ConocoPhillips (NYSE: COP) stock price has been under pressure over the past few months amid declining energy prices. Although its shares recovered slightly after bottoming around $50, the stock price is still presenting an attractive entry point. COP shares are down significantly from 52-weeks high of $80.

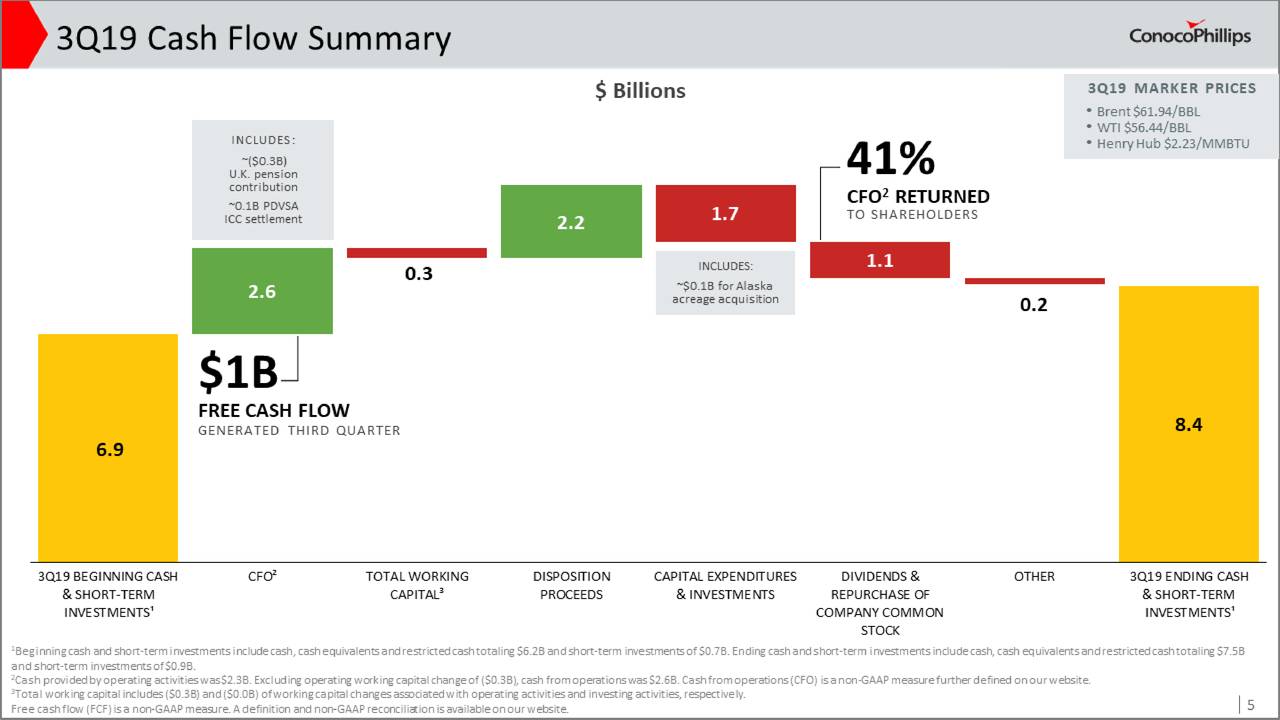

The company has also reported a significant decline in third-quarter revenue and earnings. The decline was only due to the drop in realized oil and gas prices. However, the company has successfully enhanced its production to reduce the impact of lower prices. In addition, its cash generation remains strong enough to cover cash returns.

Cash Returns Are Safe

The company has recently raised its quarterly dividend by 38% to $0.42 per share. The dividend increase has boosted its dividend yield to 3%. In addition, COP has also announced a share buyback plan of $3 billion in fiscal 2020.

The company is working on the strategy of returning half of its cash generation to investors. It has returned almost 45% of cash operation to investors in the past three years.

“Since announcing our returns-focused value proposition in 2016, we have improved our underlying performance drivers and lowered our sustaining price for the business. Given these enhancements, we are confident we can fund a higher, growing cash dividend while maintaining a substantial, consistent buyback program,” said Ryan Lance, chairman, and chief executive officer.

Its third-quarter free cash flows stood around $1 billion. Moreover, COP has generated $4 billion in free cash flows in the past three quarters. The cash generation is also receiving support from asset sales.

Production Growth Is the Catalyst for ConocoPhillips Stock Price

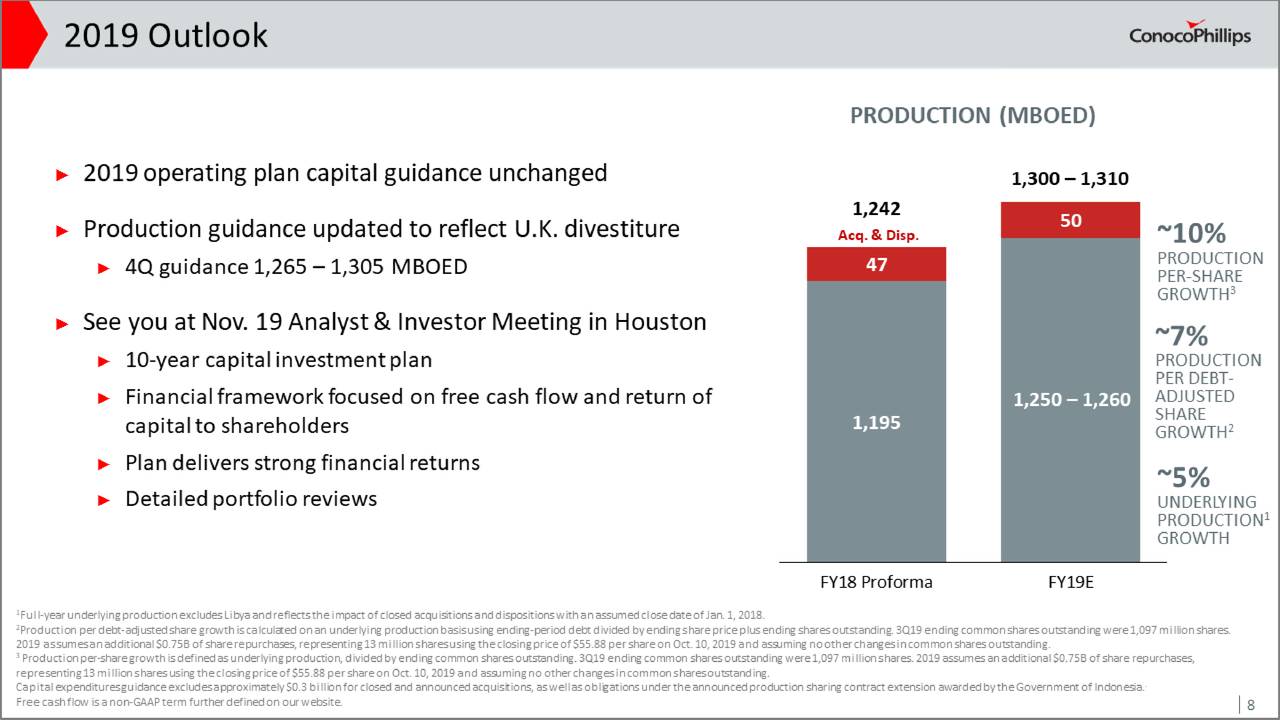

The largest U.S. E&P company Conoco reported third-quarter total production of 1.322 million boe/d. This represents an increase of 98,000 barrels of oil equivalent per day (boe/d), thanks to higher production from with output from U.S. shale basins.

The company has been focusing on U.S. assets while it is selling low margins assets in the U.K. and other parts of the world. Overall, the cash returns and production potential are supporting ConocoPhillips stock price.

Click here to learn more about stock brokers and stock trading.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account