To get the Best of the Bond Market delivered to your email daily click here.

To get the Best of the Bond Market delivered to your email daily click here.

Bill Gross is out with his investment outlook for March, which is compelling reading for any investor. This month he gives us an inside look at how the investment process works at PIMCO.

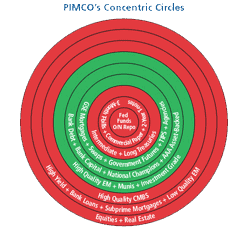

Gross says that permanently affixed to the whiteboard of PIMCO’s Investment Committee boardroom is a series of concentric circles, resembling the rings of a giant redwood, although in this case exhibiting an expanding continuum of asset classes with the safest in the center and the riskiest on the outer circles.

Treasury bills and overnight repo sit right at the centre, which then turn outwards towards riskier notes and bonds, and then again into credit space with corporate, high yield, commodities and equities amongst others on the extremities.

Simple eh, no not exactly, Gross notes that the message of this diagram is much more complex than it seems.

“Change the price of credit at the center and you change the price of assets at the outer extremities…In addition to the changing policy rate at the center, asset prices on the outer circles are dependent on investor expectations and the confidence in policymakers and the effectiveness of their policies. The center must have credibility, the center must “hold” or else the entire array of asset prices at the extremities is at risk.”

The crux of the matter is; central bankers need to convince investors that their abnormal policies can recreate a semblance of the old normal economy, if they can do that, then risk assets at the outer edges of our circle will have higher future returns than otherwise.

“As long as artificially low policy rates persist, then artificially high-priced risk assets are not necessarily mispriced. Low returning, yes, but mispriced? Not necessarily.” Says Gross.

But what if they can’t, what if central bankers lose credibility? Then the center may not hold and markets may not outperform cash.

You can read the full investment outlook here.

Todays Other Top Stories

Municipal Bonds

Albuquerque Business First: – NM municipal bond projects surged in 2013. – New Mexico’s municipal bond market saw a nice increase last year over 2012, increasing by 10 bond issues and a 40 percent boost in dollar volume.

Daniel Silliman: – Creationists sell enough junk bonds to build an ark. – Against formidable odds and with dubious financials, Ark Encounter LLC has raised sufficient funds to start building a 510-foot replica of the most famous boat in the Bible.

Punch: – Sale of U.S. municipal bonds fell in February. – United States cities, states, and authorities this month sold the smallest amount of municipal bonds for February in 14 years as refinancing slowed to a trickle, Thomson Reuters data released on Friday showed.

MarketWatch: – Puerto Rico’s travails hit muni bond firm that bet big. – The Oppenheimer Rochester group of municipal bond funds has more than a sixth of its assets under management tied up in the struggling commonwealth of Puerto Rico, a bet that made it a star when the island’s bonds were in high demand, but that recently led to losses, outflows, and regulatory scrutiny.

Education

Market Realist: – Comparing high yield bonds and investment-grade corporate bonds. – The risk associated with investment-grade corporate bonds is less than high yield bonds. The difference between the rates of return for investment-grade corporate bonds and high yield bonds is known as the “junk-to-investment-grade spread.” This spread, also called “credit spread,” is the premium investors demand in order to hold high yield bonds over lower-yield investment-grade corporate bonds.

Treasury Bonds

Nasdaq: – TIP: ETF outflow alert. – Looking today at week-over-week shares outstanding changes among the universe of ETFs covered at ETF Channel , one standout is the iShares TIPS Bond ETF where we have detected an approximate $22.5 million dollar outflow.

ValueWalk: – Net short positions in Treasuries still very large. – According to Royal Bank of Scotland traders Jim Lee and Nicholas Kirschner, the net short speculator position in 10 year futures equivalents fell $8.71 billion to $37.30 billion, the first fall since January 7, 2014. Longs in 10-year Treasury note futures (TY), 5-year Treasury note futures (FV), and Fed Funds and short covering of positions in Treasury bond futures longer than 15 years (US) and TY triggered the net short position decrease.

CNBC: – Inflation risk low, investors shun TIPS. – The prospect of rising interest rates is weighing heavily on the minds of fixed-income investors as the Federal Reserve scales back its massive bond-buying program, thanks to a strengthening U.S. economy.

Corporate Bonds

Income Investing: – Goldman: Corporate bond spreads still above 90-year average. – Goldman Sachs recently looked at corporate bond spreads over the past nine decades, trying to determine whether today’s spreads are too low, having compressed (in the case of junk bonds) from 20 percentage points in 2008 to just 3.81 today. That spread basically serves to compensate corporate bond investors for default risk, but Goldman notes that risks like liquidity risk and expected loss are also embedded in there.

High Yield

Investopedia: – High times ahead for high yield bonds. – As the Fed has kept interest rates at persistently low levels, investors have shown a penchant for anything that kicks off a high dividend. Master limited partnerships (MLPs), real estate and dividend paying stock funds- like the Guggenheim S&P Global Dividend Opportunity ETF have become portfolio necessities as investors try to navigate these uncharted waters.

FT: – Junk bond rally approaches end of line. – Junk bonds have been set ablaze in both popularity and success as benchmark rates fell to rock bottom, and the cheap capital provided a lifeline for companies with fragile balance sheets. But after a multiyear rally, fund managers and analysts are asking whether junk bonds are approaching the end of the line.

Emerging Markets

MNI News: – No broad emerging market crisis despite Ukraine. – While developments between Russia and Ukraine are feeding negative sentiment in European stock markets and flight to quality out of Russia, Aberdeen Head of Emerging Markets and Sovereign Debt Brett Diment sees investors’ differentiation as a key factor preventing a widespread crisis.

Investment Strategy

LearnBonds: – Money, it’s a gas (and cheap). – If investors insist on investing in credits rated below B, we suggest selecting bonds with maturities inside two years as rate should remain low enough to suppress corporate defaults within that time period. CCC exposure should remain within three years and B-rated investments within five years. We try to keep our BB exposure inside seven years.

WSJ: – How to predict the next decade’s bond returns. – Want to bet on what bonds will return over the next decade? You might want to wager on today’s yield—or about 2.7% in the case of the 10-year Treasury note.

Toronto Star: – Stocks vs. bonds: Can you risk less and make more? – A running debate between two prominent author-academics advises exactly opposite courses of investing action. Here’s what you should do.

Bond Market

About.com: – February 2014 and year-to-date bond market performance. – Continued evidence of sluggish economic conditions helped the bond market deliver a second straight month of positive returns in February.

Bond Funds

WSJ: – Some new bond funds take in big bucks. – A year of turmoil in the bond market didn’t stop some fund companies from rolling out a host of new bond vehicles—and some attracted a lot of cash.

ETF Trends: – Bond ETFs help investors navigate changing market tides. – Fixed-income assets are making a comeback as investors turn to safer, more conservative plays in response to rising volatility in the equities market. Specifically, more people are turning to fixed-income exchange traded funds as their go-to investment vehicle.

Reuters: – Pimco’s Gross says returns on risk assets depend on Fed. – Bill Gross, manager of the world’s largest bond fund at Pimco, said Tuesday that risk assets should outperform cash this year and post higher returns if central banks can convince investors that easy money policies are stimulating growth.

WSJ: – The risks of go-anywhere bond funds. – Unconstrained bond funds have little in common with the bond funds most investors have had at the core of their portfolios. “These funds are much more complex,” says Eric Jacobson, senior fund analyst at Morningstar Inc. “Right now investors are so blinded by the fear of rising rates, I worry that people are going to make poor portfolio decisions.”

Gross: My Investment Outlook this AM suggests future asset returns depend on success of Fed’s new “qualitative” policy. March mtg important.

— PIMCO (@PIMCO) March 4, 2014

S&P cites possibility of mid year budget cuts for Puerto Rico in their rating comment on $3.5 billion GO deal (BB+ neg) #muniland

— Cate Long (@cate_long) March 4, 2014

The PIMCO unconstrained bond fund has been an unmitigated disaster, -2% over 1yr (5th percentile) and 12th percentile over 3 years

— David Schawel (@DavidSchawel) March 4, 2014

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account