Envestio Review 2021 – Is it a Good Crowdfunding Platform?

P2P crowdfunding and lending platforms have helped in expanding investment opportunities for small investors in high yielding assets. These platforms are coming up with innovative ideas that help both borrower and investor grow simultaneously.  Some peer to peer platform consists of lending money to individuals while others are offering investment opportunities in real estate and mortgages.

Some peer to peer platform consists of lending money to individuals while others are offering investment opportunities in real estate and mortgages.

Choosing the right P2P crowdfunding platform is the biggest challenge. This is because the P2P industry is still immature. Following the crumple of the P2P lending industry in China and the collapse of U.K. based Lendy, investors need to be cautious when chasing high yielding platforms.

To help you with that, we have reviewed Envestio – which is one of the big names in the emerging online lending and crowdfunding industry.

What is Envestio?

Established in 2014, Envestio is among the leading companies in the industry, which offers best investment opportunities through the digital crowdinvesting marketplace. The platform only offers selective projects to the public investors; these projects successfully pass due diligence process conducted by Envestio professional team.

Envestio has made it easier for investors to successfully increase their wealth by becoming a co-investor in a major project in your country or abroad. Envestio is working on the objective of providing easy, secure and instant access to investment opportunities online. The investor is eligible to select any projects of his own choice and diversify his investment portfolio – with the minimum investment of EUR 100. On the other hand, Envestio encourages ambitious and young entrepreneurs – who are looking for new financial sources to fund their projects.

What are the Pros and Cons of Envestio?

Pros:

✅High-interest rates

✅Several types of Projects

✅New projects are added regularly to the platform

✅The Potential to sell back investments

✅A buyback guarantee is available

✅Strong customer support

✅Premium projects only

Cons:

❌ The platform is very young

❌ Lending to individuals and businesses is not available

❌ No checking account

❌ Lack of payment methods

How Envestio Works?

Envestio offers 22% returns on investments. It also allows investors to sell their investments anytime to Envestio. It charges no registration fee, no deposit fee, and no monthly and annual fee. Its platform is different from other P2P platforms. This platform helps investors in investing in business projects instead of offering loans to small consumers and businesses.

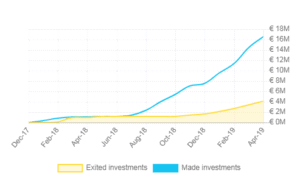

Envestio has exited 42 crowd-investing projects after successfully conducting and fully receiving principal and interest from project partners. The company transfers these earning to investors after deducting small portion. It has provided total capital of EUR 18.49M, while income from interest stood around EUR 980K. The historical interest rate is around 18.89% per annum for the crowd-investing projects.

What Projects Envestio Offers?

Since 2017, Envestio has been mostly offering projects from three high growth industries. The energy sector accounts for 20% of the total funds, cryptocurrency mining account for 17% and real estate stands around 8% of the total funds. Other projects attracted 55% of the total investments. The platform also offers projects related to production or manufacturing. It offers projects for both short and long-term.

One can easily view the list of completed and funded projects on the website along with duration period and interest rate. Envestio informs its registered clients through email when they publish new projects on the website. Generally, innovative projects get the specified funding within a few hours. For instance: Urban mining gather 100000 Euros in less than 24 hours.

How Does Envestio Choose its Investment Projects?

Its business model depends on cooperation with project owners to provide bridge financing/temporary equity replacement for their business projects. The platform gathers funds from investors by posting those projects to its portal, where investors are eligible to fund the project with the minimum amount of 100 Euros.

The platform also looks at investment projects from an ethical perspective – its selected projects likely to turn into an established business that creates new jobs. It does not offer personal, and payday loans to consumers. If the project owner believes his project is worth considering, the project owner is free to present an investment opportunity to Envestio.

What Countries does Envestio Accept?

Anyone who is above 18 years can invest through this platform. It accepts clients from EEA member countries or Switzerland. The investor and borrower should have a bank account in the EU. The platform also accepts people from other region but this involves more paperwork. Below is the list of countries that are accepted on this platform:

- Austria

- Belgium

- Bulgaria

- Croatia

- Italy

- Netherlands

- Norway

- Poland

- Cyprus

- Czech Republic

- Denmark

- Finland

- Greece

- Hungary

- Ireland

- Malta

Does Envestio Account Creation is Simple?

The account creation process is really easy and simple. It takes less than one minute to fill the registration form. It offers two types of accounts:

- Personal: Personal account is developed for investors who are looking to invest in projects.

- Corporate: The corporate account is developed for borrowers who are looking to get funds for their projects.

The verification process for both accounts is straightforward and smooth. However, the account creation for a corporate account is complex compared to personal. This is because of the requirement of more documents from the borrower. Below are the few steps that borrower needs to go through for account creation.

What is the Registration Process for Project Owners on Envestio Website?

Present your investment opportunity to Envestio using an online form or send the application, including a full description of the project, to [email protected].

- Wait until Envestio contacts you.

- Accept Envestio’s offer and conclude the contract.

- Watch crowdfunding campaign for your project at Envestio website.

- Receive the funding and launch your project.

Is Envestio Dashboard User-Friendly?

Its website is simple and user-friendly. One can easily find the required information from the website. Its Dashboard highlights the overview of investments repayment schedule and account balance. The Investments tab highlights all the available active investments; they also offer strong filtering options to filter investments of your choice. The user will see several other tabs such as Stats, documents, my account.

What are the Innovative Features of Envestio?

- Early exit: The investors can exit their position anytime they want. Although there is no secondary market for selling an investment, Envestio buybacks your investments without making big deductions. An investor can any time get back the 95% of the principal amount from the platform.

- Manual investing: The platform permits investors to choose the projects of their own choice. The platform notifies Investors through email when new projects arrive.

- Auto-invest feature: The platform does not offer the auto-invest feature at this time.

Does Envestio Offer a Buyback Guarantee?

The buyback guarantee is one of the best features of this platform – which reduces the risk to investments. Their buyback feature is different from others because it allows investors to sell the investment at any time without losing principal and interest payments. The investor can sell an investment at any time to get back 95% of the principal invested. The investors are eligible to get interest payment for the period he held funds in that investment.

In the case of default (which hasn’t happened yet on any project), investors are eligible to receive 80% of the invested amount instantly; the platform offers two options for the remaining 20%. It offers half of that 20% instantly or waits for the recovery of full debt to get all of the remaining 20%.

What Deposit and Withdrawals Methods Envestio Accepts?

Envesto does not accept credit cards and other forms of electronic payments. Though the platform is still analyzing these means of deposits, but investors can currently only deposit money through bank accounts. In addition, it does not accept funds through Western Union and crypto-currency.

Credit cards and online payments services providers are also not accepted for withdrawal of funds from Envesto platform. The investors can only withdraw funds to the bank’s accounts.

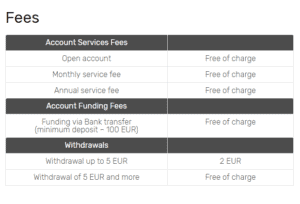

What is the Cost Structure of Envestio?

Envestio is famous for offering lower charges. They do not charge account opening fee as well as they don’t charge monthly and yearly fees. Account funding is also free of charge while the platform deducts a small amount on withdrawals.

How are Investments Secured with Envestio?

The investments are 100% secured with Envesto. This is because of buyback guarantee and reimbursement of funds in case of default. If a borrower defaults in a secured debt project, the platform would offer a 5 day grace period to the borrower. After those five days, the investors will receive 80% of the invested amount – with the option to receive the rest of 10% instantly or waiting until the debt is recovered from the borrower. Consequently, the investors 90% of the funds are fully secured.

On the other hand, if Envestio platform defaults, the investor’s funds are still safe. This is because of its trilateral electronic agreements between Envestio, borrowers, and investors. In the case of default, investors’ claims against borrowers remain valid and will be transferred to a third party (a debt collection agency) in Estonia.

What Interest Rates Envestio Offers?

The interest rate at Envestio currently stands in the range of 14% to 22% according to the project category and risk factors. For instance, the interest rate on cryptocurrency related projects is significantly higher compared to other projects. However, the risk level with crypto projects is also high. The interest in real estate projects stand in the range of 14% to 20% with lower risk. All interest payments will transfer to the Envestio participant’s investment account according to the project schedule. Interest that is accrued, but not yet received, is written-off at the moment of confirming the buyback.

Is Envestio Customer Support Good?

Its customer support appears strong considering the live chat feature along with other communication methods such as an e-mail and phone call. They actively solve investor’s queries regarding accounts and funds. They also listen to issues regarding the interest payments and buybacks. They also send email notifications to investors when they transfer funds, interest payment and the principal amount. The platform also informs investors about new projects through emails.

What are the Closest Competitors of Envestio?

CrowdEstate, Crowdestor, Grupeer, BulkEstate, Kuetzal, and EstateGuru are among the closest competitors of Envestio. CrowdEstate and Grupeer have been working in P2P crowdfunding industry over the years and they have strong recognition. Envestio has also emerged as a key player amid higher returns and no defaults. Its guaranteed returns and buyback of investments make it one of the best platforms. The platform also refunds investors money in case of default – which is very rare in this emerging industry. EstateGuru is also one of the best platforms but it is only offering projects related real-estate and business loans, which offer a rate of return around 11%.

What Risks are Involved with Envestio?

Unlike traditional saving accounts, every type of investment activity carries risks. In addition, it’s essential to understand that past performance has never been considered as a guarantee for a successful future. Therefore, it’s important to evaluate investment through forwarding analysis.

There are several risk factors that one needs to consider before investing in a platform like Envestio. Below are the few factors that could impact your returns:

- Market risk

- Liquidity risk

- Inflation risk

- Currency risk

- Political risk

- Regulatory risk

- Interest rate risk

- In the case of Envestio, the risk factor is lower than other platforms. This is because of its early exit feature and reimbursement program in the case of project owner default.

What is Envestio Affiliate/Referral Program?

Envestio has recently launched an affiliate/referral program – which offers a new opportunity to registered Envestio participants to make money.

It’s really easy to join this program. You only need to be a registered participant to make money from Affiliate/referral program. Once you login into Envestio portal, just go to the upper right corner and click the “Invite” icon to reach the affiliate/referral program page.

You have two options once you reach this page. You can send invitations to your friend either through email or you can also generate a direct link. The participant can also send emails to several friends at the same time.

If the person who is invited completes the registration process and transfer the funds to Envestio account, both of you will start earning additional income. Both Envestio participants – the one who sent the invite or published the link and the one who followed the link and completed registration will get a EUR 5 “first deposit bonus”. This bonus is paid within 24h after at least EUR 100 is transferred to the investment account of newly registered Envestio participant.

Conclusion

Envestio is one of the best platforms in the P2P crowdfunding industry. There are several benefits of using this platform such as getting higher returns with the lower risk level. Projects that receive support from Envestio management get the required funding within a few hours – which is an indication of investors’ confidence in Envestio project selection criteria. Moreover, the zero default rates on funded projects give this platform edge over others.

FAQ:

What Envestio offer to investors?

Does Envestio cost to use its platform?

Who can invest at Envestio?

Is it necessary to verify identity on Envestio?

What documents corporate investors need to provide?

How investors can get the bank account details?

Peer 2 Peer – A-Z Directory