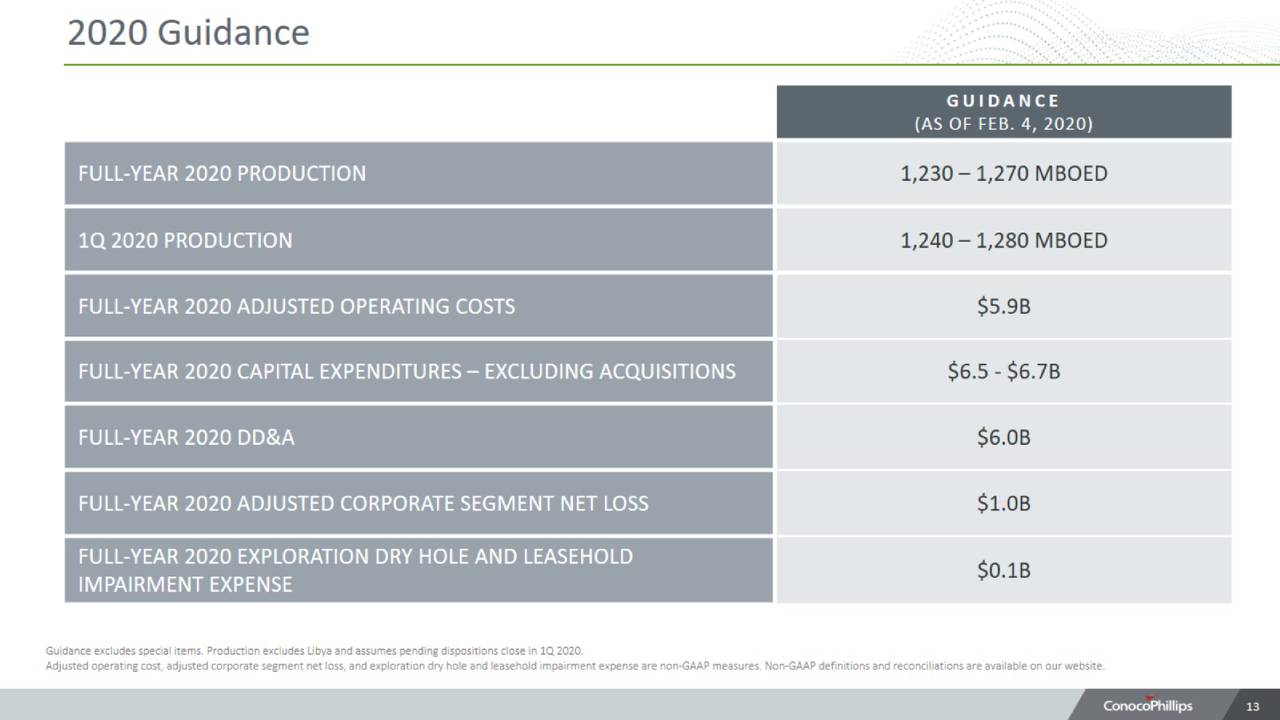

ConocoPhillips says the coronavirus impact is likely to hinder its previous financial forecasts due to lower demand and inventories build-up. The company declined its production and financial outlook for the March quarter and fiscal 2020. ConocoPhillips Chief Executive Officer Ryan Lance claims that oil demand could see a 100,000 to 200,000 barrel per day decline this year due to the outbreak of the virus in China.

The CEO also anticipated pressure on oil prices in the coming days. ConocoPhillips reduced its 2020 production outlook from 1.27ml barrels of oil equivalent per day to the range to 1.23ml. Lower production forecast and oil price outlook could impact COP’s cash generation in fiscal 2020 in the analyst’s view.

The Analysts are Showing Concerns on ConocoPhillips Stock Performance

The market analysts are presenting the gloomy outlook for the COP share price. They believe the largest exploration & production company will accelerate the declining trend in 2020 after posting a double-digit revenue drop in fiscal 2019. This situation could also negatively impact its cash returns for investors. The company had recently announced to buyback $10bn of common outstanding stock in 2020.

“Given COP’s consistent outperformance for the last two years, guidance slightly below consensus expectations will probably slightly tarnish the company’s gold reputation,” Scotiabank analyst Paul Cheng said.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account