We are only seven days away from the long-awaited launch of custody and physically delivered Bitcoin futures contracts by Intercontinental Exchange’s Bakkt subsidiary.

After receiving the green light from the New York State Department of Financial Services, Bakkt will debut its Bitcoin futures and warehouse on September 23. Before getting approvals for Bitcoin futures launch, Bakkt had undergone through a rough path with regulators.

The launch Bakkt Bitcoin Futures contracts are expected to have some impact on the price of Bitcoin and possibly, the entire cryptocurrency market.

It is worth noting that Bakkt has allowed clients to deposit Bitcoin in its warehouse. During the September 23 launch, we will have the physical Bitcoin futures contract.

Why Physical Bitcoin Futures are the Difference

The game-changer seems to lie within the physical Bitcoin futures. These are contracts that are payout in the underlying cryptocurrency rather than cash. Current Bitcoin futures contracts enable users to carry out practices such as shorting, something that can lead to market manipulation.

Analysts believe that Bakkt model will spur Bitcoin’s bullish run.

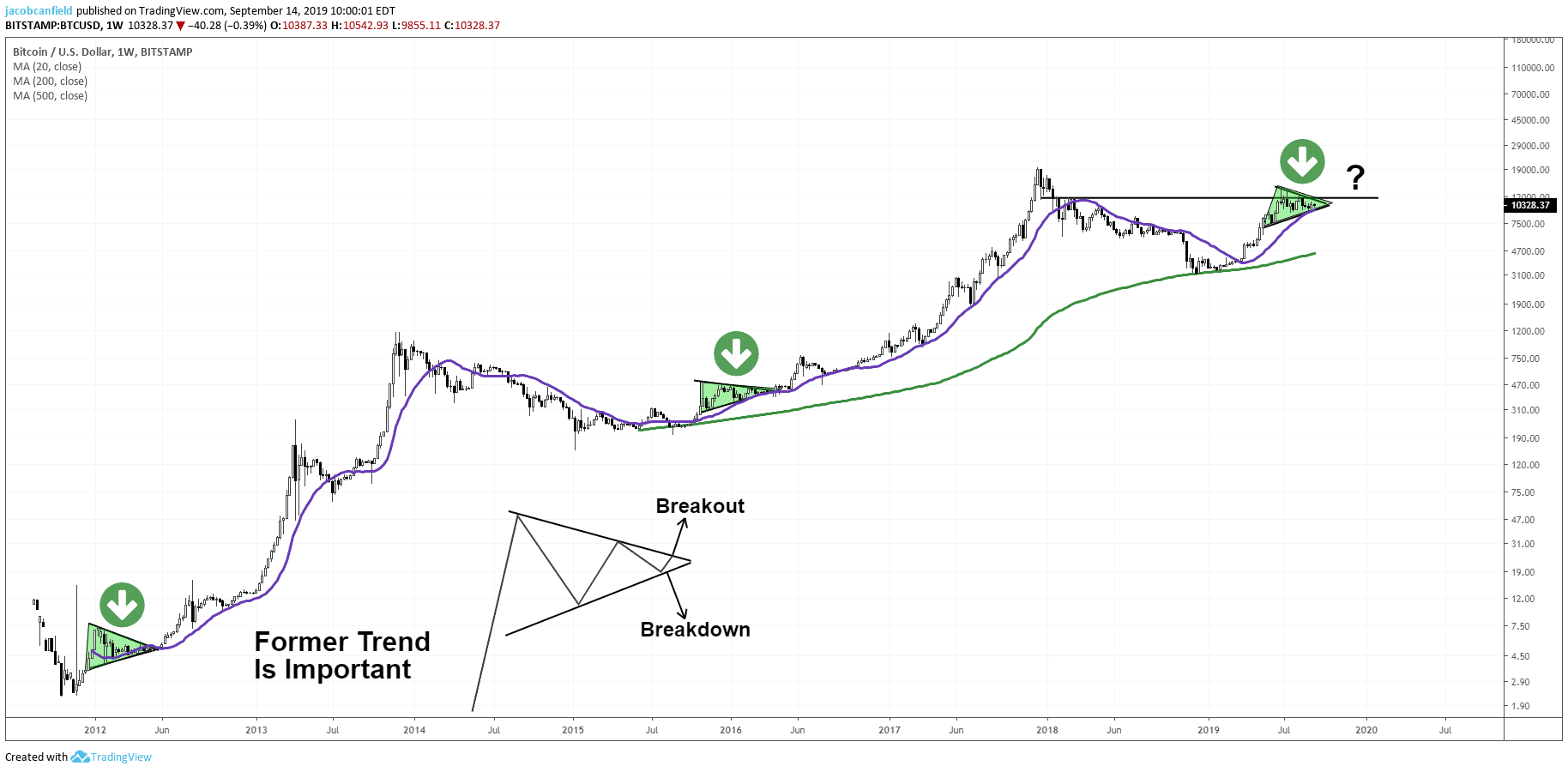

To understand the impact of Bakkt’s Bitcoin futures launch, it is essential to look at Bitcoin’s price trends over the past six months in the build-up to the futures launch.

Baidu Search Index

Currently, data from the Baidu index indicates that the overall daily average of the Bitcoin search index for the past seven days was 21,228, a 23% increase compared to 2018 when it was 33% lower than that of the previous week.

On the other hand, the overall daily average of the blockchain search index for the last seven days was 4,069, representing a 7% lower than that of the previous year and 12% lower than that of the previous week.

A look at the Bitcoin price trend in the last six months shows that the asset is approaching an end to a trading pattern with a $10000 range.

Currently, Bitcoin is trading at $10,236.11. In August, the maiden cryptocurrency traded in the range of $10,250. Interestingly, Bitcoin’s value started fluctuating at $9,500 and $10,800; it managed to move above $10,000 in September. Notably, over the last six months, Bitcoin has not significantly dropped.

Bitcoin’s first bullish run emerged in May when the asset managed to recover from a low of $5000. Between June and July, Bitcoin gained perfectly almost hitting the $14, 000 mark.

Possible Break out From Symmetrical Triangle

From the above trend, Bitcoin is undergoing a symmetrical triangle, something that might change with Bakkt launch. The triangle is characterized by two converging trend lines that link a series of sequential peaks and troughs.

Some crypto experts have begun predicting that Bitcoin might embark on bullish run witnessed back in 2017. According to Tim Draper, a venture capitalist, his previous $250,000 Bitcoin price prediction in 2020 still stands.

It is worthing noting that when Bitcoin a high of $20000 in 2017, we had the first futures launch by the CME group.

In the meantime, Bakkt has managed to partner with Microsoft, Starbucks, Boston Consulting Group and global bank BNY Mellon, Fortress Investment, Eagle Seven, and Susquehanna International. These partnerships are expected to have an impact on the user base of Bakkt.

Click here to know more about Bitcoin Trading.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account