General Electric (NYSE: GE) share price hit the highest level of this year after trading in a narrow range over the past two quarters. The shares are trading around $11.55 for the first time this year. The upside momentum is supported by traders improving sentiments regarding GE cash position, order backlog along with the reduction in debt.

General Electric share price has further upside potential in the coming days. Indeed, some market players are expecting GE stock price to double in 2020. This is only due to the positive impacts of business strategy that is designed by its CEO Larry Culb.

The strategy is based on increasing focus on industrial and power businesses while selling non-core businesses to improve the balance sheet.

Positive Analysts Remarks are Adding to General Electric Share Price

Market analysts started praising GE’s business strategies. For instance, Coe believes that the guidance for this year’s cash-flow is achievable.

In addition, the analyst expects steady improvement in free cash flows in the following years. Moreover, the analyst claims GE’s business portfolio is strong enough to face economic downturns.

The company anticipates industrial free cash flow for this year in the range of zero and $2B. This is significantly higher from previous guidance of negative $1B to positive $1B.

The company sold billions of assets in the past couple of quarters to improve the liquidity position. Analysts say GE’s debt position would drop to 4.4x EBITDA by the end of next year – which is not a scary level.

Future Fundamentals are Improving

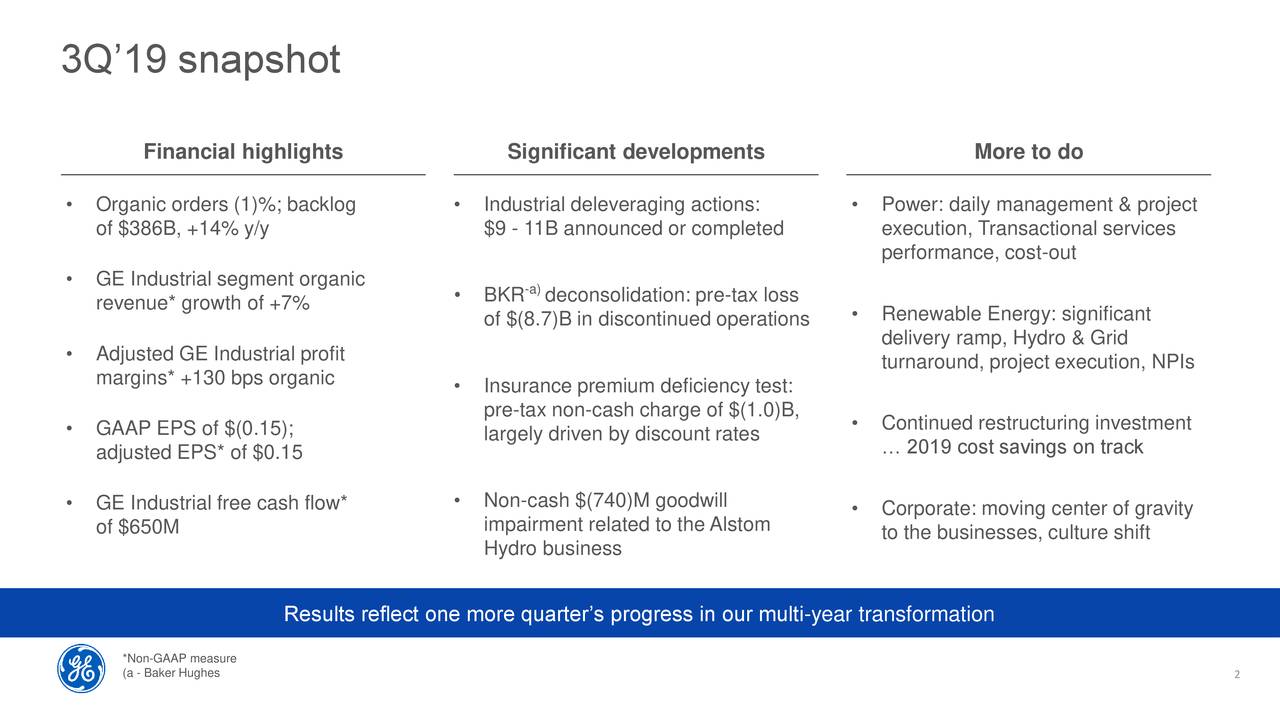

The company has been witnessing improvement in its key businesses such as industrial and power. Consequently, its third-quarter adjusted earnings per share of $0.15 increased 36% year over year. Furthermore, its quarterly loss from the power segment reduced by 79% year over year.

The management believes that business strategies are helping in transforming the struggling company. The CEO says, “2019 represents a progress year. It’s ‘still early’ in a multi-year transformation and 2020 and 2021 will be ‘meaningfully better.'” Overall, several factors are supporting General Electric share price upside momentum.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account