Bitcoin fell under $10,000 before the official launch of Bakkt’s Bitcoin (BTC) futures. The virtual currency has fallen below that level several times in the last few months. However, there are several traders that consider Bitcoin looks bearish.

The Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE), tomorrow will be launching physically-backed Bitcoin futures through its institutional-grade platform called Bakkt.

Bitcoin Traded Close To The $10,000 Region

Bitcoin is currently being traded under $10,000, a level that the most popular digital asset broke many times in the last few months. However, after this happened, Bitcoin came to be traded above $10k.

According to the recognized chartist and trader Peter Brandt, Bitcoin looks bearish.

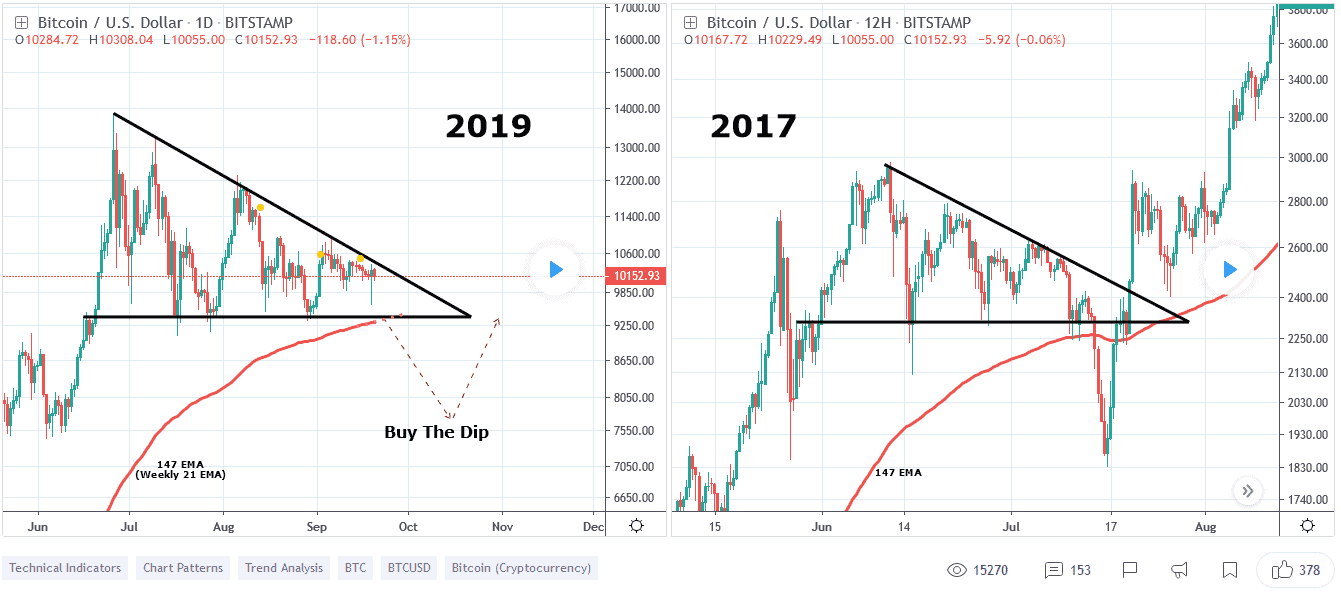

In a recent tweet he wrote that markets have a tendency to do what the most number of market participants least expect and don’t want to happen. He has also explained Bitcoin is in a descending triangle a figure that is most often bearish.

One thing I have learned from 45 years of trading:

Markets have a tendency to do what the most number of market participants least expect and don’t want to happen.

Descending triangles are most often bearish. $BTC pic.twitter.com/bKlYPke8AA

— Peter Brandt (@PeterLBrandt) September 21, 2019

The cryptocurrency community remains undecided about the effect that Bakkt could have on the market.

The crypto analyst Alex Krüger conducted a survey on Twitter in which he compared the CME bitcoin futures with the VanEck ETF-like solution for investors.

The CME traded $460 million during the first week operating and it is now handling around $700 million. The question he asked the community was whether Bakkt would flop or launch successfully.

In just a few hours almost 1,300 individuals answered. 52% considered Baktt would “flop” while, 48% answered it would be a “successful launch.”

CME bitcoin futures traded $460 million on its first week. Current volume is around $700 million. The Van Eck fake ETF traded $0 on its first week.

How much volume will Bakkt attract is a key variable for the week ahead. Would you expect Bakkt to flop or to launch successfully?

— Alex Krüger (@krugermacro) September 22, 2019

In order to invest in Bitcoin, it is always important to take into account both bearish and bullish comments from experts.

The Bullish Case Scenario

In a recent analysis made by the recognized investor CryptoBullet, he shows that Bitcoin could be falling under $9,400 before resuming its bull trend started earlier this year. He mentioned there is a probability of having a “Single Busted Descending Triangle.”

If Bitcoin falls from its current support, buyers will “buy the dip” as we remain in a bull trend rather than in a bearish environment. About it, he commented:

“If we are lucky enough, we’ll get a spring to shake out all weak hands before BTC takes off again. Bakkt launch is very close (Sept 23) and on Sept 27 6 moths CME Futures expire. These news events can really shake the market.”

A few days ago, we reported at LearnBonds that we are just a few days away from the launch of physically delivered Bitcoin futures by Bakkt. Several experts consider this could have a positive impact on the price of Bitcoin and the whole crypto market.

Bitcoin could continue its bull trend if Bakkt launches successfully attracting several investors to the crypto market. If this doesn’t happen, Bitcoin could be traded close to the current levels for some more time.

Click here to know more about Bitcoin Trading.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account