3M (NYSE: MMM) stock price traded in a narrow range after fumbling from over $200 level at the end of the first quarter. The company experienced pressure on share price due to a considerable decline in financial numbers. The gloomy global economy and trade war tensions impacted its financial numbers.

MMM shares are trading around $180 at present, down 7% in fiscal 2019. The company missed earnings estimates for the third quarter; it has also reduced outlook for the final quarter and fiscal 2019. 3M is a diversified industrial company. Its business model is directly correlated to global economic environment, manufacturing and construction activities.

Bleak Financial Numbers Impacted 3M Stock

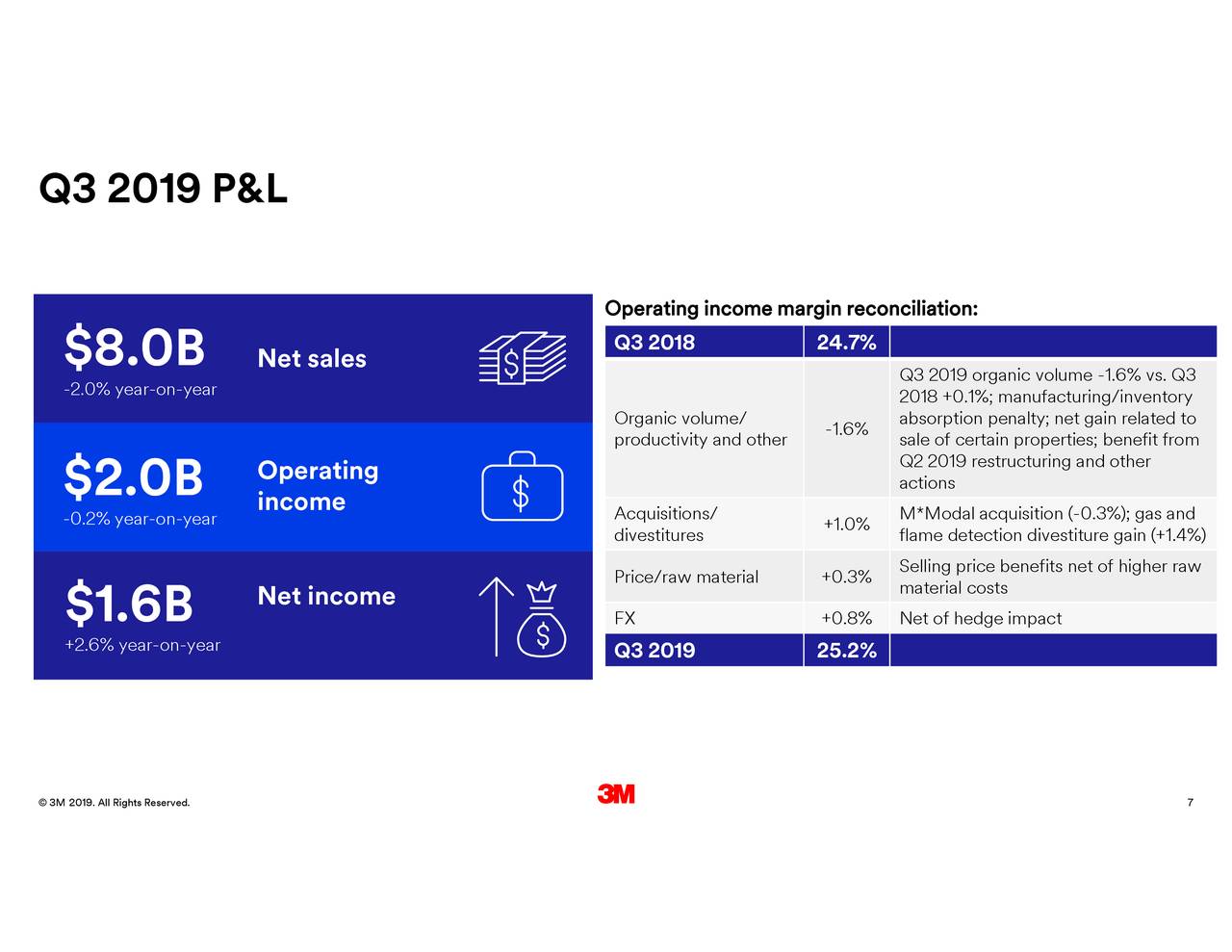

The company reported third-quarter sales of $8 billion, down 2% from the year-ago period. Besides healthcare segment, it’s all other business segments experienced a significant decline in sales. The company blamed microenvironment uncertainties for lower sales.

On the positive side, the management has successfully tuned the negative sales growth into positive earnings. Its earnings per share grew 5.4% year over year in the latest quarter, thanks to strong operational efficiencies and share buybacks.

The CEO said, “While the macroeconomic environment remains challenging, we executed well and built on the progress we made in the second quarter. We continued to effectively manage costs and reduce inventory levels, while generating strong margins and cash flow.”

Dividend and Positive Economic Outlook Could Support 3M Shares

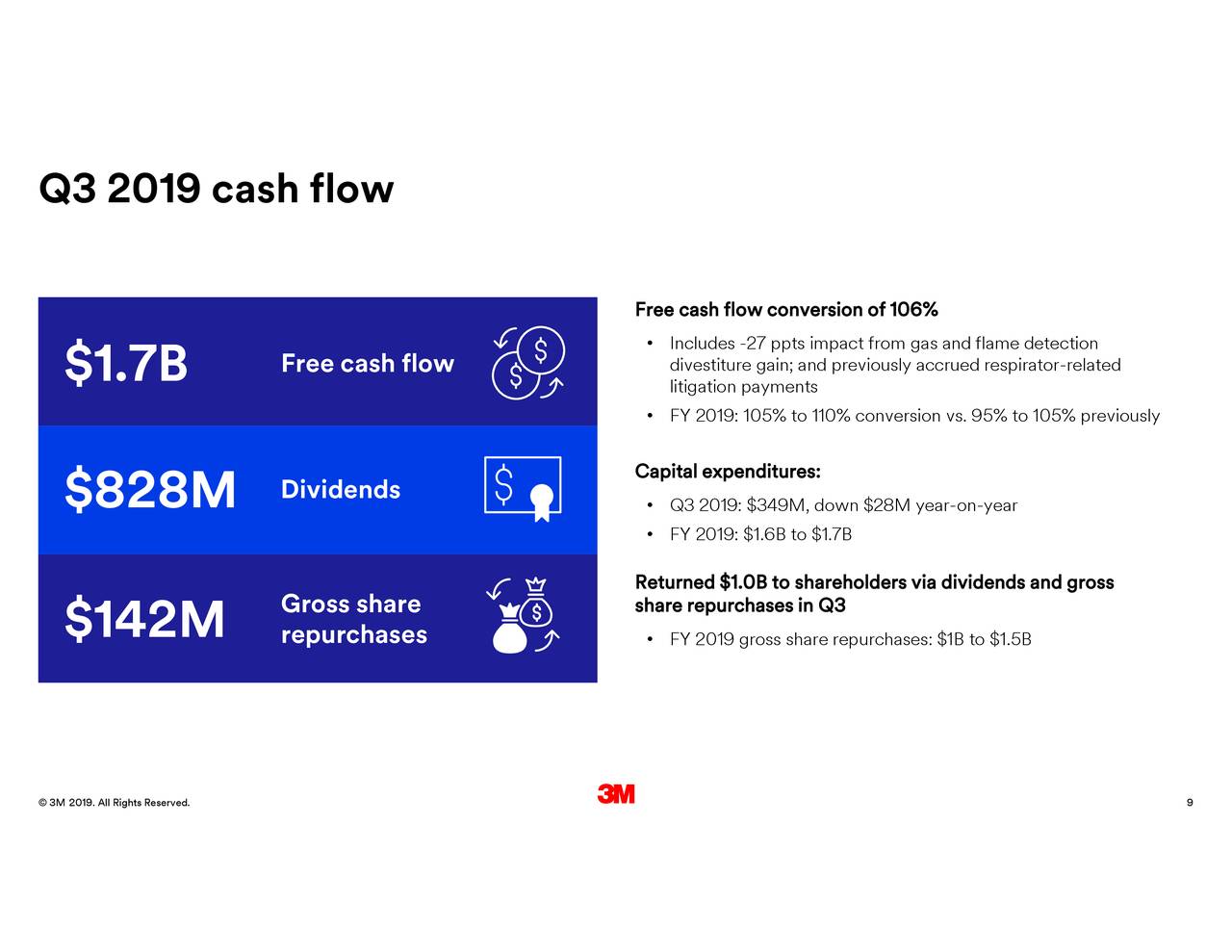

Although its sales fumbled in the past few quarters, the company appears in a strong position to enhance cash returns. Its dividends are safe amid strong cash generation. Indeed, the cash flows are offering a room for share buybacks and investments in growth opportunities.

The company has repurchased $1 billion of common stock in the last three quarters. The share buybacks always support dividends and earnings. Analysts are expecting mid-single-digit dividend growth in 2020. In addition, the economic environment is improving after trade war agreement between the two largest economies.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account