Johnson & Johnson (NYSE: JNJ) stock price soared sharply in the past few months on the back of prospects for sustainable revenue and earnings growth. In addition, the latest financial numbers along with 2020 outlook indicate that JNJ is well set to enhance cash returns in the following quarters. The company is planning to invest in product innovation and inorganic growth opportunities to support its revenue base.

Johnson & Johnson stock price surged 15% in the past three months. JNJ share price is currently trading around 52-weeks high of $150. Fortunately, the JNJ share price still looks undervalued considering price to earnings ratio of 17 compared to the industry average of 25 times. In addition, Johnson & Johnson is considered a dividend king due to its history of increasing dividends in the past 57 years in a row.

Recent Financials and 2020 Outlook Supports Johnson & Johnson Stock

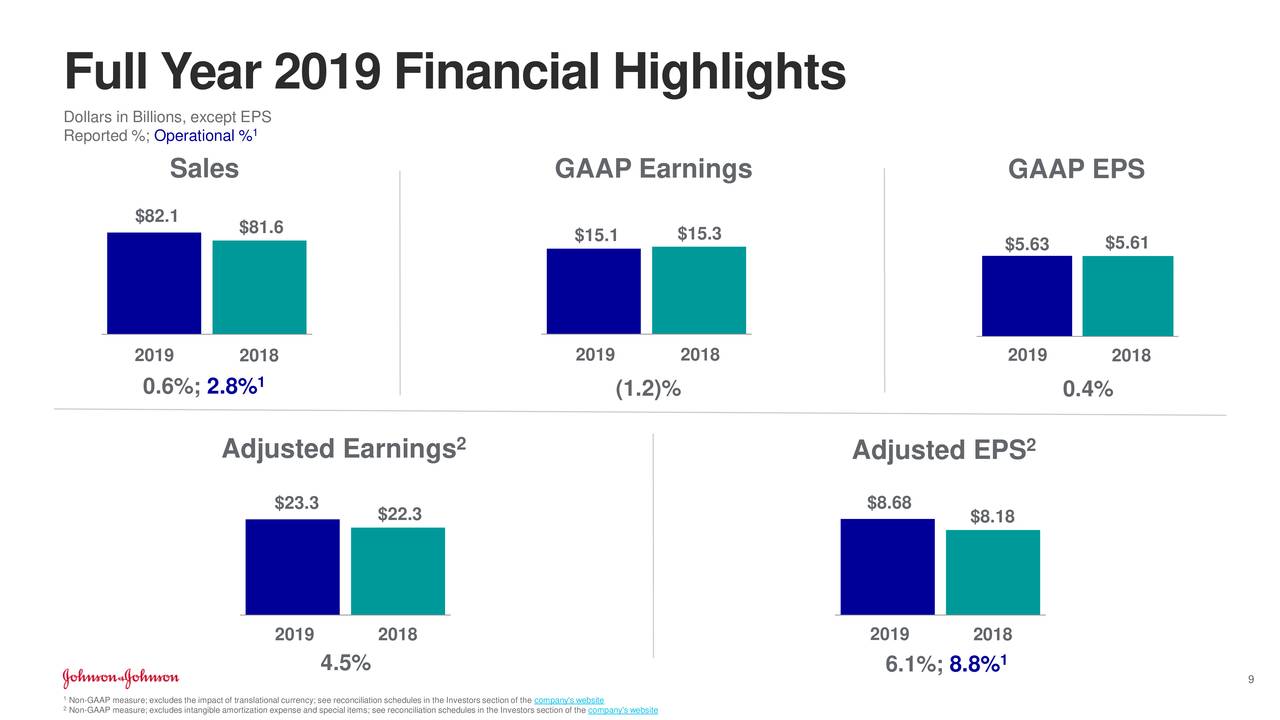

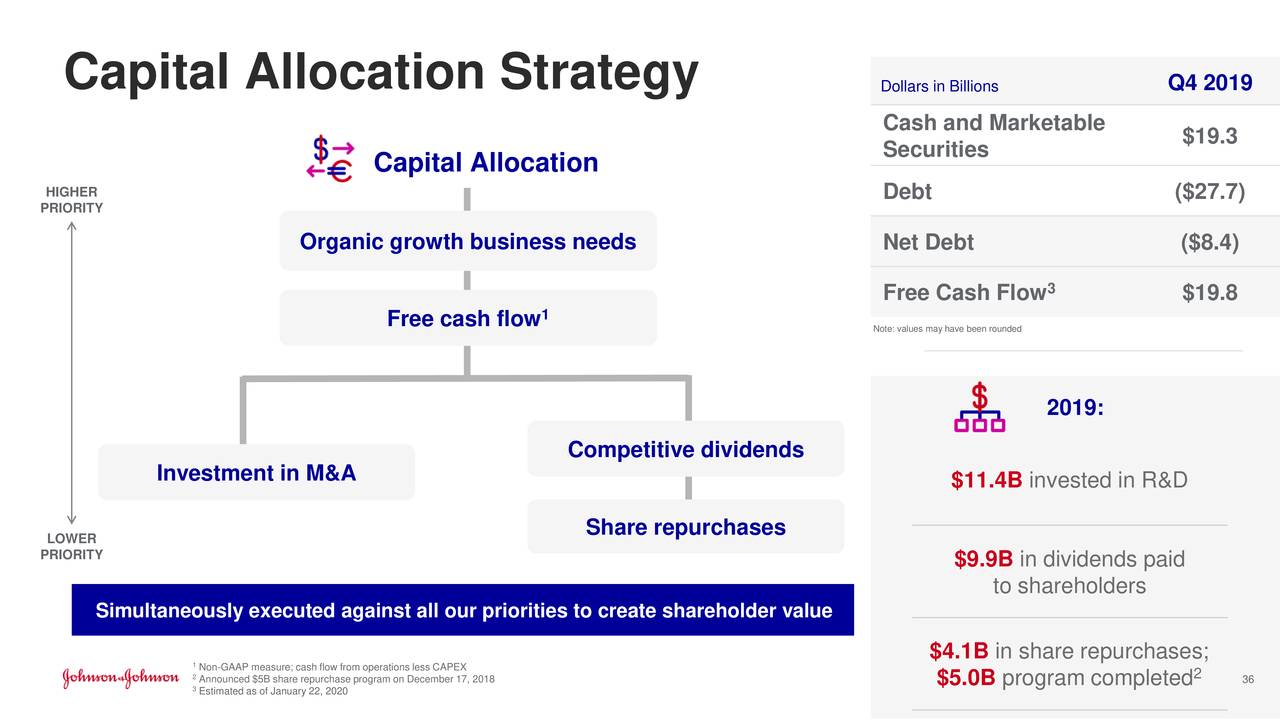

The company generated sales growth of low single-digit in fiscal 2019. Its earnings per share rose 6% from the past year. The company experienced growth across all business segments in the last year. JNJ expects similar growth in fiscal 2020. The company is seeking to support its revenue growth through investments in both organic and inorganic growth opportunities.

Alex Gorsky, Chairman, and Chief Executive Officer. “As we enter into 2020 and this next decade, our strategic investments focused on advancing our pipelines and driving innovation across our entire product portfolio, position us well to deliver long-term sustainable growth and value to our shareholders.”

A Safe Play for Dividend Portfolio

Dividend investors always like to invest in companies that have sustainable growth potential along with a solid business model. Johnson & Johnson has a long dividend growth history. In addition, the expected growth in its financial numbers is likely to permit it to raise the dividend in 2020. Moreover, the JNJ share price is trading at a discount. Thus, Johnson & Johnson’s stock price is also poised to extend the momentum in the coming days.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account