Caterpillar (NYSE: CAT) stock price lost substantial value since the beginning of fiscal 2018. Concerns over trade war escalation along with pressure on the construction industry are adding to bearish sentiments.

The majority of rating agencies have lowered their price targets and financial outlook for CAT.

China recently announced $75 billion of tariffs on U.S. agricultural and other products. On the other hand, the U.S. has also been imposing tariffs on various Chinese products. This situation continues impacting big companies like Caterpillar – who have extensive footprints in both countries.

Goldman Sachs recently declined Caterpillar stock price rating to Neutral from Buy. The bank says the U.S.-China trade war could create further weakness in Chinese and North American construction equipment markets.

Buckingham’s analyst Neil Frohnapple claims that lack of catalysts along with the possibility of a decline in growth could hurt stock price performance.

Stephens analyst Ashish Gupta said, “While we are impressed with [CAT’s] progress, slowing global economic growth leaves the equity with a negative risk/reward trading above 10x our view of cycle peak earnings.”

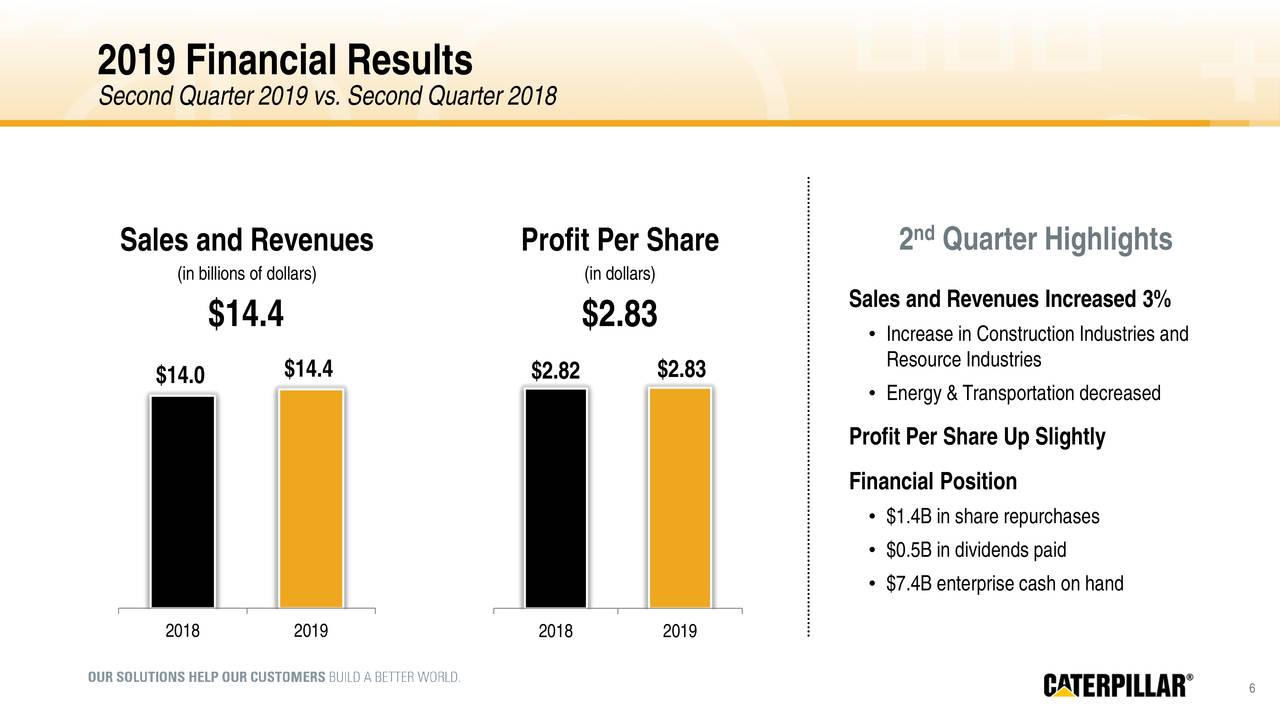

The company’s latest financial results display pressure on revenues and earnings. Its revenue of $14.3 billion missed the consensus estimate by $40 million. The earnings per share also came lower than expectations. Its Q2 earnings per share of $2.83 were flat with the previous year period, but missed analysts’ consensus estimate by $0.22.

Caterpillar expects to generate modest sales growth in the following two quarters. It expects to hit the lower end of the full-year profit per share outlook range of $12.06 to $13.06.

The dividends are safe despite slower financial growth. This is because Caterpillar operates in a less capital intensive industry – which means it is free to use cash flows for dividend payments.

It has returned almost $1.9 billion to investors in the latest quarter. CAT currently offers a quarterly dividend of $1.03 per share, yielding around 3.5%. Overall, it appears that global economic growth and trade concerns are likely to keep Caterpillar stock price under pressure.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account