Crowdestor Review 2022 – Is it a Good Investment?

The emergence of online P2P lending and crowdfunding platforms has made it possible for retail investors to invest in alternative investments and funding campaigns.

The emerging online crowdfunding platforms have developed several innovative safety features to maximize returns and reduce risk factors. These features include auto investing, guaranteed buybacks, and the development of secondary markets. Therefore, like the brokerage industry, choosing the right P2P crowdfunding investment platform helps in maximizing gains.

To help you with that, we review Crowdestor – which is an emerging crowdfunding platform that offers double-digit returns along with buyback guarantee.

What is Crowdestor?

The peer to peer crowdfunding platform Crowdestor offers investment opportunities in business, real estate, transports, and startup projects. The platform has produced an average return of 12% for investors and it expects to increase investor’s returns combined with safety features in the coming days. The platform is regulated and licensed. The central office and working team are based in the heart of the Baltic States – Riga, Latvia.

Crowdestor is based in Estonia as the majority of crowdfunding opportunities emerge from Latvia. This allows the platform to ensure that all investments are covered by the Estonian and Latvian laws. This platform also holds investors funds in a separate account to ensure as much protection as possible.

What are Crowdestor Pros and Cons?

Pros:

✅Double-digit interest rates

✅Diversification

✅Buyback guarantee

✅Low minimum investment requirement

✅Projects are added regularly

Cons:

❌ The platform is limited to business projects

❌ High-yield projects sell out quickly

❌ No auto-invest feature

❌ No secondary market

How Crowdestor Works?

Unlike other peers to peer lending platforms, Crowdestor allows investors to make direct peer-to-peer lending in projects instead of loans. The platform permits investors to directly invest in projects that are listed on its website. They use strong criteria for evaluating each project to check the borrowers potential for repayment of the loan. It offers loans to business in the areas of real estate, transport, and startup projects. In addition, each loan is backed by collaterals. This means that borrower has to provide tangible assets as a guarantee before receiving loans.

Moreover, the platform has created a buyback fund to compensate investors in the case of borrowers default. Launched in 2018, the platform is still young and it lacks several features that other developed platforms offer. Despite the short time in the P2P lending market, it has funded several projects.

On the whole, Crowdestor permits every European account holder to invest directly in various projects without hidden conditions or costs and the interference of middlemen. With Crowdestor you can start investing from 50 Euros with an annual interest rate from 12%.

Crowdestor offers two types of crowdfunding models at present:

- Classic crowdfunding – This type of crowdfunding allows borrowers to raise capital for business projects from numerous investors by giving guarantees or collaterals on it.

- Equity crowdfunding – This types of crowdfunding permits borrowers to raise capital from multiple investors by issuing a portion of equity.

What Products Crowdestor Offers?

Unlike traditional platforms, Crowdestor does not offer consumer and personal loans. They only permit investors to invest directly in projects for fixed interest rate and time duration.

Crowdestor has developed a simple and user-friendly website. The investors can easily find the number of projects listed on the website by clicking the investing tap that is situated at the top of the home page.

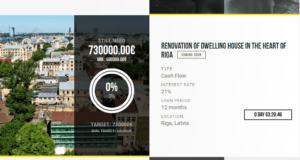

Each project that is listed on the website shows clear information about the loan amount, interest rate, duration of the loan as well as the minimum and maximum funding amount. The duration of projects stands in the range of three months to two years. They support projects that have high-interest rates and shorter duration. The amount needed for each project is usually small (around €100 000 – €200 000), so they get funded rather quickly.

The most inspiring fact about Crowdestor is that it allows investors to invest in multiple sectors. The diversification has always been considered as best practice for investors to reduce risk and increase profits. The investor can invest in the following sectors through Crowdestor platform:

- Real-estate

- Restaurants

- Retail shops

- Hotel

- Energy production plant

- Transportation

The investor is not eligible to check the personal details of borrowers along with key business documents. The borrower is liable to pay interest from the day when an investor starts investing instead of when the project is completely funded. Moreover, if the project fails to attain the desired funds, the investor is eligible to get an interest for the time period of his investment.

What is Crowdestor Account Creation and Investing Process?

The website is user-friendly and the account creation process is simple. The investors are required to create an account and fill up the registration form before starting investing through this platform. The investors can easily signup with the help of user name and password. They also allow you to log in through Facebook or Google account.

The account registration process is simple. The investors are only required to enter personal information such as your bank account details along with personal verification document. They ask for your following contact details:

- Address and country

- Date of birth

- Phone number and email

- Personal identification document

- Bank information

- PIN code to approve transactions

The investors also need to select a personal PIN code. The pin code is required every time you confirm your transactions. Once you completed the registration process, you need to wait for verification. Generally, the platform takes a couple of hours for the verification process.

After the verification, you need to fund your account for investing purpose. In order to make the funding process easier, Crowdestor will provide you with IBAN number. The investors can easily transfer funds from bank account to the provided IBAN number. You can also use TransferWise to make the transfer.

Once you deposited your Crowdestor account, you are free to invest in a project that is available on the website. Once you selected the project which you believe fulfill your investment criteria, you just need to click the ‘Invest’ button and validate your investment.

The investor can easily view his money in Crowdestor account along with how much profit you have made, how much you invested, average interest rate, etc.

What Deposit and Withdrawal Methods Crowdestor Offers?

Crowdestor does not accept payments from online payment services companies and electronic wallets. This is due to its compliance with anti-money laundering policies. The investor must have a bank account in Europen banks to transfer money to Crowdestor account. They also accept payments through TransferWise. Transferring funds to Crowdestor account is composed of three steps:

- Move your money to Crowdestor account through a bank account or TransferWise.

- It could take 1 to 3 days for the confirmation of the availability of funds.

- After the funds are received and added to the account, you will receive an e-mail confirmation.

The withdrawal process is also simple. The investor is only required to click the “withdraw funds” button and entering the desired amount. Once you have withdrawn funds, you need to wait for 1 to 3 business days to receive the funds. The platform does not impose any restriction on minimum withdrawal amount with no fees for withdrawing the funds.

Does Crowdestor Offer Buyback Guarantee?

In order to attract investors and ensure the safety of their investment, several P2P lending platforms have been offering a buyback feature. Crowdestor also offers a buyback feature. It has recently created the Buyback Guarantee Fund with the initial amount of 50,000 Euros. This fund has currently 70,000 Euros and the platform plans to reach the value of 100,000 Euros by the end of 2019. The main reason for creating this fund is to compensate investors in case borrowers default. They are using 1 to 2% of the commission that they receive from projects for this fund.

Does Crowdestor Offer Auto Invest Feature and Secondary Market?

No, Crowdestor does not offer an auto investing feature at present. This feature is available on different platforms because investors always like to relay on investment techniques from robots and financial advisors. This feature is perfect for those who don’t have time to evaluate each investment opportunity.

They also don’t offer a secondary market. This means that investors are not eligible to sell their investment to other investors. The investor cannot even cancel the contract once funded the project. Meanwhile, this feature is available on several other P2P lending and crowdfunding platforms.

Does Crowdestor’s Customer Support Team Good?

Customer support always plays a big role in enhancing investor’s confidence on the platform. In the case of Crowdestor, it does not offer a live chat feature – which is one of the easiest ways of reaching the customer support team. The investors can only contact the support team through email. They generally respond to each query within three business days.

What Countries does Crowdestor accept?

Anyone who is above 18 years old and has an active bank account in the European Union is eligible to invest through this platform. They don’t accept clients from the United States and other parts of the world due to regulatory restrictions. Only clients from European Union are accepted on this platform. Below are the countries that are accepted on Crowdestor:

- Austria

- Belgium

- Bulgaria

- Croatia

- Italy

- Netherlands

- Norway

- Poland

- Cyprus

- Czech Republic

- Denmark

- Finland

- Greece

- Hungary

- Ireland

- Malta

What are the Risks of Investing in Crowdestor?

Every investment carries risk. In the case of P2P lending, the majority of risks are related to the platform that you choose for investing. This is because these platforms are responsible for evaluating each project and borrower before placing the request on the website. In addition, the platform is responsible for taking collaterals and other guarantees from borrowers.

Moreover, in order to reduce the risk level, these P2P lending and crowdfunding platforms offer buyback guarantees and secondary markets. Besides from platform related risks, the major risk to investment comes when the borrower goes to default, which can result in a loss of part of your capital.

In order to reduce the risk, analysts always suggest investors diversify investment in different projects instead of putting all eggs in one basket. Consequently, even if one project defaults, your overall yield won’t suffer that much.

This platform has been offering buyback guarantee in the case of borrowers default. This means that even if the borrower fails in paying the principal amount along with interest, the platform will pay on behalf of the borrower.

The platform has highlighted the amount they have in buyback funds. Therefore, funds exceeding that amount wouldn’t avail this guarantee.

What is the Fee Structure of Crowdestor?

Crowdestor is transparent regarding the fee structure. They do not charge account opening fee to investors. They also don’t charge any fee-related to deposits and withdrawals. Account management, investment, and contract creation are free of charge. However, they charge significantly to borrowers. They charge 0.5% structuring and 0.2% administration fee. The fee for establishing and releasing the mortgage by Crowdestor Security Agent is 350 EUR + VAT. The fee for mortgage releasing for the second time by Crowdestor Security Agent is 100 EUR + VAT.

Conclusion

Crowdestor is relatively new in P2P lending and crowdfunding industry when compared to Envestio and a few others. They only offer investments in business projects. Investment option in consumer loans is not available. They also don’t offer a secondary market and auto investment feature. However, the platform offers investment opportunities in various sectors. The loans are secured by collaterals along with the buyback guarantee.

FAQ: