The Affordable Care Act (ACA), also known as Obamacare, is unlikely to have much impact on the municipal bond market, and the ultimate impact may take years to discern. There are two primary ways the ACA may affect municipal bonds: 1) via direct impact to municipal bonds backed by hospital revenues; and 2) via broader credit quality implications to states’ credit quality. The latter impact may vary greatly and will take longer to determine. With October 1, 2013 marking the start of enrollment for government run health-exchanges, it is worth taking a look at potential municipal market impacts.

On the surface, the ACA is a modest positive for hospital bonds, which comprise nearly 13% of the broad municipal bond market as represented by the Barclays Municipal Bond Index. The ACA, by providing insurance to more individuals and lowering the number of uninsured patients, may reduce the risk that hospitals will not be paid for medical services. In turn, this reduces credit quality risks, helps lower the threat of ratings downgrades, and helps decrease potential price pressures.

However, risks remain for the hospital sector. Hospitals, particularly not-for-profit hospitals, faced a challenging environment with or without the ACA, due to an aging population and prospects of reduced reimbursements under Medicare. The ACA includes a cut to Medicare reimbursements just the same and will offset the benefit of greater patient coverage.

Investors should be aware that historically default risk in the hospital sector is second only to housing. Hospitals and healthcare service providers comprise approximately 32% of all municipal defaults from 1970 through 2012, according to a long-term study by Moody’s on all its rated bonds. Housing-related issues comprised roughly 41% of municipal defaults over the period. Together both housing and hospital sectors (73%) have experienced the most defaults by far and far more than infrastructure, the next highest default cohort, representing 6% of defaults.

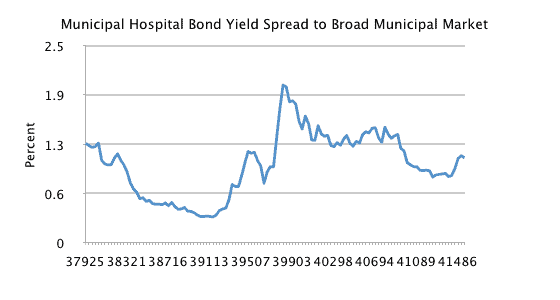

Recent behavior in the municipal bond market suggests that despite the widely anticipated ACA, investors are likely to continue to treat hospital bonds for what they are – a credit-sensitive sector in the municipal bond market. Because of their higher default history, hospital bonds have historically traded with higher yields than higher-quality general obligation bonds and essential service revenue bonds. The nearby chart shows the average yield advantage, or spread, of Barclays Municipal Hospital sector compared to that of the broad market.

Source: Barclays Index data, LPL Financial 9/30/13. The spread is measured as the yield of the Barclays Municipal Hospital sub-Index minus the yield of the Barclays Municipal Bond Index.

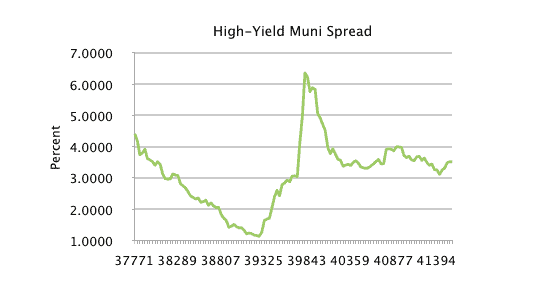

Like all credit-sensitive sectors, yield spreads spiked wider during the financial crisis before widening again during summer 2011, in response to the last debt limit debate and rising European debt concerns. It is perhaps no surprise that the yield spread pattern is similar to other credit sensitive bonds as represented by the average high-yield municipal bond spread. Investors generally demand a higher yield for the greater default risk. In 2013, hospital bond yield spreads increased as a result of the recent sell-off but this behavior was similar to other higher yielding sectors. The ACA is a modest positive, but investors may await proof that benefits are accruing to hospital and healthcare service issuers before changing their approach to hospital bonds, a process that may take a few years.

Source: Barclays Index data, LPL Financial 9/30/13. The spread is measured as the yield of the Barclays Municipal High-Yield Index minus the yield of the Barclays Municipal Bond Index.

The ACA may potentially affect state credit quality, but the ultimate impact is largely unknown at this stage and may vary greatly by state. If rising healthcare costs as a result of the ACA burden a state’s finances, the odds of a ratings downgrade may increase and lead to price pressures. State level debt comes in many forms and how it is ultimately impacted depends on the seniority of a specific issue. Not all states are moving forward with adopting all provisions of the ACA, including whether to expand Medicaid, and therefore it is too early to assess potential cost implications. It may take several years for the ACA to have an impact, if any, on state level debt obligations.

About Anthony Valeri

Anthony received a BA in Quantitative Economics and Decision Sciences from the University of California at San Diego in 1992 and received his Chartered Financial Analyst designation in September of 1999. Additionally, Anthony is Series 7 and 63 registered. Anthony is a member of both the Association for Investment Management and Research and the Financial Analysts Society of San Diego. Anthony has been with LPL Financial since June 1993.

Important Disclosures: The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly

This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Municipal to Treasury Ratio is a comparison of the current yield of municipal bonds to US Treasuries.

Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

An obligation rated ‘AAA’ has the highest rating assigned by Standard & Poor’s. The obligor’s capacity to meet its financial commitment on the obligation is extremely strong.

Municipal Market Advisors (MMA) is an independent strategy, research and advisory firm.

The Barclays Capital Municipal Bond Index is a market capitalization-weighted index of investment-grade municipal bonds with maturities of at least one year

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

This research material has been prepared by LPL Financial.

If you are looking for more information on US Bonds please follow the link: LearnBonds.com/Bonds

If you are looking for more information on UK Bonds please follow the link: Learnbonds.com/UK/Bonds

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account