3D Systems (NYSE: DDD) stock price has been under pressure over the past couple of years. The share price also experienced big price swings due to market speculations and micro headwinds. Fortunately, DDD share price bounced strongly after hitting 52-weeks low of $6 at the end of the third quarter.

3D Systems shares are currently trading around $10, up more than 30% in the last three months.

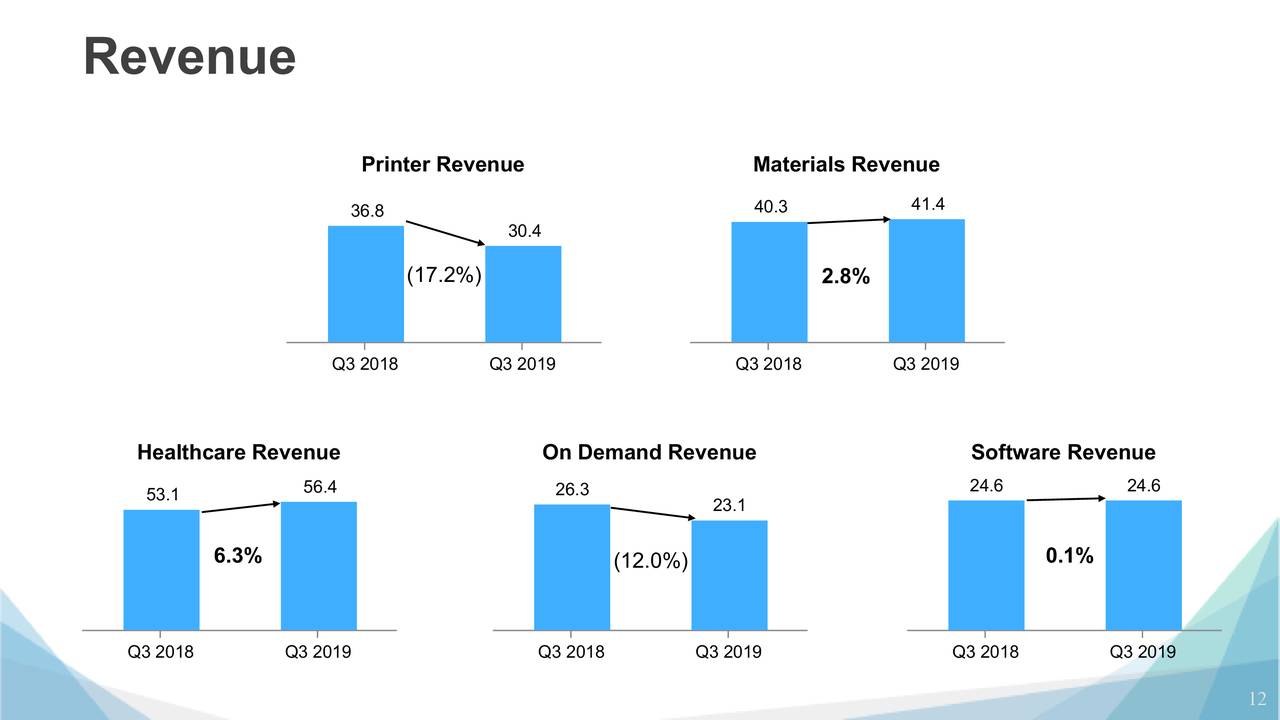

The share price upside momentum is supported by the trader’s confidence in its cash generation potential. In addition, 3D’s strategy of reducing the cost structure combined with investments in growth opportunities is optimizing the trader’s sentiments. Moreover, the robust growth from materials and healthcare segments is helping in offsetting declining sales from the printers segment.

Little Recovery is Likely for 3D Systems Stock

3D Systems stock price is unlikely to get a huge boost in the coming days. However, DDD share price could steadily extend gains in the following quarters. Its share price movement is highly dependent on performance from key business segments and profitability potential.

Investors are expecting the company to trim losses from the printers segment. They also want to see huge growth from materials and healthcare segments.

Its printer’s revenue plunged 17% year over year in the latest quarter. On the other hand, the healthcare segment and solutions revenue rose 6.3% from the year-ago period. Materials revenue bounced 2.8% year over year.

The Company Bets on Cost Cuttings

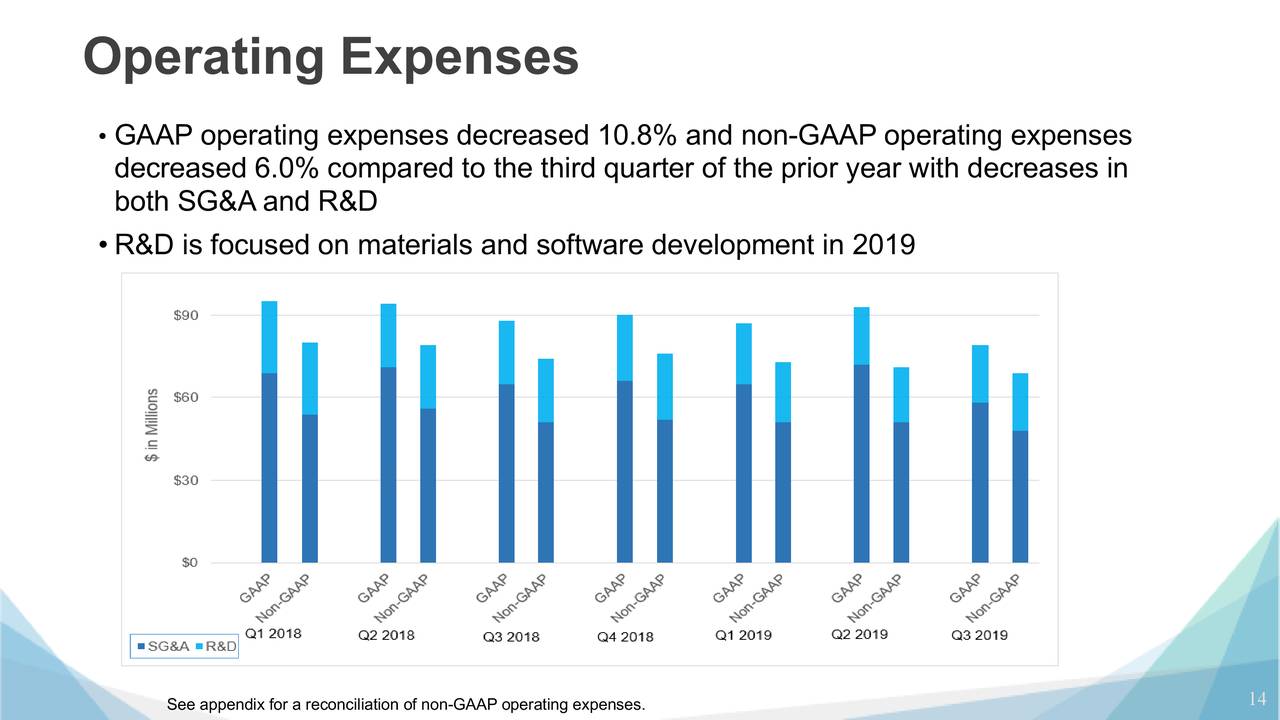

3D management is aggressively working on lowering the cost structure to boost revenues despite a negative growth from sales.

It had successfully declined operating expenses by 10.8% year over year to $79.2 million in the latest quarter. The company believes they are in a position to invest in growth opportunities according to the market trends.

Vyomesh Joshi, president, and the chief executive officer said, “We remain focused on cost reductions, cash generation, and profitability in the near-term and driving long-term growth with the opportunities we have in our product portfolio and target markets.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account