Walmart (WMT) will release first-quarter results on Tuesday with the market eager to discover how far anxious shoppers hoarding food, and non-essential shops shuttered during coronavirus lockdowns, has boosted the retailer’s bottom line.

The world’s largest retailer is expected to post earnings per share of $1.13 on revenue of $131bn for the first three months of the year, according to analysts’ consensus.

Walmart has been one of the winners from increased traffic and consumer spending amid the pandemic with shoppers flocking to the chain’s stores for essential items. As a result, the company is looking to reward its full- time, part-time and temporary workers. The beneficiaries include hourly associates in stores, clubs, supply chain and offices, drivers and assistant managers in stores and clubs.

The retail giant said on Friday it would spend another $390m on bonuses for associates at Walmart and Sam’s Club, the group’s chain of membership-only retail warehouses. That puts its total commitment for associate bonuses at $935m so far this year.

“Walmart and Sam’s Club associates continue to do remarkable work, and it’s important we reward and appreciate them,” Walmart chief executive John Furner said in a statement.

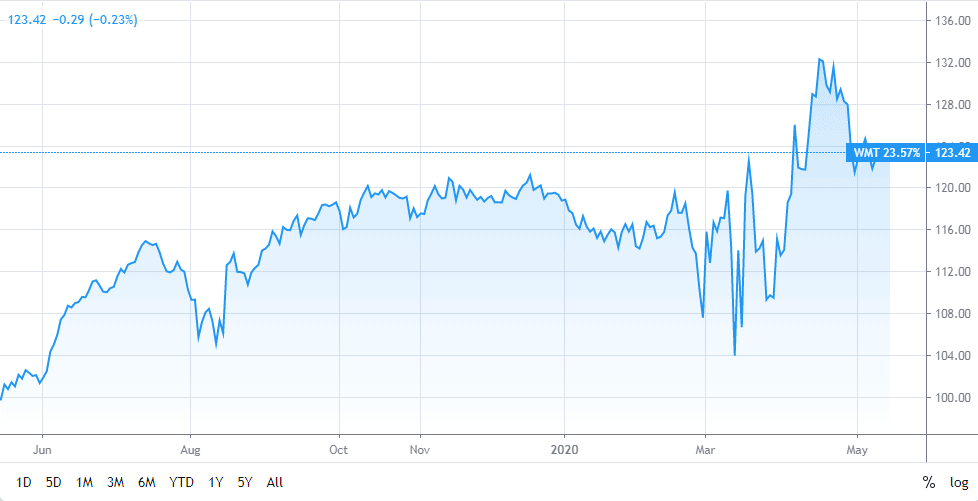

Walmart shares recently traded at $124.38, up 0.57%. The stock has climbed 8% in the last three months, compared to a 13% drop for the S&P 500.

Walmart’s e-commerce channel will be a focus for investors this week, and so will the updated outlook that management issues about the strength of the consumer heading into a slow restart of the economy.

To cater to the rising demand and traffic, Walmart recently unveiled a new service — Express Delivery – in addition to expanding its workforce with 200,000 more workers. All of these factors lead some analysts to view Walmart as “the only American retailer that can compete comprehensively with Amazon”.

You can find more stocks to buy or short by using one of the recommended stock brokers on our list.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account