GE (NYSE: GE) stock price bounced back substantially in fiscal 2019 on the back of CEO Larry Culp’s strategy of enhancing the liquidity position. GE shares soared 53% in fiscal 2019, outperforming the broader market rally of 29%.

The share price momentum also outpaced the Dow Jones Industrial Average and SPDR Industrial Select Sector ETF in the past few months.

GE shares grew 38% in the last three months compared to the SPDR Industrial Select Sector ETF and the Dow Jones Industrials growth of 10.8% and 10.3%, respectively. Its share price performance was best since 1982. Before the fiscal 2019 rally, GE shares lost substantial value in the past two years.

GE Stock Is Likely To Extend Performance in 2020

Market analysts and investors are showing confidence in the future fundamentals of GE stock price. The company has been successfully declining its debt along with improving its cash position.

The company is enhancing its liquidity position by selling noncore assets and investing in only a few key areas such as industrial, and power businesses.

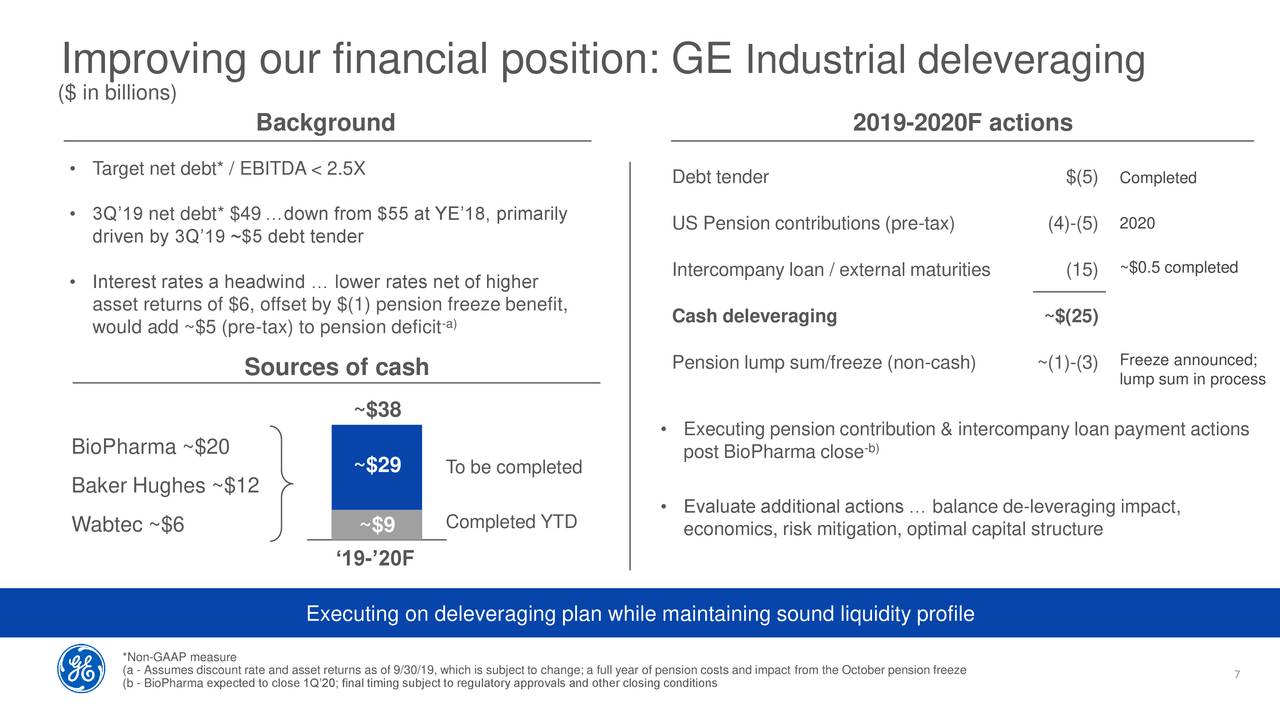

Investors are praising Larry Culp’s strategy of targeting less than 2.5x net debts to EBITDA in GE’s industrial business combined with 4.5x debts to total capital.

Analysts have raised their price target for GE shares. UBS analyst Markus Mittermaier provided a Buy rating with the stock price target of 14. The analyst said, “GE shares are at a positive inflection point into 2020 given the company’s successful de-levering, strong estimated earnings growth in 2020 and 2021, and a tripling of free cash flow to $2.3B next year.”

Improving Cash Position and Declining Debt is Biggest Catalyst

The company had sold billions of dollars of assets in the past couple of quarters to reduce its debt position. It announced or completed almost $9B in total industrial deleveraging actions in the past quarter alone. The company expects to generate almost $2 billion in industrial free cash flows in fiscal 2019.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account