Amazon (NASDAQ: AMZN) stock price is likely to face pressure in the coming days. This is because its third-quarter results have strengthened the bear’s case. The company has missed revenue and earnings estimates. In addition, the profits declined when compared to the same period last year.

Amazon stock price has been trading in the range of $1700 to $1800 level over the past couple of months. AMZN shares are struggling to breach the physiological mark of $2000. The shares are down 12% from 52-weeks high of $2035 that it had hit three months ago.

Soft Q3 Results Could Negatively Impact Amazon Stock Price

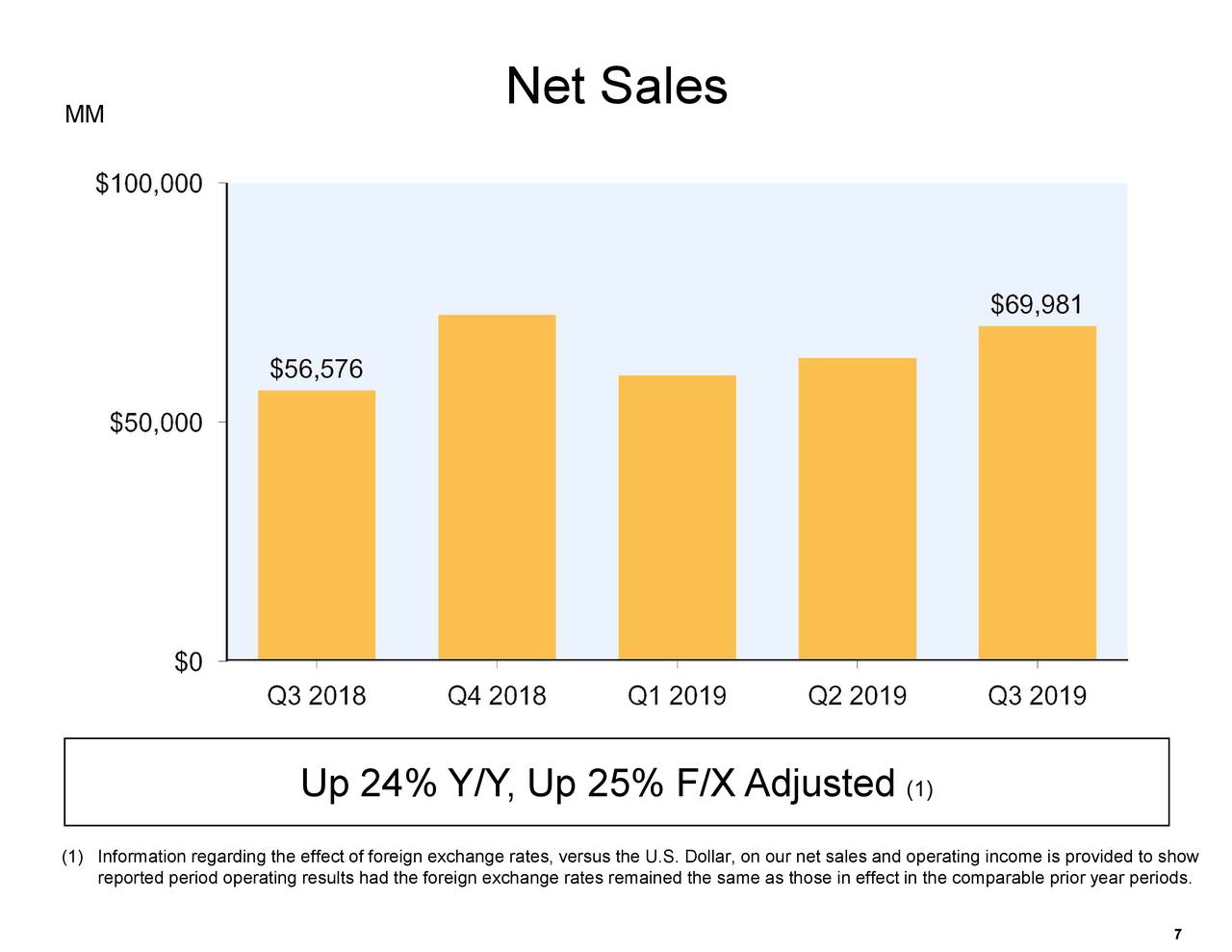

The company has reported lower than expected growth in revenues and earnings. Its revenue jumped 24% compared to the year-ago period, down from the previous revenue growth range of 30% to 40%. The softening revenue growth is impacting investor’s sentiments. Its AWS net sales came in at $9B, down from the expectations for $9.19B.

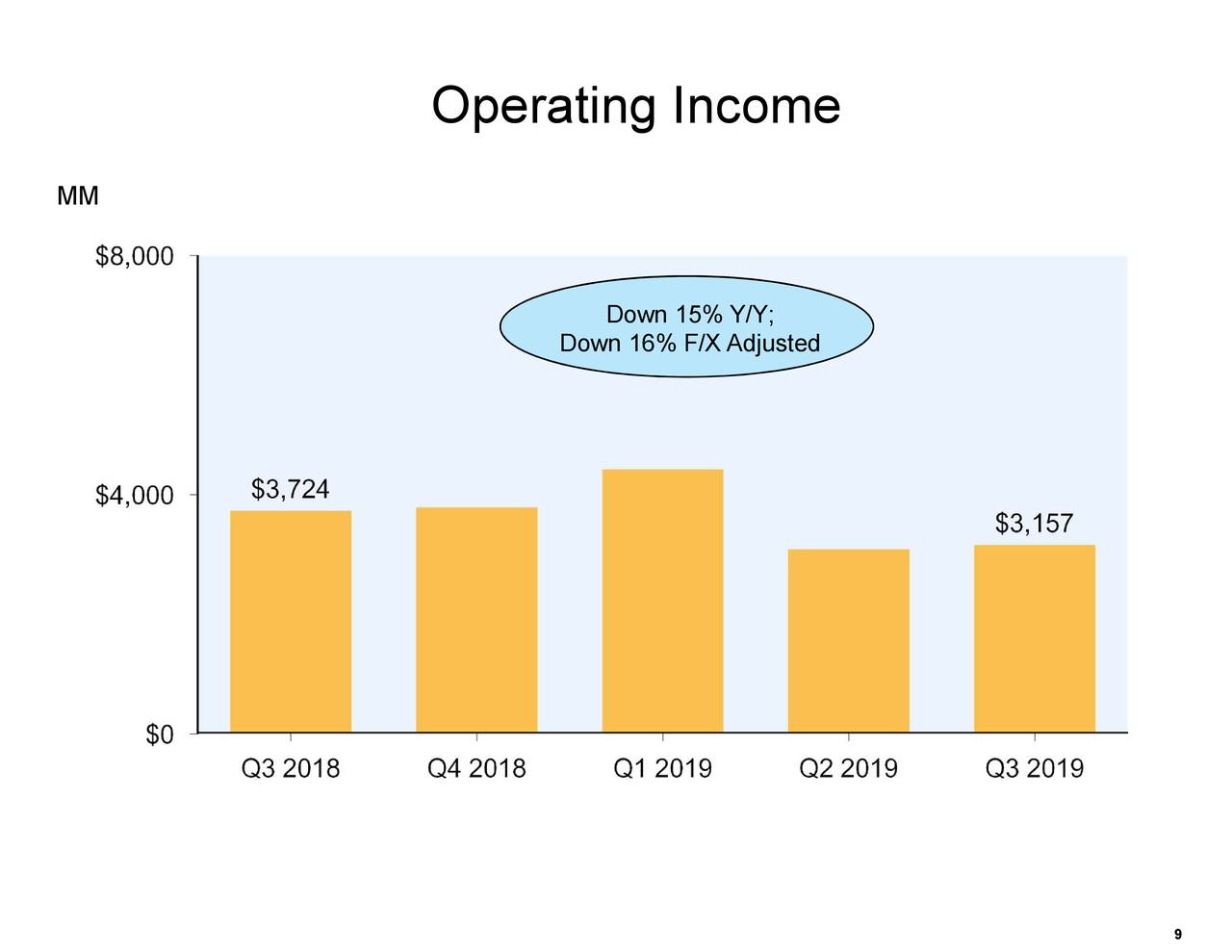

In addition, AMZN has missed earnings estimates by a wide margin of $0.32 per share. Its operating income declined to $3.2 billion in Q3 from $3.7 billion in the year-ago period. Moreover, the company experienced a substantial drop in net earnings. Its net earnings dropped to $2.1 billion from $2.9 billion in the same period last year.

The company believes that they are taking innovative steps to expand its customer base. “We are ramping up to make our 25th holiday season the best ever for Prime customers — with millions of products available for free one-day delivery,” said Jeff Bezos, Amazon founder, and CEO.

Revenue Growth is Likely to Decelerate

The company has presented a lower than expected outlook for the fourth quarter. It expects fourth-quarter revenue to stand around $80B-$86.5B, down from consensus for $87.2B.

The revenue guidance reflects 11% to 20% growth from past year period. Moreover, the company’s guidance for operating income of $1.2B-$2.9B reflects a huge decline from operating income of $3.8B in the previous year period. Overall, Amazon stock price is likely to face headwinds in the short-term.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account